- SEC has just approved the long-awaited spot Bitcoin ETFs in the US

- This ends a saga of more than a decade of filings from the first filing of a spot Bitcoin ETF product to its final approval today

- We expect the cumulative price effect of these approvals on the price of Bitcoin to be around +87% over the medium term

The Long Wait

The history of Bitcoin ETFs in the United States is marked by a series of regulatory challenges and evolving perspectives. A key moment came in 2013 when the Winklevoss twins filed for the Winklevoss Bitcoin Trust, a groundbreaking move as Bitcoin traded at around 90 USD.

However, the SEC rejected their proposal twice, citing the risky nature of the emerging cryptocurrency market. This set a precedent, as the SEC continued to reject various forms of Bitcoin ETFs, including spot, futures-based, long-only, leveraged, and inverse funds, over concerns of inadequate investor protections.

A significant period of scepticism was noted during Jay Clayton's tenure as SEC Chairman (2017-2020), highlighted by the rejection of 9 Bitcoin ETF proposals in a single day in August 2018. Clayton emphasized the need for stringent rules and surveillance to prevent manipulation in digital currency trading. Custody issues and the nascent state of Bitcoin futures markets were also significant concerns.

In contrast, the tenure of Gary Gensler, who succeeded Clayton, brought renewed optimism for Bitcoin ETFs. Gensler's openness to considering Bitcoin ETFs, especially those based on CME-traded Bitcoin futures, led to a flurry of filings in 2021.

This shift was further supported by the approval of U.S. Bitcoin mutual funds that summer, which invested in Bitcoin futures, indicating a likelihood of futures-based ETFs being the first to launch. However, the possibility of tracking errors in futures-based ETFs, which must transition from one futures contract to another, raised concerns, prompting calls for the approval of spot Bitcoin ETFs that directly own Bitcoin.

BlackRock’s filing on the 15th of June 2023 was seen as a watershed moment in the history of both Bitcoin spot ETFs and Bitcoin itself. It also released another flurry of filings by one of the largest financial institutions in the world that would compete in this space as well. It seemed as if Bitcoin would finally become a mainstream asset.

The latest deliberations by the SEC on the preferred structure were already indicative of an upcoming approval, as discussions between the SEC and the filing financial institutions reached a fever pitch in the last weeks. For instance, frequent adaptions of the filing documents were evidence of intensifying discussions.

Most of these recent discussions focused on in-kind vs. cash redemption model underlying the ETFs.

In-kind redemption allows for the exchange of ETF shares directly for the Bitcoin held by the ETFs. This model is often preferred by firms as it is believed to be more appealing to investors. Conversely, cash redemptions involve selling shares for cash. The SEC, however, has shown a preference for cash redemptions over in-kind redemptions, likely due to regulatory and operational concerns.

However, we think that cash redemptions are structurally inferior to in-kind redemptions due to issues surrounding market impact and liquidity, operational complexities and costs, and a larger tracking error amongst other things.

What’s the potential price effect of these approvals?

A major talking point among investors is the potential price impact on Bitcoin if a spot Bitcoin ETF is ultimately approved in the US.

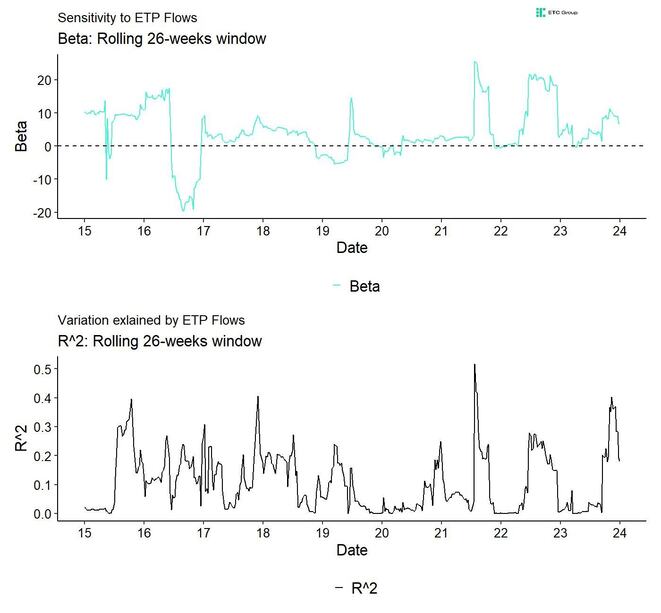

In general, a good starting point to answer this question is Bitcoin’s performance sensitivity to global ETP flows. As the chart above suggests, both the sensitivity (Beta) and the importance (R^2) of the flows for the performance of Bitcoin can vary significantly over time.

The most recent numbers over the past 6 months suggest that variations in global Bitcoin ETP flows were able to explain around 20% of the variation in the price of Bitcoin.

Moreover, the sensitivity of Bitcoin to these ETP flows was around 6.75 suggesting that a +1% increase in global Bitcoin ETP AUMs was on average associated with a +6.75% weekly performance of Bitcoin – a very significant number.

That being said, this “multiplier” can sometimes even be negative as was the case in 2016 - negative inflows being associated with positive price performance and vice versa.

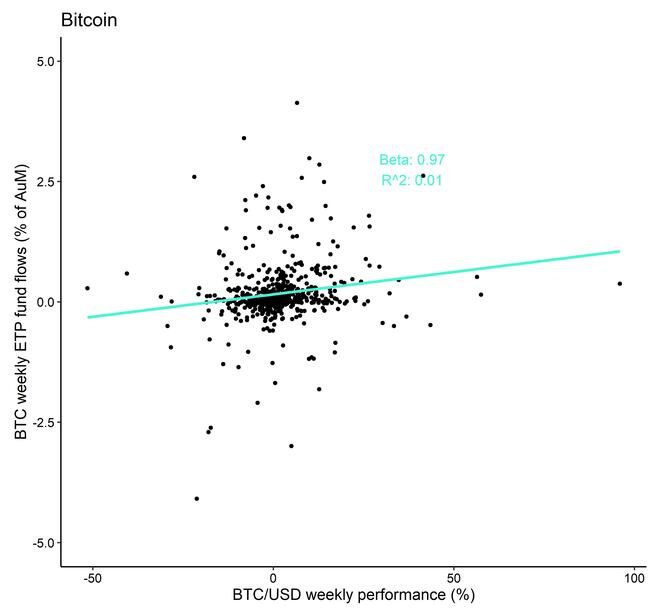

However, the average numbers suggest that 1% of global Bitcoin ETP inflows were on average associated with a 0.97%-points weekly performance of Bitcoin.

So, almost a 1-to-1 relationship.

Now, the aggregate amount of AUM of ETFs in the US around 7,627 bn USD of which 6,013 bn USD are invested into risk assets like equities according to data by ICI.

Under the assumption that 20% of investors would consider such an investment and allocate 3% of their AUMs into Bitcoin, the potential amount of new capital entering the market would be around 36.1 bn USD (6,013 bn USD * 20% * 3%).

In comparison, the global Bitcoin ETP market currently amounts to only 41.3 bn USD per end of 2023. Hence, an inflow of around +36.1 bn USD would imply an increase of around 87% in AUM – almost a doubling in global Bitcoin ETP AUMs.

If you assumed the abovementioned almost 1-to-1 price sensitivity on average, we would be talking about a potential price impact of approximately +87% over the medium term.

Keep in mind that this is possibly a conservative number since the Beta (“multiplier”) of Bitcoin’s performance to these fund flows has sometimes increased up to a factor of 20 as happened during the bull market in 2021.

Caveat: Other unobserved factors might be more important at times. As always, correlation is not causation.

But this amount of capital won’t enter Bitcoin overnight. It will take many months before investors start migrating into these newly issued ETFs.

Gradually, then suddenly as they say.

Bottom Line

- SEC has just approved the long-awaited spot Bitcoin ETFs in the US

- This ends a saga of more than a decade of filings from the first filing of a spot Bitcoin ETF product to its final approval today

- We expect the cumulative price effect of these approvals on the price of Bitcoin to be around +87% over the medium term

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.