From ‘digital gold’ back to currency

Signs flourished during Q3 2021 that Bitcoin is switching back to a currency after years of narrative buildup that its utility lies in being ‘digital gold’.

More than a decade after its debut rattled the world, and having amassed 100 million users, the prevailing economic theory still holds that Bitcoin is a store of value in troubled economic times but practically useless as a daily means of exchange, given spikes in transaction fees and slow transaction confirmations.

Notably, Bitcoin’s base layer can only complete around 7 transactions per second. And at any one time there can be thousands of unconfirmed Bitcoin transactions — ranging from $50 to several million — waiting to be added to the digital ledger.

Figures compiled by ETC Group show that in Q3 2021 Bitcoin transaction volumes soared by over 650% year on year, but interestingly enough, transaction fees fell from $90.8m in Q3 2020 to $65.5m in Q3 2021.

Median transaction fees — how much it costs to send the average BTC transaction — dropped by 66% year on year, from $1.49 to just $0.50. Something crucial is happening here: and one explanation is that the Bitcoin network has become more efficient at processing transactions.

The rapid growth of the Layer 2 technology Lightning Network — a way of netting payments off the blockchain — is key to Bitcoin’s conversion back to the ‘peer to peer electronic cash’ as described in the title of its 2009 whitepaper.

The Lightning Network is powered by smart contracts and employs micropayment channels to carry out transactions near-instantaneously. It is generally seen as one of the key methods of scaling Bitcoin as a currency. And because it moves transaction processing away from the main Bitcoin blockchain, the Lightning Network makes it much more feasible to carry out day-to-day payments and microtransactions using Bitcoin.

In summary, Lightning Network offers:

Instant payments: Transaction speeds are typically measured in milliseconds. Lightning Network relies on smart contracts rather than having to wait for confirmation on-chain.

Scale: Lightning Network can theoretically process millions of transactions per second.

Low fees: Transactions are settled off-chain, making Bitcoin micropayments practical.

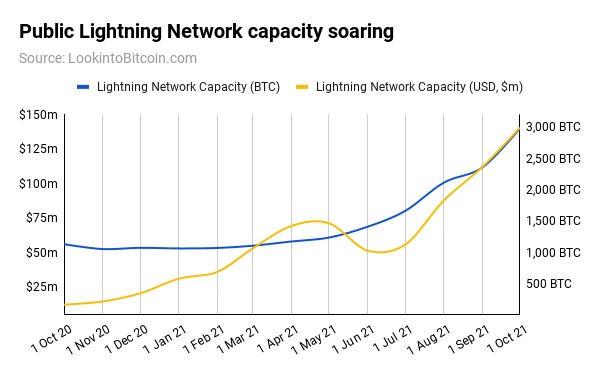

Across Q3 2021 the number of unique Lightning Network channels rose by 45.5% to 70,403, according to BitcoinVisuals.

The amount of capacity on these Lightning Network channels is also seeing substantial growth.

El Salvador tests Lightning Network in the wild

In Q3 Bitcoin gained the addition of several million new users in the form of El the Salvadoran population: we now have a live experiment in Bitcoin currency use at national level.

On 7 September 2021 El Salvador crossed the Rubicon to become the first country to adopt Bitcoin as a legal means of payment. And the country is using the Lightning Network to allow Bitcoin payments to flow much more quickly between citizens and businesses than using Bitcoin’s base layer.

By any metric, user adoption has been rapid.

According to the Salvadoran Foundation for Economic and Social Development, reported by Reuters, 12% of the population have used Bitcoin in the month since it became legal tender alongside the US dollar.

National news site ElSalvador.com adds that by the end of Q3, 2.73 million people in El Salvador had downloaded Chivo, the country’s official Bitcoin wallet. In a country of 6.4 million people, that’s a 42.6% adoption rate. Contrast this with the latest available figures on bank account adoption. Only 29% of people in El Salvador have a bank or mobile e-money account.

Bitcoin is still not proven in El Salvador. Most notably there are security issues with the Chivo wallet that cannot be ignored. But while some economists dispute that millions will actually use Bitcoin as a payment method — instead withdrawing the $30 that the government gives away to promote the system ($81.9m of public funds have already been paid out to El Salvadorans to this end) — the country and the world are one month into a multi-year experiment.

Bitcoin settles 40 times more value than Visa Europe

One additional point to make is that more value has been settled on the Bitcoin network than ever before.

Analysis by ETC Group shows that in Q3 2021 $12.84 trillion passed back and forth using Bitcoin, its largest figure to date. This is up 7.5x year-on-year.

One of the less-reported outcomes of Bitcoin’s efficiency growth is in its transaction volume, which is now outstripping Visa Europe by 35 to 1, according to the Bank of England’s Real-Time Gross Settlement (RGTS) data.

RGTS is the central bank’s infrastructure that holds accounts for banks, building societies and other institutions, with balances used to move money in real time.

The bank’s figures show that Visa Europe settled just over £2.4bn ($3.5bn) daily in Q3 2021.

The Bitcoin network settled $139.6bn daily in the same period, 39.88 times larger than the credit card network.

Bitcoin’s transaction throughput also reached all-time highs in Q3, according to on-chain analysis by Woobull. On 18 September 2021 the network transmitted $183,082/sec, more than double its value of $82,296/sec on 1 July 2021, and 7 times larger than the value transmitted a year before.

These figures relate only to the Bitcoin base layer: transactions and value transmitted on Layer 2 operations like sidechains and the Lightning Network are not included in these calculations, adding weight to the conclusion that the network is becoming more efficient over time.

Bitcoin’s Second Layer

Bitcoin is arranged by miners securing the network, beavering away to help maintain the correct copy of the digital ledger. For expending their processing power in this manner they are rewarded in Bitcoin and are allowed to choose which transactions they include in a block. Miners will generally choose transactions that offer the largest fee per byte, as it makes them the most money — simple economics. Unprocessed transactions sit in a buffer called the ‘mempool’ waiting for miners to pick them up.

If Lightning Network can move more transactions away from Layer 1 — the base layer — the main chain should become less congested, and provide a better user experience at lower cost.

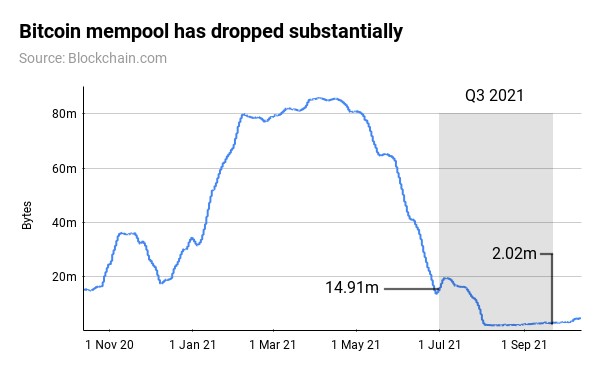

And if the Lightning Network is really working as intended, we would be seeing more transaction throughput on Bitcoin, and the size of this mempool should be falling over time.

Data from Blockchain.com confirms one part of this theory. The picture is complicated by the fact that there is a very large amount of divergence on a daily basis, so we instead looked at 180-day averages to draw out general trends.

At 1 July 2021, the start of Q3, the Bitcoin mempool stood at an average size of 14.91 million bytes. By the end of the financial quarter, it had dropped by 86.4% to 2.02 million bytes.

One conclusion we can draw is that more transactions are being confirmed more quickly, and hence the size of the mempool is falling. Bitcoin is being used — and is more useful — as a currency.

Layer 2 solutions provide an elegant solution to the compromises inherent in Bitcoin’s 12-year old technology. In short: the data show that Bitcoin has become more efficient and more cost-effective. We expect the Lightning Network to continue contributing strongly to Bitcoin’s transaction volume growth going forward.

China destroys its Bitcoin industry — USA wins

China’s continuing mission to eviscerate its gigantic Bitcoin industry from both a regulatory and financial perspective gathered significant pace in Q3.

In April 2021 China banned the approval of any new Bitcoin mining hubs in one of its largest regions, Inner Mongolia, which at the time was responsible for over 8% of global Bitcoin hashrate. Since the summer of enforcement, analysis by the South China Morning Post shows that more than 20 major cryptocurrency companies have fled the country, including digital asset exchanges Binance and Huobi, and the largest Ethereum mining pool, Sparkpool.

The People’s Bank of China (PBoC) then announced via its website on 24 September that all cryptocurrency related activities were now illegal.

The PBoC has not only demanded that domestic companies stop financing cryptocurrency companies — e-commerce giant Alibaba stopped the sale of cryptocurrency mining equipment to overseas users as the bank tightening its grip — but on 28 September 2021 extended its embargo to foreign businesses. Anyone providing support to offshore exchanges would be a target for investigation, the central bank said, adding that digital currency exchanges providing services to Chinese citizens would be engaging in illegal activities.

Xi Jinping’s government has long had an uneasy relationship with its formerly vast Bitcoin mining industry. Mining pools Hashcow and BTC.TOP were among the first operations when Beijing called for shutdowns in May 2021, and enforcement has ramped up across Q3.

According to TheBlockCrypto Asia editor Wolfie Zhao previous regulatory crackdowns were largely orchestrated for the benefit of officials — with operations creeping back into action as soon as delegations returned to Beijing.

Zhao told Frank Chaparro’s 7 September podcast:

There were a lot of talks in 2018-2019 but there wasn’t anything seriously enforced. But this time it seems like there’s no way back

Along with banks cutting funding channels for OTC trading desks, more recent regulatory actions have been severe. In June 2021 the province of Sichuan began telling electricity companies to cut power to any mining operations they discovered. The Yunnan provincial government also told its power companies to stop making side-deals with miners, The Verge reported at the time.

Cryptocurrency markets as a whole suffered a jittery period in the wake of such regulatory strictures. After the 24 September announcement, the price of Bitcoin dipped 5.5% to $42,667, while Ether gave up 8.4% to hit $2,824.

But Chinese dominance of Bitcoin mining has been wiped away, and with little short or medium term impact on market prices.

Since the ban, and in the post-quarter period to 14 October 2021, Bitcoin has demonstrated its resilience, climbing almost $15,000 to $57,588, while Ether has added 34.3% to reach $3,794.

China’s (energy) crisis of confidence

One potential reason for China’s dismantling of its Bitcoin industry is to do with industrial demand for resources, which have been uptrending for years. According to the International Energy Administration’s July 2021 Electricity Market report:

In the second half of 2020, electricity demand significantly exceeded 2019 levels. This trend continued in the first quarter of 2021, with industrial demand exceeding the first quarter of 2019 by more than 15%. Commercial electricity demand in the first quarter of 2021 exceeded 2019 demand for the same period by 16.5%.

Despite Xi Jinping’s September 2020 pledge at the UN General Assembly that China would achieve net-zero emissions by 2060, coal still makes up more than 60% of domestic energy generation and rather than falling, is on the rise.

And while renewable energy production hit record rises in 2020 — to 210TWh — and coal’s share of power generation fell to a record low of 58% in October 2020, in the first four months of 2021, the share spiked to 66.5%, higher than the same periods in 2019 and 2020.

In early May, the local grid operator issued a note asking companies to reduce power consumption. In the southern province of Guangdong, a large manufacturing hub, limited hydro availability, together with strong economic recovery and associated high electricity demand, resulted in electricity shortages leading to production halts IEA, Electricity Market Report, July 2021

“In early May, the local grid operator issued a note asking companies to reduce power consumption. In the southern province of Guangdong, a large manufacturing hub, limited hydro availability, together with strong economic recovery and associated high electricity demand, resulted in electricity shortages leading to production halts.”

China hands US the keys to Bitcoin hashrate

Bitcoin hashrate is a measure of the amount of computing power employed to secure the network and mint new coins.

In general, the higher the Bitcoin hashrate, the more resistant it is to attack. According to Crypto51, it would now cost an attacker more than $1.8m per hour to rent enough hashpower to alter the Bitcoin record of transactions or double-spend coins.

Higher hashrates are also an indication of a healthier network, as well as being a determiner of positive sentiment in cryptocurrency trading, in that miners continue to invest in more powerful equipment. Both of these factors can be a frontrun indicator of higher future Bitcoin values.

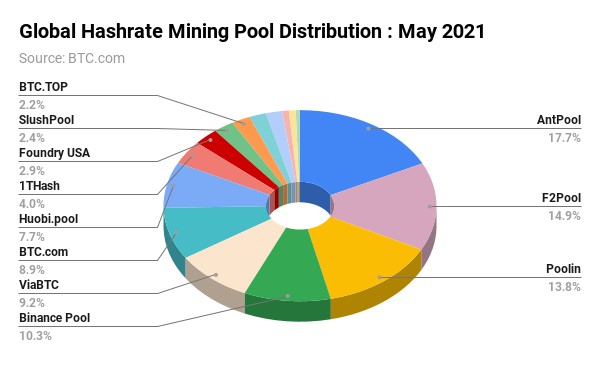

When China announced its most recent aggressive major regulatory action in May, mining pool Poolin — which at the time controlled around 13.8% of Bitcoin hashrate — moved its operations to Texas, according to CEO Kevin Pan.

He told the BBC: “We decided to move out once [and] for all. [We’ll] never come back again.”

Time is money in Bitcoin mining, and literally every second counts.

We also witnessed the extraordinary situation of Chinese miners airlifting tonnes of ASIC mining machinery out of the country. Guangzhou-based Fenghua International told CNBC in June it would move 3,000 kg (6,600 lbs) of machines to Maryland.

Shenzhen-based BIT Mining has announced plans to invest $26 million in a 57-megawatt data center to be built in Texas.

Western miners, too, have wasted little time in the hunt for cheap energy and unrestrictive regulatory boundaries. London-listed miner Argo Blockchain (LSE:ARB) began construction in July on its 200MW Helio mining facility in Dickens County, adding on 30 September that it was purchasing 20,000 Antminer Pro S19J rigs to extend its hashpower by more than 2 exahash.

By destroying its vast Bitcoin mining industry, China has rescinded its first mover advantage and effectively handed its greatest economic rival the keys to a trillion-dollar industry.

There now exist the statistics to prove this, via the Cambridge Center for Alternative Finance (CCAF).

US doubles its Bitcoin hashrate

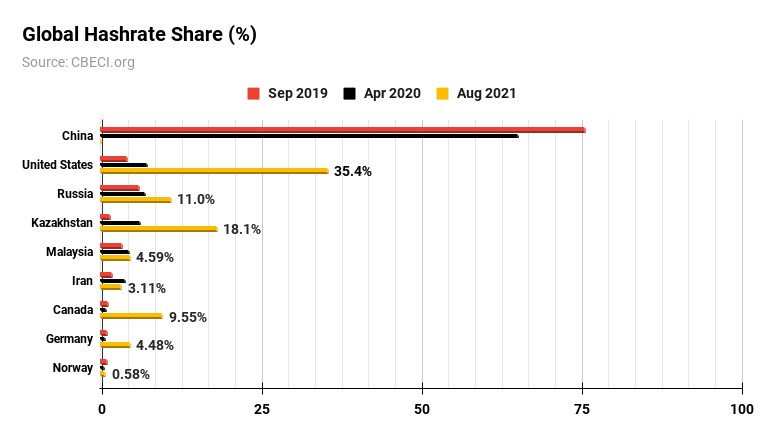

Updated data from CCAF shows figures up until the end of August 2021, cataloguing the wholesale shift in network hashrate.

The United States now leads in global hashrate with 35.4% of the total. The US has doubled its share of Bitcon mining in the four months since China began its cryptocurrency clampdown.

Researchers tracking Bitcoin mining activity partnered with mining pools BTC.com, ViaBTC and Foundry USA to compile data, finding that mining operations in mainland China have effectively dropped to zero, from a high of 75.53% when figures were first recorded in September 2019.

As predicted in ETC Group’s major research project: ‘Bitcoin ESG and the Future’ countries that offer cheap electricity have also surged: Kazakhstan doubled its share to 18.1% while Russia has moved up to third with 11% of global hashrate.

Industrial electricity prices in the two countries commonly range from less than 1 cent to 5 cents per kilowatt hour. Data from the US Energy Information Administration show that industrial prices in West Texas, the country’s largest oil, gas, and wind energy-producing state, are now 5.28 cents per kilowatt hour.

The next largest Bitcoin hashrate contributors are: Canada (9.55%), Ireland (4.68%), Malaysia (4.59%) and Germany (4.48%).

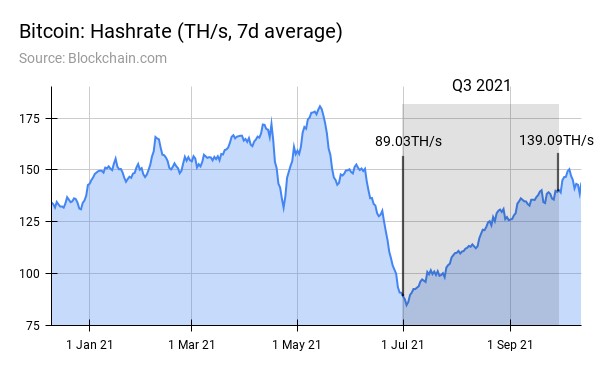

Ongoing Chinese crackdowns on both power operators directly, and Bitcoin miners indirectly, led to a 38% drop in global Bitcoin hashrate in June 2021 but bounced back by 20% in July and August, says the CCAF, adding weight to anecdotal observations that Chinese mining equipment had been successfully moved overseas.

One of the major beneficiaries will likely be the sprawling capital markets firm Digital Currency Group, whose subsidiaries include Grayscale Investments, cross-border settlements company Korbit, industry news site Coindesk, and Luno, and which has over 240 registered investments in everything from BitGo to Dapper Labs and Silvergate Bank.

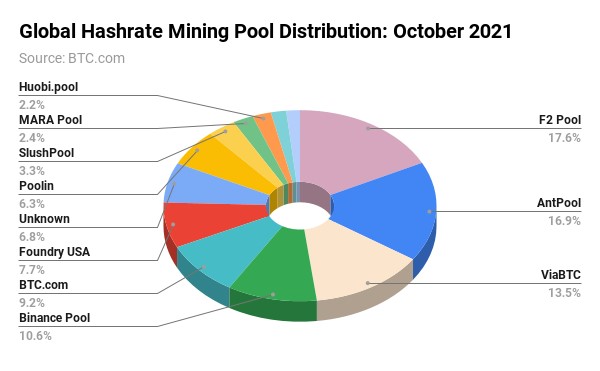

It too owns Foundry USA, North America’s largest Bitcoin mining pool, which since our Q2 report has more than doubled its Bitcoin hashrate share from 2.9% to 7.7%.

ETC analysis of Q3 data shows that Bitcoin hashrate rebounded by 56% from a low of 89.03Th/s on 1 July 2021 to 139.09Th/s by 30 September 2021. This is still some way off the all-time high of 180.66 of 14 May 2021, but the trend is clear.

[As] of early October, the hashrate trajectory is indicating that all, or nearly all, of that June downturn would be fully recovered soon. If the August data updates are an indication for the future, then that recovery will likely be further distributed predominantly between the largest share gainers — US, Kazakhstan and the Russian Federation Michel Rauchs, Rauchs, digital assets lead, Cambridge Center for Alternative Finance.

The effect of the Chinese crackdown is an increased geographic distribution of hashrate across the world, which can be considered a positive development for the decentralised principles of Bitcoin Michel Rauchs, digital assets lead, Cambridge Center for Alternative Finance.

Concerns over data-sharing and transparency have long plagued Chinese international relations and the same has been true throughout the Bitcon era. We would agree that the reconfiguration of mining power in the hands of friendlier territories and countries, most notably the United States, certainly bodes well for the future of Bitcoin’s network security.

US policy favours Bitcoin mining

High-level policymakers in the US are now starting to see more value in Bitcoin mining than ever before. Speaking at the Texas Blockchain Summit on 8 October 2021, Senator Ted Cruz noted the huge opportunity base in using renewable energy like wind, and stranded assets like flared gas to mine Bitcoin on US soil.

“There were a lot of things that went wrong [during the winter storm] that I think are worthy of study, but I do think that Bitcoin has the potential to address a lot of aspects of that. Number one, from the perspective of Bitcoin, Texas has abundant energy. You look at wind, we’re the number one wind producer in the country. Number two, I think there are massive opportunities. Fifty percent of the natural gas in this country that is flared, is being flared in the Permian [Basin] in West Texas right now. I think that is an enormous opportunity for Bitcoin because right now, that is energy that is just being wasted.”

The comments were reported via Twitter by Nic Carter, general partner at Castle Island Ventures, co-founder of blockchain analysis firm Coin Metrics and an advisor to the Bitcoin Clean Energy Initiative.

Using stranded natural gas is one way to reduce greenhouse gas emissions while at the same time producing revenue for industry to which it would otherwise not have access.

Bitcoin miners can take advantage of stranded renewable energy assets, mine off-grid by utilising waste natural gas (a byproduct of oil extraction) and participate in demand response by giving energy back to the grid when it is most needed, Cruz concluded.

And as CBNC reported in September, more meetings are putting Bitcoin miners in touch with oil and gas executives keen to exploit demand for cryptocurrency mining by recycling otherwise unproductive energy usage.

Bitcoin miners care most about finding cheap sources of electricity, so Texas – with its crypto-friendly politicians, deregulated power grid, and crucially, abundance of inexpensive power sources – is a virtually perfect fit. The union becomes even more harmonious when miners connect their rigs to otherwise stranded energy, like natural gas going to waste on oil fields across Texas MacKenzie Sigalos, CNBC, 4 September 2021

Senator Cruz is a member of the US Congressional Joint Economic Committee, which has a mandate to report on the economic condition of the country and make suggestions for improvements to the economy. The committee is chaired by Rep Don Beyer, who on 28 July 2021 put forward the most comprehensive cryptoasset regulatory proposals in the United States to date: the ‘Digital Asset Market Structure and Investor Protection Act’.

While experts often do not often agree on how Bitcoin’s energy use is calculated — nor whether such vehement censure should be applied when other industries like gold mining are arguably more polluting — these options do offer an elegant solution to Bitcoin’s main source of criticism.

Foundry USA’s own dataset, released on 9 September, shows that the majority of US Bitcoin mining hashrate (19.9%) is currently concentrated in New York, with 18.7% in Kentucky, 17.3% in Georgia, and 14% in Texas.

As always, clear regulation is the key to growth. And after winning the signature of Governor Greg Abbott in June, Texas House Bills 1576 and 4474 officially came into effect on 1 September 2021. The latter alters the state’s Uniform Commercial Code to recognise cryptocurrencies under commercial law.

With the crypto-friendly regulation now in force in Texas, we would expect those mining hashrate percentages to shift in favour of the US’s largest energy-producing state.

And to conclude: China had Bitcoin in the palm of its hand, and threw it all away. The beneficiaries are its global economic rivals.

Crypto regulation comes of age

- El Salvador makes Bitcoin legal tender

- Ukraine, Cuba legalise Bitcoin

- US attempts realistic regulation

- Rest of World: Institutional, retail adoption booms while central banks seek refuge in CBDCs

Since their inception cryptocurrencies have been locked in a long-running turf war with central bankers, governments and financial watchdogs. In Q3 2021 we watched as era-defining regulations came into force. Ukraine, Cuba and El Salvador all legally recognised cryptocurrencies. The United States is making realistic efforts at categorising cryptocurrencies, and in the post-quarter period approved its first Bitcoin ETF, albeit a futures product rather than spot-based.

From risk to opportunity

The same kinds of fears have been peddled for many years: that cryptocurrencies pose financial stability risks due to their unregulated status. Crypto businesses say: so regulate! We would welcome it!

The Bank of England’s deputy governor for financial stability laid out central banks’ terms of engagement in one particularly useful speech.

Money, like electricity and water, is crucial to the operation of a modern society. Our job is to ensure it works safely and reliably, through ups and downs, so that everyone in society can depend upon it. That means ensuring its value can be depended upon. Sir John Cunliffe, speech, February 2020

Cunliffe has backed up those comments recently, saying that crypto regulation needs to happen in the UK “as a matter of urgency”.

The deputy governor is by no means a crypto-sceptic or a Luddite. Speaking to global financial conference SIBOS 2021 on 13 October he said:

Technology and innovation have driven improvement in finance throughout history. Crypto technology offers great opportunity. As [Ralph Waldo] Emerson said: ‘if you build a better mousetrap the world will beat a path to your door’...bringing the crypto world effectively within the regulatory perimeter will help ensure that the potentially very large benefits of the application of this technology to finance can flourish in a sustainable way

It is not the fault of cryptoasset issuers that regulators have been slow to move. The kind of overhaul of financial systems that crypto proposes is labyrinthine in scope and cross-border in nature. Painstaking detail and focus must be applied.

A $2 trillion+ market has grown up in stages: in some areas arguably without any legal clarity at all. It is to everyone’s benefit, from private banks to pension funds and the small retail investor to high net worth individuals if strong regulation is applied.

EU Rules

The Washington Post alleged back in 2018 that with the introduction and enforcement of GDPR that it was in fact Europe and not the US which was the world’s most powerful tech regulator. The Europeans appear to be taking the same lead in crypto.

The EU has committed to introducing cross-border, bloc-wide regulations on cryptoassets by 2024 under the MiCA legislation (Regulation in Markets on Crypto Assets). This is a sprawling, complex, 168-page stack of laws now going through their first readings in the European Council. MiCA offers 28 definitions for key terms in markets, including “crypto-assets”, “distributed ledger technology” and “utility token”, as well as aiming to provide comprehensive coverage for stablecoins and cryptoasset service providers.

The regulation will supersede any rules imposed by the EU’s 27 member states, in favour of one set of shared regulatory boundaries.

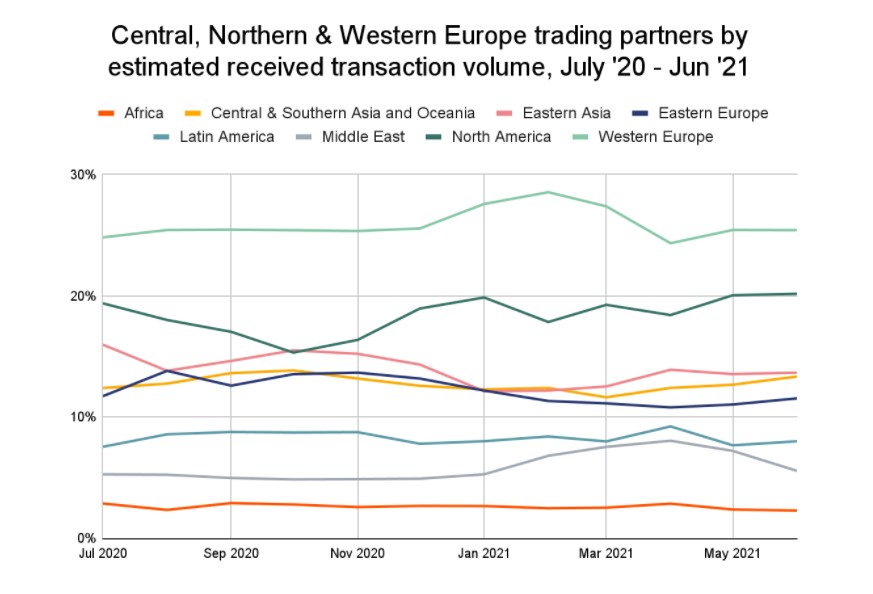

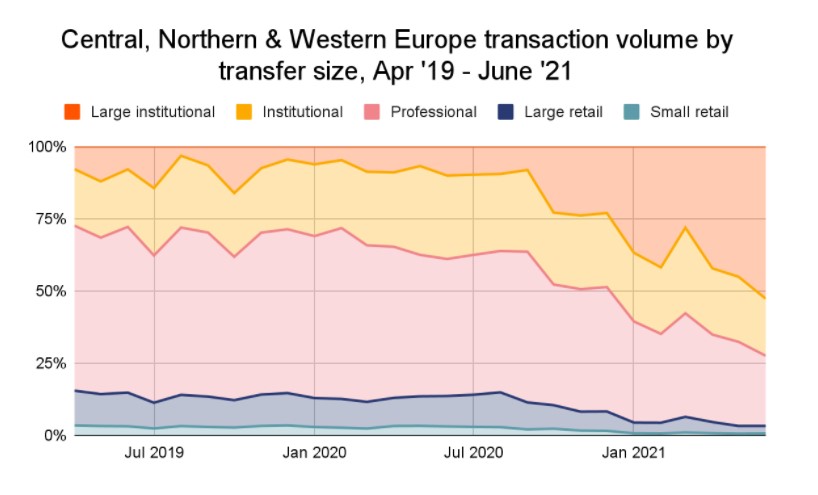

It is no wonder then that Europe has quickly grown into the largest cryptoasset market in the world, according to Chainalysis research published in Q3.

Central, northern and western Europe (CNWE) received over $1 trillion of digital assets across trade, investments and business dealings between July 2020 and June 2021, the research shows. That accounts for 25% of global crypto activity. Transaction volume grew significantly across virtually all cryptocurrencies and service types, including on-chain value, on-chain retail value and peer-to-peer exchange trading. The region also became the biggest crypto trading partner for every other area, sending at least 25% of all value received by other regions, including 34% of value received by North America.

Large institutional transactions — those valued at more than $10m apiece — grew from $1.4bn in July 2020 to $46.3bn in July 2021.

News that Europe is the world’s largest crypto economy comes as no surprise. Institutions across the continent are funnelling ever greater amounts into cryptocurrencies, with centrally-cleared ETPs the greatest beneficiaries.As the issuer of the world’s most-traded crypto ETPs on regulated stock exchanges in London, Paris, Amsterdam, Zurich and Frankfurt, we have witnessed first-hand seen the power that strong regulation has had on the ability for innovation to really flourish Bradley Duke, CEO, ETC Group

As the biggest counterparty to every other trading region globally, CNWE is a key source of liquidity to cryptocurrency investors around the world, the research shows.

Researchers found that activity really started to pick up in the middle of Q2 last year.

CNWE’s cryptocurrency economy began growing faster in July 2020. At this time, we saw a hige increase in large institutional-sized transactions, meaning transfers above $10 million worth of cryptocurrency. Chainalysis, research, 28 September 2021

ETC Group’s BTCE is now the world’s largest, at more than $1.3bn AUM. It is also the most-traded physical single-asset cryptocurrency ETP. Research published in Q3 by CryptoCompare found that institutional investors traded $26.3m of BTCE on average daily, a volume more than seven times higher than its nearest competitor.

Clear regulation always brings more opportunities for growth; or to put it another way: capital always follows greater legal clarity. Companies can conduct and grow their business without inadvertently falling foul of grey-area uncertainty. As such, institutions who want exposure to Bitcoin no longer have to deal with feeling exposed and vulnerable when the regulators come knocking.

United States attempts regulatory unity

Studies and surveys disagree on the exact proportion of the US population that owns cryptocurrency in one form or another. NORC, a research group at the University of Chicago, published findings in July 2021 that 13% of Americans bought or traded crypto in the last 12 months, from a sample of 1004 adults. Digital asset exchange Gemini claimed in May the figure was 14%, from a survey of 3,000 people, and Gallup found that 6% of 1,037 people surveyed in June owned Bitcoin.

Spun out to national level, these figures represent anywhere from 25.8 million to 43 million people.

The lack of national or even federal resources aimed at defining market participant size has left private companies with relatively small sample sizes to fill the gaps. But whatever the true number, it is clear that tens of millions of Americans own, interact with, custody, trade and pay taxes on cryptocurrency holdings each year.

And yet there is no commitment set for national cryptaosset regulations in the US.

US rivals for trade globally have set out their stall. Europe we already know about. China has made its feelings clear across Q3 — it has scuppered its vast crypto industry in favour of stricter controls and bans.

That’s why there was so much excitement around one piece of proposed US legislation which landed on the mat on 28 July 2021.

Digital Asset Market Structure and Investor Protection Act

One of the most ambitious efforts to date to provide US legal clarity arrived in Q3, on 28 July 2021. Representative Don Beyer, a Democratic Congressman for Virginia, published the Digital Asset Market Structure and Investor Protection Act (DAMSIP).

As the world’s second-largest law firm by revenue, Latham & Watkins, noted on publication, this proposed regulation “casts a wide net, and could bring cryptoassets into the mainstream regulatory fold”.

The Act would effectively sort cryptocurrency projects into two separate and distinct baskets: securities, or commodities. In doing so it would offer clear guidance as to which US regulator would have jurisdiction over any past, present or future cryptocurrency project.

Under US law, the SEC deals with securities, while the CFTC rules over commodities markets.

US regulators and lawmakers have effectively already determined that the two main digital assets, Bitcoin and Ether, are not securities. We have known this since June 2018, from Bill Hinman’s famous speech while he was head of the SEC corporate finance division. That position has been supported by SEC chair Jay Clayton in recent years.

Decentralisation is key to this definition: there is no central authority issuing Bitcoin or Ether and therefore no third party offering purchasers an expectation of a future return on investment.

The genie is out of the bottle for Bitcoin and Ether. You cannot go back and say, well, we’re going to make those securities. Industry would go wild over that. That’s not going to happen. So I think it’s lesson learned Patrick McCarty, former CFTC general counsel

However, XRP, the $50bn cryptoasset created by Ripple, is being sued by the SEC for the sale of unregistered securities. In that case, the SEC alleges, there is a centralised authority (Ripple Labs) who issued digital asset tokens to investors who had some expectation of a return.

Ripple claims that XRP is a commodity, and therefore outside the SEC’s jurisdictional mandate. The authority claims the opposite.

Interestingly enough, Ether has been ‘de-securitised’, as per one of the provisions in Don Beyer’s Act. Ethereum carried out an ICO in 2014, selling 50 million ETH in exchange for $17.3 million in bitcoin. Future digital assets may be able to de-securitise and become a commodity by becoming more decentralised, the Act concedes. Token issuers could even deregister their product as a security, similar to the provisions under Section 12 (g) of the Securities Act of 1934.

It would require that the tokens themselves not provide any equity or debt interest, or any right to profits, voting rights or liquidation rights. It does at least offer some replication of the Ether situation, if developers believe the tokenomics of their projects will evolve over time.

Cryptoasset issuers and developers arguably have no legal clarity from the US at all on who should regulate them or how. This is an extraordinary situation to find themselves in — particularly as these assets have found their way into the hands of hundreds of millions of people worldwide — and this is an issue that has become more urgent as the years roll on.

Crucially, the Act has a Joint Rulemaking process for the CFTC and SEC to consider the top 25 cryptoassets by market cap and by average daily trading volume. Together these projects, including Bitcoin, Ether, Litecoin, Bitcoin Cash et al formulate 90% of the total $2.4 trillion market value of cryptocurrencies. Public rulemaking would force the two authorities to identify whether each of the 25 are a security or a commodity.

Such is the variance between the approximately 12,000 live cryptocurrencies available to investors that an attempt to address them all would have regulators stuck in years or even decades of Kafkaesque committees, sub-committees and hearings. Beyer’s effort at least deals with the vast majority by trading volume of these assets.

Former CFTC general counsel Patrick McCarty has been working with Beyer’s office on the legislation for the past 16 months. “Don Beyer is pro-innovation, pro-digital assets,” he told Chris Brummer’s Fintech Beat podcast. As Chairman of the Joint Economic Committee of Democrats, and a member of the powerful Ways and Means Committee (the main tax-writing body in the US legislature), Beyer certainly has US economic prowess on his watchlist.

Commodities or Securities, nothing else

Under Beyer’s bill, digital assets have to fall into one of the two camps: commodities or securities.

If Bitcoin and Ether are not securities: and the SEC has already ruled that they are not, then that means they must be commodities. That puts the authority in charge of them as the CFTC.

“The categories are A or B. Not A, B, C, D, or E, which would be confusing,“ says McCarty.

The closest comparison for this kind of binary definition was in Dodd-Frank, the regulation that came out of the US after the 2007-2008 financial crisis. Dodd-Frank ruled that in the swaps market — all $542 trillion of it — products would either be cited under the CFTC as a swap, or under the SEC as a security-based swap.

One final point to make is that the Digital Asset Market Structure and Investor Protection Act offers regulators the ability to sanction, fine, or otherwise charge companies that allow US citizens to use their products even if those companies are located outside the US.

This provision, too, sits in parallel with Dodd-Frank, where US judges have repeatedly ruled that the SEC has jurisdiction over securities fraud occurring outside its national borders.

This is nothing new. For example, the SEC reached a $24m civil settlement in 2019 with Cayman Islands-based Block.one related to their $4.4bn EOS ICO. The regulator noted in its filing that even while Block.one attempted to region-block US IP addresses from taking part, it made no effort to block secondary market trading of EOS, nor did it stop promoting the ICO through its website. The SEC concluded that “ERC-20 token purchasers would reasonably have expected that they would profit from the efforts of Block.one.”

Similar settlements with non-US businesses, like Russia’s ICORating and even the $100m fine levied on from BitMEX by FinCEN and the CFTC during Q3 2021 show clearly that US regulators believe they have jurisdiction over companies anywhere in the world, as long as they are permitting US persons to carry out transactions with their products.

All that said, the Digital Asset Market Structure and Investor Protection Act is certainly, in the majority, crypto-friendly legislation. Under the bill there is no mention of fines for exchanges which are now trading what will turn out to be unregistered securities. This suggests there would be a stay of execution period in which service providers are given time to come into regulatory compliance.

Post Q3

What we didn’t see during Q3, in terms of regulatory updates, is almost as interesting as what we did see. Critics of recent attempts at crypto compliance complain that the process is akin to smashing a square peg into a round hole.

The Howey Test, from 1934, no less, still dominates American securities regulation. That’s not to say it doesn’t work, but it’s clearly not designed from the ground up to supply answers to the questions that the blockchain age throws up.

What we didn’t see during Q3 was the proposal for a new market regulator that is designed with cryptocurrency in mind.

In the post-quarter period we did see that. Coinbase, now a public company valued at $65.8bn, has been butting heads with the SEC over its yield-producing Lend project, and ultimately withdrew it pending the threat of legal action from the regulator. In response, it believes the best way forward is to dispense with the traditional market oversight by any of the current authorities, namely the SEC, CFTC, FinCEN or DoJ .

Instead?

The largest US cryptocurrency exchange wants Congress to block the Securities and Exchange Commission from overseeing the nascent industry and instead create a special regulator for digital assets, according to a policy blueprint reviewed by The Wall Street Journal Paul Kiernan and Dave Michaels, WSJ, 14 October 2021

Such a move does not appear to be high on the political to-do list. The DoJ is forming a specialist crypto team, but that’s intended to co-ordinate on ransomware investigations involving digital assets, after at least 75 high profile infrastructure attacks globally across Q3.

US Bitcoin ETF finally arrives

Finally, perhaps the most significant regulatory action for the US cryptocurrency industry arrived in the post-quarter period.

The Proshares Bitcoin Strategy ETF (BITO) debuted on the New York Stock Exchange on 19 October 2021. The United States has been waiting for years to see its first Bitcoin ETF. It’s not quite what retail or institutional investors wanted, but it is here.

Four days earlier, Bitcoin crossed the $60,000 threshold for the first time since April as investors bought the rumour and sent markets into overdrive.

Of course this ETF is important for Bitcoin adoption, since there are so many institutional capital pools that are not allowed to invest directly in Bitcoin or other cryptocurrencies but need regulator-approved structures by agencies such as the SEC. There is a huge pile of capital waiting to gain Bitcoin exposure by means of those products. Sebastian Markowsky, Chief Strategy Officer, Coinsource

Anticipating that incoming “huge pile of capital” were existing investors, who helped drive crypto market prices ever northwards and on to the edge of their all-time highs.

Competition for the first US Bitcoin ETF has been raging for years. The SEC has turned down scores of applications from the largest asset managers in the world, citing standard investor protections.

On a single day in August 2018, the US securities regulator slapped down eight ETF proposals: the first was Proshares’ Bitcoin futures ETF proposal, alongside one from GraniteShares and five inverse and leveraged options from Direxion.

Bitwise has been pursuing the issue since 2019, with all attempts for a pure Bitcoin ETF knocked back, delayed or outright turned down. Seeing ProShares win the race has spurred Bitwise back into action this week, as it applied for an “actual” Bitcoin ETF with NYSE Arca.

Bitcoin futures ETFs are by their nature a more speculative tool than ETPs that accurately track the price of Bitcoin directly, allow redemption in BTC and are centrally cleared, such as ETP Group’s BTCE — now the most-traded and largest of its kind globally with $1.3bn AUM.

US retail investors, specifically, are attracted to products with an ETF structure because they are eligible to be traded through tax-exempt 401(k) plans, offering direct bitcoin exposure through pension savings.

However, the structure of the ProShares Bitcoin Strategy ETF is likely to incur unwanted costs for investors, experts agree. As one analyst told Reuters:

There is no free lunch. An ETF based on futures is not ideal as there is a cost to rolling into the futures contracts, given contango...translating into underperformance versus the underlying asset. Martha Reyes, head of research, Bequant

The final quarter of the year is likely to see more US Bitcoin ETFs approved, with decisions due from the SEC on four products from Global X, Kryptoin, Valkyrie and WisdomTree.

Getting SEC approval on anything related to Bitcoin or cryptocurrencies has been an uphill battle since bitcoin’s launch over 10 years ago. This is proof positive that regulators are becoming less sceptical of crypto, and this gives the markets enormous encouragement. It would appear that the SEC views Bitcoin futures ETFs as a safer investment vehicle for investors, as they are filed under mutual fund rules. As mass adoption grows, so will the demand for these types of products. Josh Rogers, CEO, Minterest

Throughout Q3 there were other global regulatory actions that are particularly noteworthy.

Africa

Crypto adoption surged 1,200% in 2021, according to Chainalysis research released on 14 September, and Kenyans lead the world in peer to peer crypto trading, placed 1st out of 154 countries surveyed.

Many emerging markets face significant currency devaluation, driving residents to buy cryptocurrency on P2P platforms in order to preserve their savings. Geography of Cryptocurrency 2021, Chainalysis

Africa has the smallest cryptocurrency economy in the world at $105.6bn, according to researchers, but the region also boasts some of the highest grassroots adoption globally, as Kenya, Nigeria, South Africa and Tanzania all rank in the top 20 countries.

The majority of African fintech regulatory updates related to CBDCs during Q3, as the Bank of Ghana announced in August it would pilot a central bank currency with German securities firm G+D, its pilot phase starting in September as it seeks to reduce reliance on cash. Nigeria’s securities regulator established a fintech unit in September to study crypto, but maintained its prime focus on issuing a CBDC, partnering with Bitt Inc, with its launch planned for October.

South Africa beefed up its crypto taxation regulations in Q3 while its Central Bank Governor Lesetja Kganyago reiterated the stance that it had no plans to declare cryptocurrencies legal tender alongside the rand.

Europe

Billions of institutional funds flows arrived in crypto products in Q3. New laws regarding German Spezialfonds came into effect on 2 August, allowing these institutional funds to hold up to 20% of their assets in crypto. Spezialfonds are only accessible by institutions like insurers and pension funds, and currently manage assets worth ˆ1.8 trillion ($2.1 trillion), according to Bloomberg.

Ukraine’s Parliament signed the ‘On Payment Services’ law in July, allowing it to issue a CBDC, while in September it made the bombshell move to adopt the draft law ‘On Digital Assets’ which legally recognises cryptocurrencies, allows banks to open accounts for crypto businesses, and provides judicial rights protections for digital asset owners.

Some were more circumspect, keeping cryptocurrencies at arms length. For example, the Bank of Russia in July asked stock exchanges not to list crypto companies (a ruling which does not apply to a planned digital rouble CBDC), in September began blocking payments to cryptoexchanges, and watched as one high-ranking Kremlin representative said Russia was not ready to accept Bitcoin as legal tender.

Turkey’s difficult relationship with crypto continued. In May a national scandal broke out regarding an alleged $150m fraud involving a major exchange in the country, Thodex. Turkish police detained 62 people in relation to the alleged exit scam. Two weeks later, the Turkish Minister of Treasury and Finance, Lufti Elvan, announced a policy shift live on CNN Turk: that the central bank had defined crypto as a “non-monetary asset” and banned its use as a form of payment.

And yet, according to research published in Q3, Turkish crypto usage spiked 11x in a year.

The Cryptocurrency Awareness and Perception Survey 2021 (available here) by Akademetre Research found that in 2020 only 0.7% of Turkish respondents had traded crypto in some form. 84.1% had never heard of Bitcoin or cryptocurrencies before. By 2021, 7.7% of those surveyed had traded cryptocurrencies, while the number of people who had never heard of Bitcoin fell to just 30.1%.

The country’s largest cryptoexchange, Paribu, saw its userbase climb from 600,000 to over 4 million in the period surveyed. Average daily trading volume improved from $34m in 2020 to $610m in 2021.

Trust in cryptocurrencies is increasing, but this research shows us one more time that we need clear regulation to establish a complete trust for the userbase. Yasin Oral,CEO, Paribu

In July we also heard that Turkey’s draft bill on cryptocurrencies would be ready to go to Parliament for voting in October 2021.

But despite significant and growing retail support for cryptocurrencies, the government will likely take a hardline stance against them. Speaking to a national conference of students on 18 September, President Erdoğan argued that its CBDC was far more important and that the country was in a “war” against crypto.

We would never give [cryptocurrencies] that premium. Because we will continue on our way with our money, which is our fundamental identity in this matter.

Turkey’s digital lira has moved beyond the pilot phase and the Central Bank of Turkey reported in Q3 it was being tested in the wild, with the first results likely to be reported in early 2022.

Caribbean

Few Caribbean countries made regulatory moves on crypto in Q3: the Bank of Jamaica minted its first $230m of CBDC coins in August, while the East Caribbean Central Bank extended its DCash expansion to St Vincent and the Grenadines.

But Cuba’s acceptance of Bitcoin was the regional highlight. A 26 August resolution signed by the Banco Central de Cuba President, Marta Sabina Wilson Gonzalez, notes that the central bank will now be able to use cryptocurrencies like Bitcoin “for reasons of socio-economic interest”, as long as all transactions are overseen by state officials.

The use of cryptocurrency is not mandatory, unlike in Cuba’s neighbour to the south El Salvador, however the resolution does recognise cryptocurrencies as a means of payment exchange for banks and institutions, and says the central bank will grant licences to crypto service providers. The text of the law leaves the door open for the adoption of a range of cryptocurrencies nationally, but local media reported that both bitcoin and ether will likely be accepted as the two most recognised and highest-value cryptocurrencies.

Cuba’s reasoning is more nakedly political than most. The US embargo, and its associated sanctions regime, has crippled industry for decades, and remittances to the country are exorbitantly expensive, the World Bank says.

Everyone is watching if it goes well for El Salvador and if, for example, the cost of remittances drops substantially...other countries will probably seek that advantage and adopt it. Guatemala, Honduras and El Salvador are the countries that would have the most to gain if the adoption of bitcoin lowered the cost of sending remittances. Dante Mossi, executive president, Central American Bank for Economic Integration

Cuba’s move indicates that grand experiments using crypto are now accelerating at an international level.

Asia/Pacific

Chinese officials shut down crypto mining in Anhui province in July, marking the start of a series of regulatory actions against the vast industry. The dominos started to fall thereafter.

One high profile court ruled in August that cryptocurrency was “not protected in law” and on 24 September the People’s Bank of China declared all crypto-related activities illegal. Exchanges like Huobi have since blocked all mainland Chinese accounts, with Binance ending yuan trades in the post-quarter period.

South Korea, perhaps the most regulatorily-active country in the region, enacted legislation in July to allow it to seize crypto from tax evaders, and ramped up enforcement against unregistered exchanges with 40 venues expected to close by August. Offshore crypto activity that impacted domestic business would also be subject to Korean law and supervised by the Korean Financial Intelligence Unit, authorities ruled in Q3.

Japan strengthened its scrutiny of crypto in Q3, beginning in July with diplomatic efforts to block the use of cryptocurrencies and additions to the oversight mandate of the Financial Services Authority regulator.

Singapore granted its first license to a cryptocurrency exchange in August, in a bid to lure operators to the city-state, with retail adoption booming as high as 66%, according to reports.

South America

El Salvador was clearly the biggest story of Q3, with its Bitcoin Law coming into effect on 7 September. In the month since Bitcoin was introduced as legal tender in parallel with the US dollar, 2.73 million Salvadorans — 42.6% of the population and well above the number with bank accounts (see Theme 1) — downloaded the government’s official Chivo wallet and its $30 of free bitcoin, with more than 1 in 10 having since used the cryptocurrency as payment, according to Reuters. The law additionally exempts foreign investors from tax on bitcoin gains, a move designs to spur crucial Foreign Direct Investment in the country.

The ripple effects in South America have been noticeably broad, without any one country putting its head over the parapet. Argentinian President Alberto Fernandez told reporters in August he was “open” to adopting bitcoin as legal tender in response to inflationary pressures, while in the same month legislation arrived on the docket in Uruguay to legalise digital assets, allow banks to accept crypto payments and to provide a regulatory framework to integrate crypto with the existing financial system.

Middle East/North Africa

Kazakhstan's proportion of Bitcoin hashrate soared in the wake of China’s crackdown, becoming the world’s second-largest after the United States. Its Bitcoin hashrate share tripled to 18.1% in the year to August 2021, according to recently-published data from the Cambridge Center for Alternative Finance.

And its government began a one-year pilot in July to allow banks to process payments in cryptocurrency. No further official statements have emerged.

Iran continued its back and forth with crypto mining, ordering legal miners to halt production in July in the wake of blackouts, then announcing the activity could continue from September.

Dubai’s free zone became the Middle East’s latest regulatory test-bed, as UAE regulators approved crypto trading in September.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

À propos de ETC Group

ETC Group développe des instruments financiers innovants adossés à des actifs numériques, notamment l'ETC Group Physical Bitcoin (BTCE) et l'ETC Group Physical Ethereum (ZETH), qui sont cotés sur des échanges européens, comme le XETRA, Euronext, SIX, AQUIS UK et Wiener Börse.

ETC Group a lancé le premier produit négocié en bourse (exchange traded product- ETP) Bitcoin à compensation centralisée au monde en juin 2020 sur la Deutsche Börse XETRA, la plus grande plateforme de cotation d'ETF d'Europe.

ETC Group travaille en permanence à l'élargissement de sa gamme d'ETPs garantis par des crypto-monnaies, de qualité institutionnelle, offrant aux investisseurs la possibilité de s'exposer au Bitcoin, à l'Ethereum, au Cardano, au Solana et à d'autres actifs numériques populaires sur les principales bourses européennes.