Introduction - what is Polygon?

Anyone who has been interested in the blockchain space for any length of time will have discovered that the technology has a hard time scaling up to meet rapidly-growing demand. The introduction of smart contracts in Ethereum in 2015 birthed vast new verticals in digital assets, from non-fungible tokens (NFTs) to decentralised finance (DeFi) and decentralised apps (dapps).

But ever-increasing demand for blockspace on the Ethereum mainnet means that end-users continue to face the dual frustration of congestion and high gas (transaction) fees. Naturally, they have begun to seek out the most effective alternatives.

Overcoming performance bottlenecks in the Ethereum ecosystem is already a multi-billion dollar business, and yet the technology to improve this state of affairs is only just emerging out of its early testing phase.

Ethereum-compatible networks that aim to greatly reduce the time and cost to carry out transactions, whether sending ETH between wallets, buying or selling NFTs, or using DeFi, have a variety of technologies behind them. These include rollups, sidechains, plasma chains and Layer 2 solutions.

Polygon is the most prominent, highest-value Layer 2 solution for Ethereum. Since its mainnet launch in June 2020 [ https://blog.polygon.technology/the-matic-network-mainnet-is-now-live/ ] it has amassed a market cap of $12.1bn [ https://coinmarketcap.com/currencies/polygon/ ], making it the 16th highest-valued digital asset on the market. Adoption has also been swift. By October 2021, the network hosted over 3,000 dapps, compared to just 30 a year earlier. Today, more than 7,000 dapps use Polygon [ https://blog.polygon.technology/polygon-developer-ecosystem-hits-new-milestone-with-over-7000-dapps/ ].

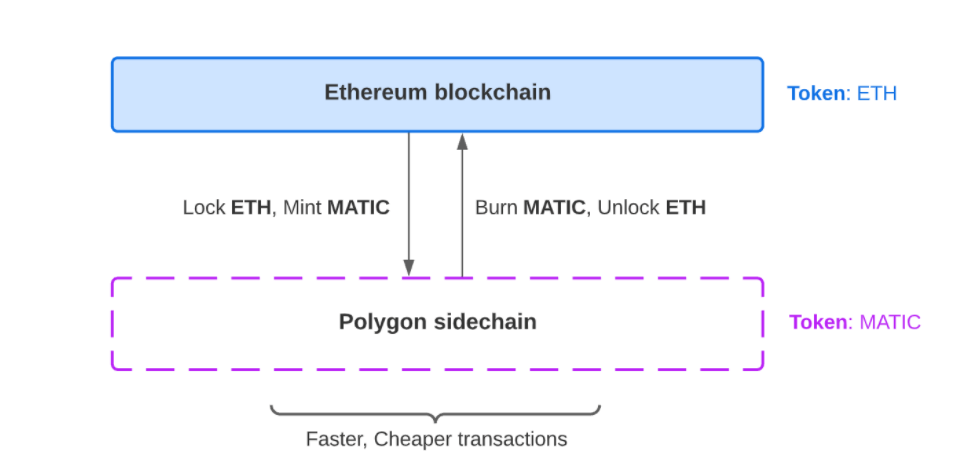

Polygon uses a series of sidechains, or blockchains which run alongside the Ethereum main chain, and connect to it. Doing this pulls processes, transaction confirmation and computation time away from the Ethereum main chain, thereby making transactions faster and cheaper for users and developers building dapps on Ethereum. Crucially, Polygon transactions inherit the security of the underlying Ethereum blockchain.

So instead of executing transactions on the main Ethereum blockchain, Polygon has these secondary blockchains that “roll up” transactions into batches and process them off-chain. Hence the name “rollups”. Every so often, the sidechain submits an aggregated list of its recent blocks of transactions back to the main chain. To summarise, Layer 2 solutions like Polygon execute the slowest part of the process, the transaction execution, away from the main Ethereum chain, allowing it to scale up to many more users. Only the data associated with the transaction is stored on-chain.

Polygon is considered a key component of the shift from Web2 to Web3. The term Web3 is generally taken to mean the shift away from centralised internet and application architecture controlled by the likes of a handful of trusted intermediaries like Google, replaced by developers building dapps on open, publicly verifiable and decentralised networks.

MATIC token

Polygon's native currency is called MATIC. It is used to pay transaction fees and for staking to help secure the network.

The network has a circulating supply of 7.7bn MATIC, with a total supply limited to 10bn tokens.

On 12 January 2022 Polygon announced it would implement EIP-1559, the same network-wide upgrade applied to Ethereum in August 2021's London hard fork. This effectively switched the MATIC token issuance schedule to be deflationary, rather than inflationary, over time. This should lend a greater value to the MATIC tokens already issued, as it has with other deflationary digital assets like Binance Coin (BNB) and the upcoming Proof of Stake switch on Ethereum.

A brief history

Polygon was founded in 2017 in India by three computer programmers: Anurag Arjun, Sandeep Nailwal and Jaynti Kanani. Initially it was named ‘Matic Network' and its internal currency still bears the same name.

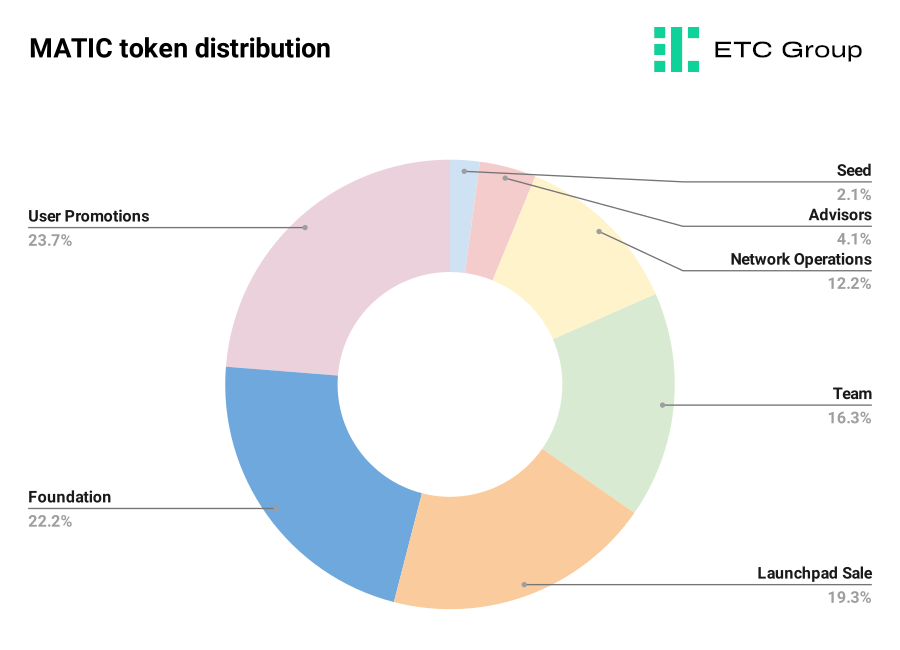

In an April 2019 token sale through Binance Launchpad, Polygon sold $5m of MATIC at $0.00263 per token. At the time that comprised 19% of the total supply of MATIC.

Early investors also include Coinbase Ventures and ZBS Capital, who added $450,000 of seed funding in May 2019 [https://www.crunchbase.com/organization/polygontechnology/investor_summary/overview_timeline]

In 2021 Matic Network rebranded as Polygon, with Ethereum developer Mihailo Bjelic joining the team.

By early 2022, Polygon had established itself as the leading scaling solution for Ethereum.

The project took another giant leap forward in February of this year when it received $450m [ https://blog.polygon.technology/polygon-raises-450000000-from-sequoia-capital-india-softbank-galaxy-tiger-republic-capital/ ]

from a series of high-profile venture funders, including Sequoia Capital India, Tiger Global and Softbank.

The deal implied an at-market value for Polygon of $13bn.

Speaking to Crunchbase [ https://news.crunchbase.com/news/web3-blockchain-startups-funding-alchemy-polygon/ ] at the time, Andreessen Horowitz general partner Ali Yahya said:

We're at an inflection point that will lead into an even faster pace of innovation and growth in Web3. It's the layer in the stack that bridges the gap between the raw infrastructure and the Web3 developers who will build the killer applications for this technology and take it mainstream.

How Polygon works

To use Polygon and take advantage of cheaper fees, users deposit ETH to a Polygon smart contract to create an equivalent amount of MATIC on the Polygon sidechain. When their transaction is complete, they can convert their MATIC tokens back to ETH.

So why is this particularly important?

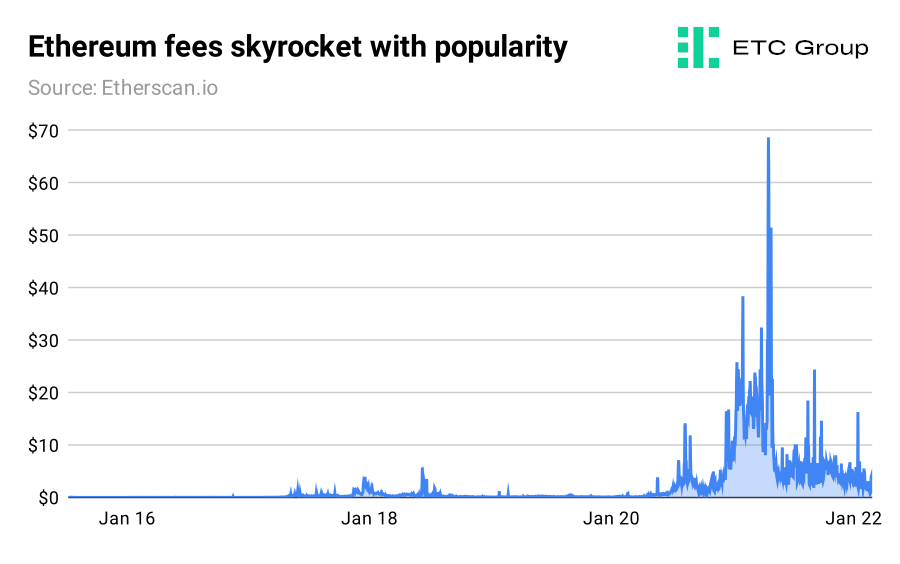

Despite its evident popularity, Ethereum has not been able to scale up to the millions of users who want to interact with the dapps on its network. This has had severe consequences on the end-user experience.

In May 2017 the average transaction fee to use the blockchain passed $0.10 for the first time, as recorded by block explorer Etherscan.io.

As more dapps came on board, and users started to flock to Ethereum, the fees continued to rise. By February 2021 the average transaction fee had skyrocketed to over $30, making the blockchain virtually unusable for all but the richest participants.

For months at a time, fees remained elevated in the high double digits of dollars, and peaked on 11 May 2021 at an average of $68.72.

Since the introduction of Polygon and other scaling solutions, these fees have started to come down to more reasonable prices.

Data from Dune Analytics shows that at the time of writing, the average Polygon gas fee was 68 gwei or 0.000000068 ETH. That's $0.0001978 in US dollars, or less than two thousandths of a cent.

Polygon's technology also allows Ethereum to process transactions more quickly.

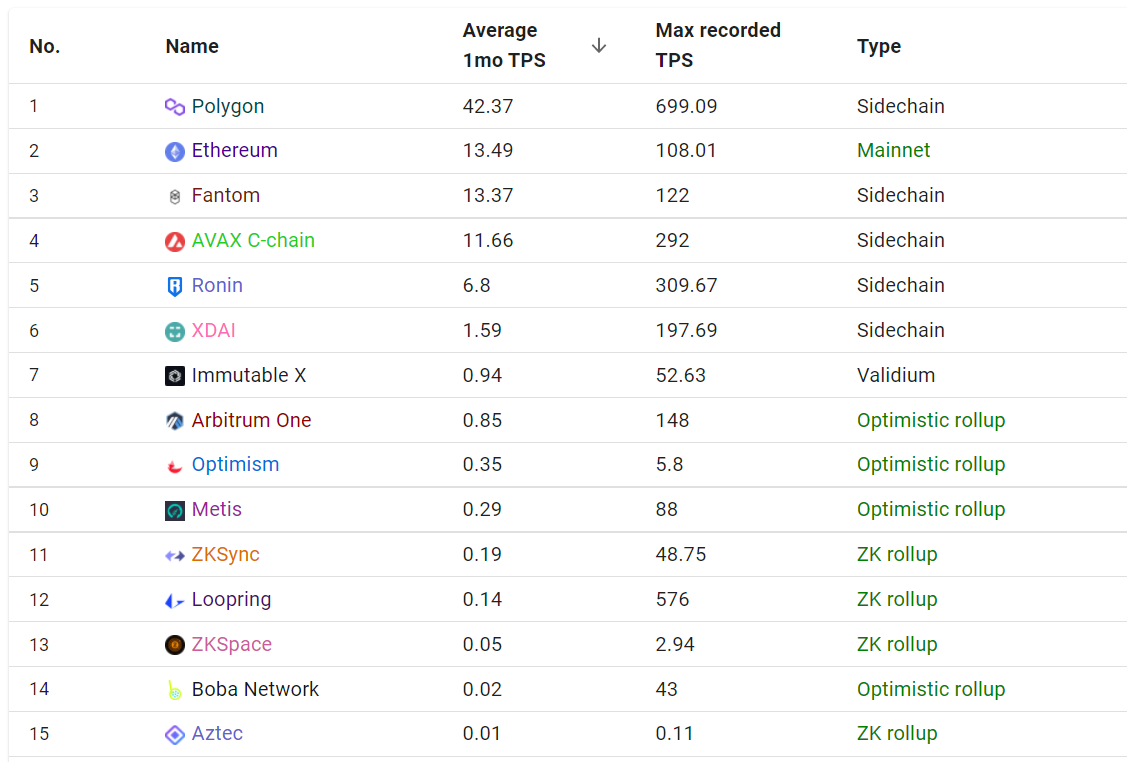

Throughput, or how many transactions a network can process at any one time, is usually measured in TPS (transactions per second).

Sharing the results from a two-month uninterrupted stress test on its CS-2008 testnet in July 2020, Polygon claimed [ https://twitter.com/0xPolygon/status/1283115941224566786 ] it had been able to take Ethereum dapp throughput to 7,200 TPS (transactions per second).

Ethereum's current mainnet TPS usually sits around the 12 TPS mark.

Theoretical maximums can be a useful tool to show how a network may perform under optimal conditions, but more often that not they are simply a marketing tool unlikely to ever reach that level in a live production environment.

And while development is ongoing constantly to refine this very new area, it pays to look beyond the hype and the VC capital-raising to see which options are likely to grab market share by dint of working the best of the current solutions.

For the in-production model Polygon's proof of stake network has an average one-month TPS throughput of 42.37, with its maximum recorded value of 699 TPS [ https://ethtps.info/ ]

Polygon is orders of magnitude faster in terms of throughput than its rivals like Optimism, Arbitrum One, Boba Network and Loopring. It is also operating at a much larger scale. Ethtps.info pegs each of these competitors at a snapshot capability speed of less than 1 transaction per second, making Polygon 25x faster.

Zero-knowledge (ZK) rollups are a very new implementation of the mathematical concept known as zero-knowledge proofs, first conceived in 1982. While Layer 2 solutions using ZK rollups have enjoyed some commercial success, for example Loopring's recent NFT integration with Gamestop (NYSE:GME), production scale for this version of Ethereum scaling is not really evident at time of writing.

Taking the top 15 solutions (and the Ethereum mainnet for comparison) into account in the table above we can see quite clearly that Polygon is the fastest option with the best throughput potential for its live market product.

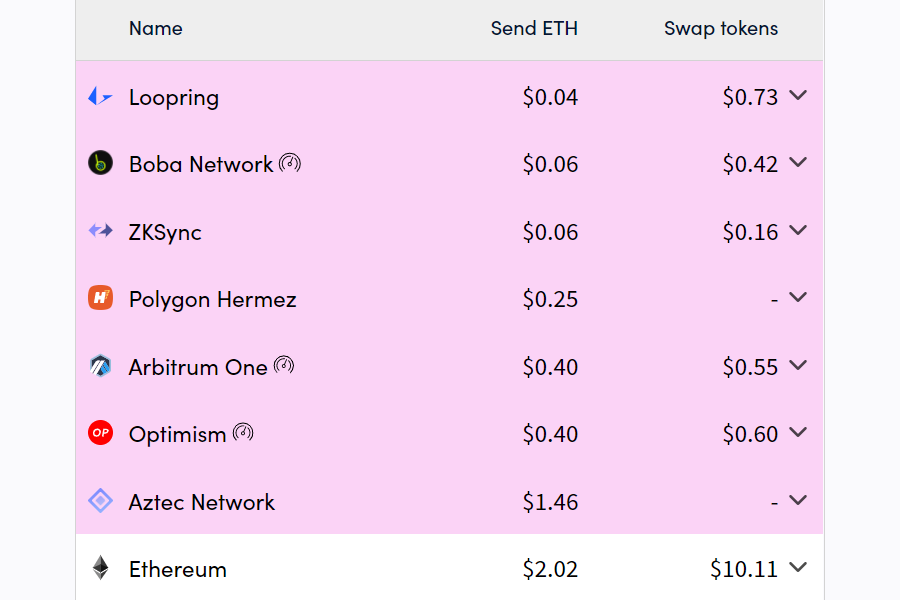

This snapshot chart by L2fees.info from 21 March 2022 shows the comparative cost of using Polygon alongside its main competition.

Loopring, Boba Network and ZKSync all use zero-knowledge proofs.

While they are between four and five times cheaper than Polygon, their throughput as noted above is several thousand times slower, so there is a clear trade-off to be had between operability and cost.

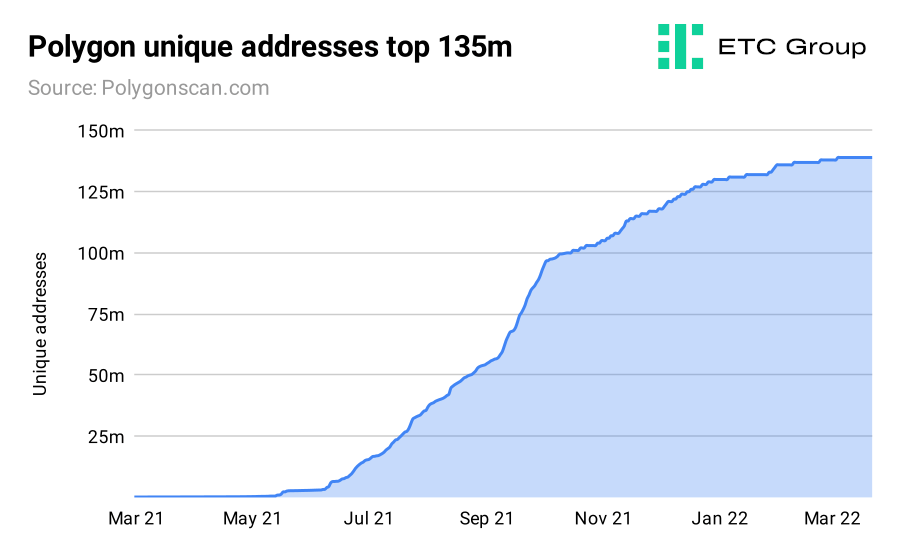

Polygon user growth has continued to go from strength to strength.

The network now records over 135 million unique addresses.

While a single user can have multiple addresses, and so the metric is not a direct correlation with the number of individual users, in general unique addresses can tell us how popular a particular blockchain is.

The Polygon suite of products comprises seven products live or in testing, with an eighth, enterprise-focused chain focused on providing solutions for cloud technology providers announced in the last month [ https://www.businesswire.com/news/home/20220316005007/en/Polygon-Taps-SIMBA-Chain-for-Upcoming-Blockchain-Technology-Business-Initiatives ].

Polygon Proof of Stake: This is the Ethereum-compatible sidechain where the vast majority of transactions take place. Currently live.

Polygon Hermez: An open-source ZK rollup chain optimised for secure low-cost token transfers. Currently live.

Polygon Edge: A modular and extensible framework for building private or public Ethereum-compatible blockchain networks. Currently live.

Polygon Nightfall: An experimental scaling solution developed in tandem with EY that uses a combination of both Optimistic rollups and ZK rollups. Currently in testing.

Polygon Avail: A general-purpose chain focused on data availability. Currently in development.

Polygon Miden: A ZK rollup chain with support for arbitrary smart contracts. Currently in development.

Polygon Zero: A ZK rollup chain that uses fast recursive proofs. Currently in development.

DeFi & TVL

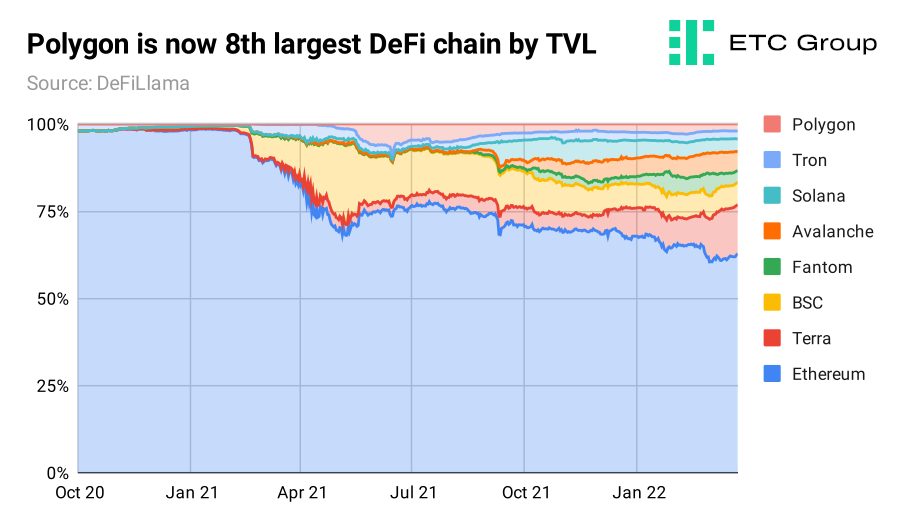

-->On 1 January 2021, approximately $40m of assets were locked in Polygon's Proof of Stake blockchain, with the chain comprising less than 0.01% of the DeFi market. Today, that figure is 100x larger at close to $4bn and 1.86% market share, making Polygon the eighth-largest DeFi chain globally [ https://defillama.com/chains ].

With 209 protocols connected to it, Polygon is also the third-largest blockchain by number of integrations, behind only Ethereum (571) and Binance Smart Chain (341).

Many of the best-known DeFi marketplaces have chosen to integrate with Polygon, including Aave, Curve, KyberSwap, Balancer, SushiSwap and crucially, market leader Uniswap. It is these kinds of leading integrations which investors in MATIC believe will bring the most value to Polygon overall.

Staking and Validators

As a Proof of Stake blockchain Polygon relies on validators to secure the network. These validators run full nodes and verify blocks of transactions, while also participating in committing checkpoints on the Ethereum mainnet.

Validators stake MATIC tokens in smart contracts that live on the Ethereum mainnet and are rewarded for expending their computing power in MATIC tokens. Staking rewards for validators currently sit at around 9.2%, or 5.94% taking into account network inflation, according to StakingRewards.com [ https://www.stakingrewards.com/earn/matic-network/ ].

Users who do not want the hassle of running full nodes can also delegate their MATIC tokens and receive slightly smaller staking rewards in return. At time of writing, those rewards are in the range of 8.4%, or 5.2% when network inflation is taken into account. There is no minimum amount of MATIC necessary to become a delegator.

As with many other Proof of Stake networks, Polygon employs ‘slashing' to combat spam and to deter malicious actors from attempting to attack the network. If a node does attempt to double-spend MATIC, or otherwise behave maliciously, they will have their staked MATIC deleted.

Polygon has allocated 12% of its total 10 billion token supply towards staking rewards. These 1.2 billion MATIC tokens will be the staking incentive up to around 2025, with more decisions to be made down the road when the supply is exhausted.

Indian conglomerate Infosys (NYSE:INFY) became one of Polygon's earliest validating nodes in May 2020 [ https://crypto.news/matic-network-indian-it-infosys/ ], with the $99bn market cap giant expanding its blockchain presence beyond banking and trade finance. As news sites reported at the time, the entry of such a major organisation was a huge boost to Polygon's back-end infrastructure, and the association with such a reputable name likely to attract more developers to their dapp ecosystem.

In March 2022, the $8bn market cap sports betting company Draftkings (NASDAQ:DKNG) became the newest corporate validator on Polygon, marking its first entry into blockchain. [ https://blog.polygon.technology/polygon-welcomes-nasdaq-listed-draftkings-as-network-validator/ ]

Risks

Polygon has a way to go to make ease-of-use improvements for its end users and the process of using the technology is still quite complicated, even for blockchain natives.. There are numerous tales of consumers accidentally losing funds in the confusion of how and where Polygon interacts with exchanges, for example. Polygon user documentation [ https://docs.polygon.technology/docs/faq/wallet-bridge-faq/ ] states:

Sadly, we regret to inform you that we may not be able to assist if you have sent tokens from the Polygon network to an exchange/wallet which is not supported.

And as one developer wrote on the Polygon forum:

Please don't send funds directly to exchanges that support only Ethereum, you have to first withdraw from MATIC to ETH and then send it to your exchange address. We have mentioned this in the disclaimer that we show before your go-ahead with the 'send' functionality on the MATIC wallet.

These may be the simple growing pains of a relatively new network.

Due consideration must also be given to the decline in daily transactions [ https://finance.yahoo.com/news/polygon-transactions-drop-half-following-104500032.html ] since around June 2021, when the Polygon team decided to increase the gas cost to use the network from a minimum of 1 gwei (0.000000001 MATIC) to 30 gwei (0.00000003 MATIC).

Co-founder Sandeep Nailwal noted the move was in response to growing spam on the network.

Offering cheap transaction fees comes with its own benefits and drawbacks: models that employ higher fees are more efficient at combating spam and ensuring that individual users do not use too many scarce blockchain resources. Real users may find it harder to make genuine transactions if blocks are filled with too much spam.

According to the Polygonscan block explorer [ https://polygonscan.com/chart/tx ] , daily transactions hit a peak of 9.1 million in mid-2021 and have steadily declined since. At time of writing, daily transactions have stabilised in the 2.5 million to 3 million region.

It will be important to watch how this metric changes over time: if transaction volume continues to decline then the investment case for MATIC as a whole will be affected.

Valuation

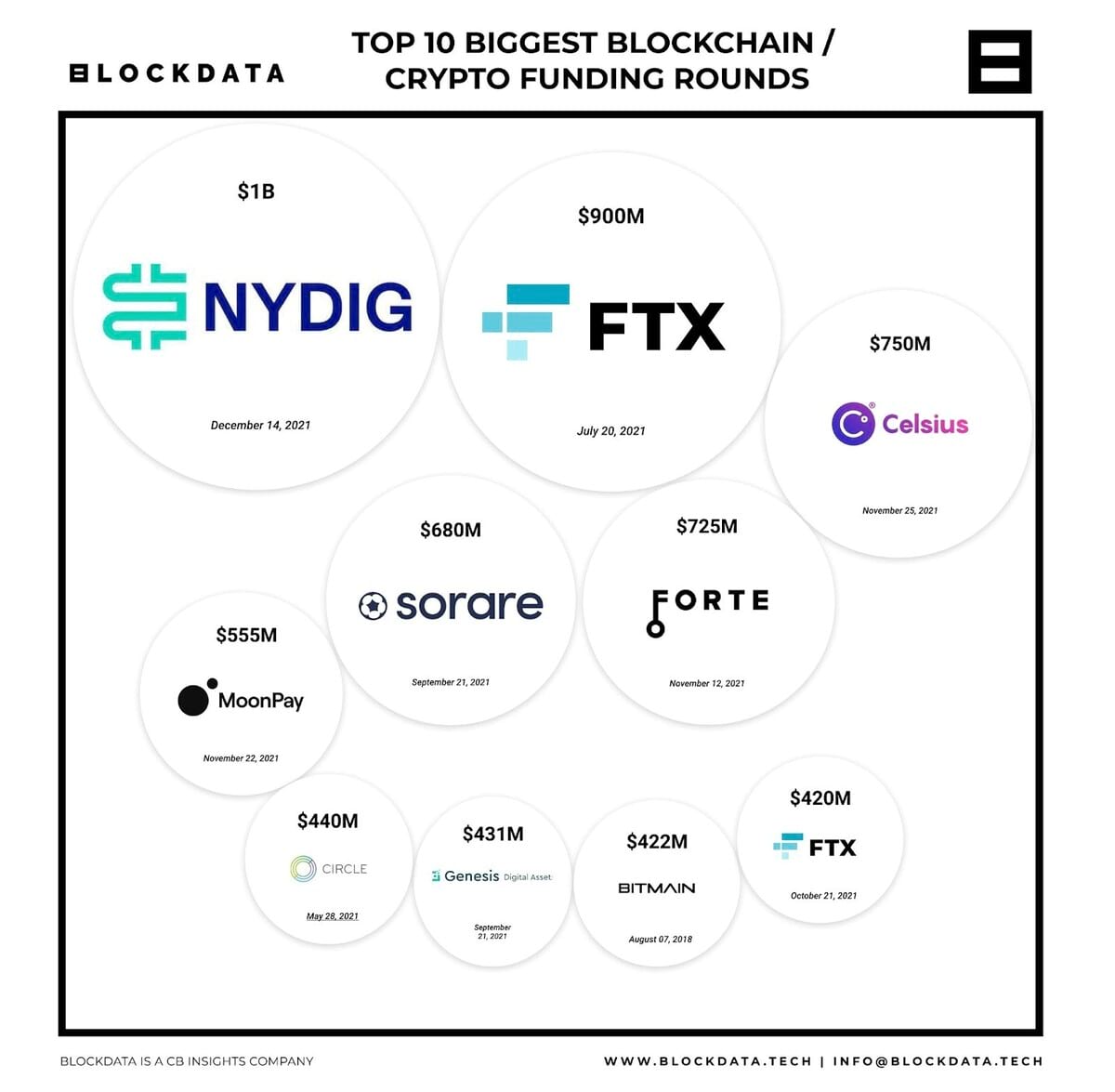

The $450m investment in Polygon by Sequoia Capital and others is a clear statement of intent, making Polygon the subject of the seventh-largest venture round of all time in the crypto and blockchain space.

That's ahead of the $422m raised by Bitcoin mining manufacturer Bitmain in 2018, the $431m raised by miner Genesis Digital Assets in 2021, and the $440m raised by USDC stablecoin operator Circle the same year. Polygon would sit in the middle of the below chart from Blockdata.tech [ https://www.blockdata.tech/blog/general/top-10-funding-rounds-in-blockchain-crypto ].

If Polygon is to be one of the main building blocks of Web3, or the next logical version of the internet, then its value will likely rise in tandem with the vast swathes of capital now being injected into the space.

Polygon does not exist in a vacuum and indeed there are multiple teams working on solutions to help Ethereum to scale more effectively.

What the network does have to its credit is a broad suite of products employing the various interpretations of rollups, and not a focus on one particular solution. So, if it turns out that ZK rollups are too complex or too cumbersome to be used in a production environment, it has alternative development options.

Polygon effectively brings to Ethereum all the advantages that Avalanche, Cosmos and Polkadot have over the current largest smart contract blockchain. This, along with its leading position as a Layer 2 solution makes it an important part of the blockchain space going forward.

Additionally, the team's ability to work with multinational enterprises - both as network validators, and on implementing scaling solutions with the likes of EY - brings forth a couple of interesting conclusions. Firstly, it shows that very serious institutions are starting to place higher importance on the next iteration of blockchain technology. Second, it brings into mainstream conversations the trade offs necessary to scale blockchain-based dapps to millions of users.

Outlook

Polygon and hence its MATIC token have first mover advantage in terms of Layer 2 scaling solutions for Ethereum. As noted above, it does have stiff competition for usage, and of course fees from those users, in the form of Arbitrum One, Optimism, Loopring and a slew of other ZK rollup protocols.

With Ethereum producing ever larger amounts of revenue, and competition for its blockspace not slowing one iota, we see a rapid-growth total addressable market for MATIC.

Today the highest-valued dapps are finance and collectible NFT-related. But the future development of the space will likely broaden significantly to include many more dapps for gaming and other non-financial activities.

And when users have the option of a dapp store to rival Apple or Android, they will need speed and scale. It appears that Polygon will be a key part of Ethereum being able to meet this kind of demand.

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

À propos de ETC Group

ETC Group développe des instruments financiers innovants adossés à des actifs numériques, notamment l'ETC Group Physical Bitcoin (BTCE) et l'ETC Group Physical Ethereum (ZETH), qui sont cotés sur des échanges européens, comme le XETRA, Euronext, SIX, AQUIS UK et Wiener Börse.

ETC Group a lancé le premier produit négocié en bourse (exchange traded product- ETP) Bitcoin à compensation centralisée au monde en juin 2020 sur la Deutsche Börse XETRA, la plus grande plateforme de cotation d'ETF d'Europe.

ETC Group travaille en permanence à l'élargissement de sa gamme d'ETPs garantis par des crypto-monnaies, de qualité institutionnelle, offrant aux investisseurs la possibilité de s'exposer au Bitcoin, à l'Ethereum, au Cardano, au Solana et à d'autres actifs numériques populaires sur les principales bourses européennes.