The FTX saga rolls on but there is light at the end of the tunnel for value seekers, NFTs show rapid mainstream adoption as Mattel and Nike join the fray with Polygon, and retail Bitcoin holders are buying the dip so aggressively that figures have reached fresh all time highs.

Retail Bitcoin holders accumulate to ATH in wake of FTX

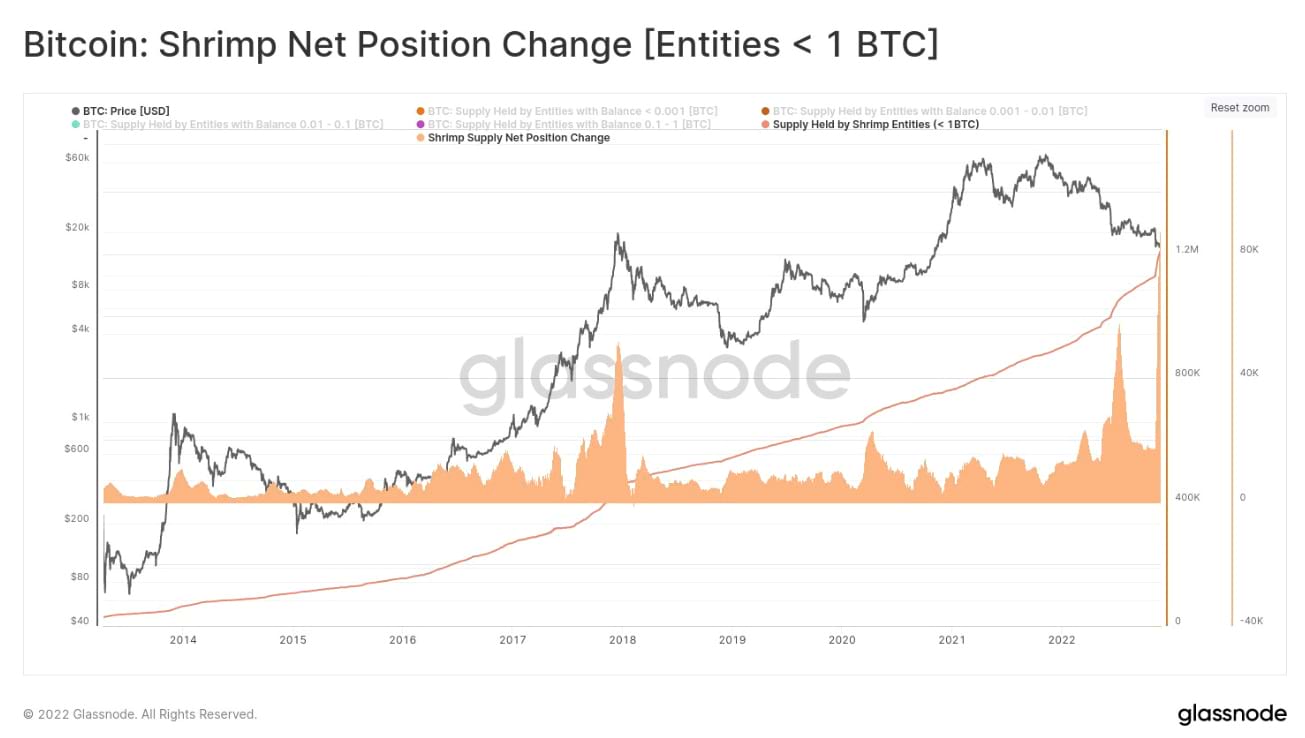

Retail Bitcoin holders have bought the dip so aggressively that small HODLer numbers are now at all time highs, according to Glassnode data.

Researchers discovered that those who hold fewer than 1 BTC in their wallets - so called ‘shrimps' to distinguish their size from rich Bitcoin ‘whales' - have added 96,200 bitcoins worth $1.55bn to their balances since the beginning of November.

Holders with less than 1 BTC now account for 6.2% of Bitcoin's total supply.

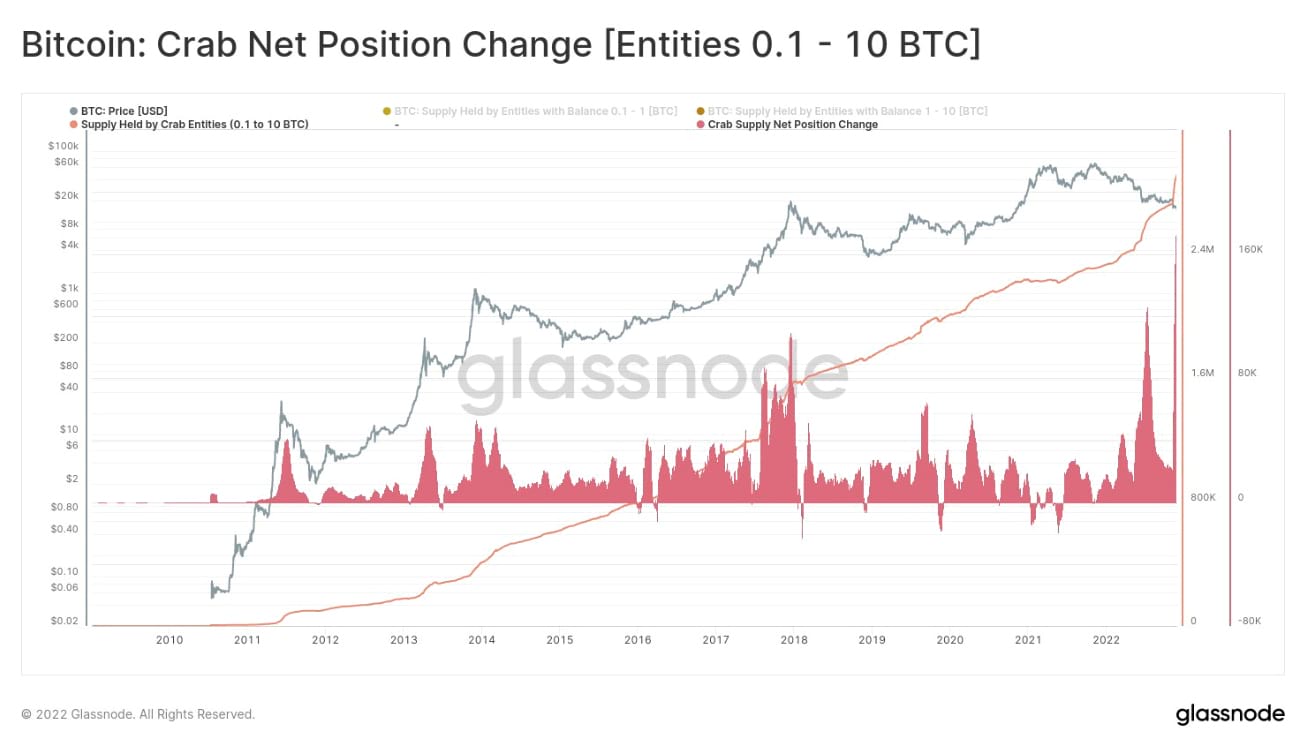

Analysts also discovered that medium-sized entities - denoted ‘crabs' under Glassnode terminology - with between 1 and 10 BTC in their wallets, also energetically bought as Bitcoin dipped to $16k.

This cohort of investors added a total of 191,600 BTC in the last 30 days. “This is a convincing all time high,” the on-chain data provider wrote, “eclipsing the 126,000 BTC/month reached in July 2022”.

The price of the world's first cryptocurrency dived from $21.3k on 5 November to $15.8k on 10 November as the FTX collapse roiled markets. As we showed in previous Crypto Minutes, the balance of Bitcoin holders saw its largest one-day increase in history as prices plunged.

BTC being reallocated from over-leveraged traders to value-seeking retail is highly bullish for the ecosystem, because Bitcoin benefits from Metcalfe's Law: the network's utility grows as it is adopted more broadly.

With the collapse of FTX and Sam Bankman-Fried's empire, and an extended period of poor market performance, critics of the crypto market have been quick to suggest that contagion is endemic and extends throughout the market. Some even see this as the beginning of the end.

But many crypto investors and enthusiasts swerved the easy charms of FTX and instead chose to invest via regulated crypto ETPs. In Hong Kong, the financial regulator recently allowed tokenised investments for retail investors. Investment giants such as Fidelity have been among the first to offer such products in this new market. Crypto ETPs can be a better option for institutional and those seeking more mature and sensible products.

ETPs are subject to all the rules of the other products traded on fiat exchanges and thus less vulnerable to situations such as the fall of FTX, Alameda Research and BlockFi.

Mattel, Nike, Apple in metaverse push: Polygon users 4x in 2022

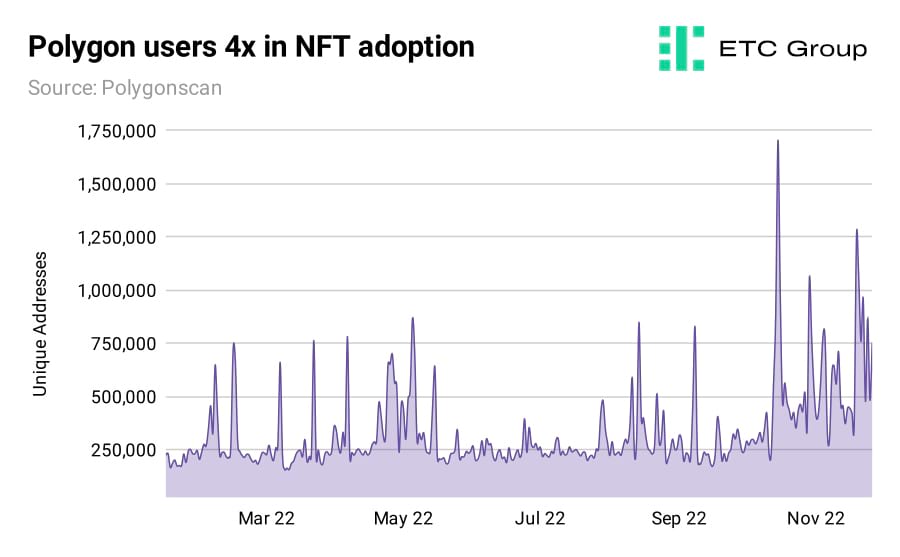

The number of daily active Polygon wallets has 4x'd in the last five months, from an average of fewer than 200,000 to over 1 million.

Why, you ask?

Polygon is a Layer 2 scaling solution for Ethereum, which allows the underlying blockchain to process transactions near-instantly and with vastly reduced fees.

The blockchain-based portion of the creator economy is alive and well, even while crypto markets struggle for momentum and direction in the midst of Crypto Winter. Toymaking giant Mattel is the latest domino to fall, launching an expanded version of its NFT marketplace on the Flow blockchain this month. The $6.3bn market cap Californian conglomerate owns the rights to popular brands including Barbie, Matchbox, UNO and Fisher Price.

Apple has now made its metaverse intentions quite clear, with a swathe of job postings picked up by Bloomberg. The tech giant is the world's most valuable company. And work on its highly-secretive but hugely anticipated virtual reality/augmented reality headset continues. In one job listing, Apple seeks developers for a “3D mixed reality world” that sounds very much like its own metaverse. In a second posting, Apple lays out its intentions to create a video service for the headset to feature “3D content that can be played in virtual reality. In May 2020 Apple acquired NextVR for a reported $100m, a company which develops tech for producing and broadcasting events in VR.

ETC Group created Europe's first Metaverse ETF (METR) to allow investors exposure to this megatrend, pegged at a total $13 trillion valuation by investment bank Citi.

Nike too has spied a major opportunity in NFTs, launching its Web3 platform .SWOOSH. It becomes one of a clutch of retail-focused platforms to partner with the Polygon blockchain to allow devoted creators to build and sell virtual trainers and clothing and unlock extra experiences using token incentives. ETC Group also offers a 100% physically-backed exchange-traded product ( MTCE ) which tracks the price of Polygon.

The sports brand joins Reddit, Starbucks, Instagram, Robinhood and JP Morgan as users on Polygon have exploded upwards. It is particularly interesting to see this mainstream adoption and NFT innovation come amid the worst bear market in recent memory.

The timing of Nike and Apple's initiatives comes in direct contrast to the obvious struggles of Facebook's parent company and metaverse flag-bearer Meta. Mark Zuckerberg has been roundly criticised for over-investing in the debacle that is Horizon Worlds, sacking 11% of Meta's staff and pulling back metaverse expenditures that comprise a near $10bn balance sheet loss.

The difficulties Meta has faced in building the Metaverse are visible from the short lifespan of Horizon Worlds, the company's flagship $15bn social virtual reality platform. It has been widely criticised for failing to attract users, even losing 200,000 players since February 2022 due to a combination of buggy software, poor quality graphics and lack of things to do in-world.

The company's Metaverse arm, Reality Labs, reported a staggering $9.4 billion loss this year. Meta has also shed 65% of its share price since the start of 2022. This shows the danger of investing in a single stock to profit from a new industry that could be worth $13 trillion to the global economy by 2030.

Metaverse tech actually involves the development of a wide range of sectors, from smart manufacturing to gaming, VR to augmented reality, 5G, blockchain-based payments to digital identity, and more.

For buy-and-hold investors, often the best method of gaining exposure to innovations that will mature over decades is by investing in exchange-traded funds (ETFs).

And the early winners and losers of the metaverse are starting to emerge.

Beyond the bear: Bitcoin on-chain value metrics

While there is still only one story dominating mainstream media headlines, it is worth noting that you don't have to understand anything about crypto, Bitcoin or blockchain to understand the FTX story. What we have seen here is really a very simple case of corporate fraud and mismanagement. It's Enron or Bernie Madoff -level stuff. If those references don't land, there's an excellent 8-part podcast documentary series called Bad Bets that covers these Web1-era frauds with fascinating insight.

But market-watchers with even the faintest interest in crypto will be thoroughly exhausted by the FTX situation. It is barely worth retreading all the ground covered to date, and indeed, all will be covered in minute detail by the investigative journalists at Reuters and the Wall Street Journal.

Thankfully, ETC Group custody provider BitGo - through whom today around 20% of all bitcoin transactions are processed - has been appointed to oversee the FTX bankruptcy and has reportedly uncovered $740m in missing client funds. At the very least, the adults have finally entered the room there.

The real question now is: if we look beyond FTX into the final month of 2022 and into 2023, is there a light at the end of the tunnel that isn't another oncoming train?

And there are only two real reasons to allocate capital in bear markets.

One: if a sector is not going away - and this should be plainly obvious to anyone with an eye on institutional adoption; and

Two: if there are no obvious other narratives or hype cycles pushing others to invest.

This way, we know that we are obtaining our asset in the cheapest range, with the largest potential upside.

Certainly the huge uptick in Bitcoin buys by the smallest holders is a signal that value-seekers see price appreciation potential from dollar-cost averaging with Bitcoin at two-year lows.

Bitcoin investing is a cyclical business, and as we discussed in our piece for ETF Stream, the Bitcoin block halving in 2024 could provide material upside for investors with an eye on both the past and the future.

Many on-chain metrics have already bottomed. Quant investor Charles Edwards, who has invented many relevant datapoints including hash ribbons for tracking distressed Bitcoin mining capitulation, put forward a new metric this month. The Bitcoin Yardstick is a simple structure that divides market cap price by hashrate, with data normalised over the course of two years.

“Today we are seeing valuations unheard of since Bitcoin was $4k,” writes the Capriole Investments chief. “Similar in concept to a [price to earnings] ratio, the Yardstick takes the ratio of energy work done to secure the Bitcoin network in relation to price.”

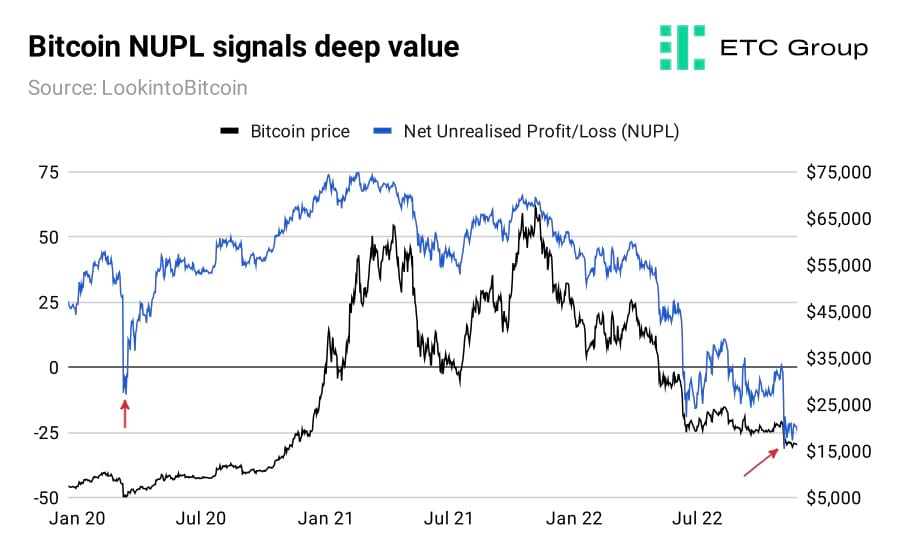

We can certainly also consider Bitcoin's NUPL, or Net Unrealised Profit and Loss. This metric looks at the average cost-basis for Bitcoin investors, and finds the price regions where historically the largest profits have been made.

With NUPL today (as of 29 November 2022) at -24.26%, there are only a handful of occasions in history when the metric has sunk this low.

The area marked by the red arrow on the left of the chart shows NUPL at its previous lowpoint before this cycle, during the March 2020 stock market crash. At that point, Bitcoin NUPL dropped from plus-26% to minus-9.92% in 24 hours. That 36% drop saw BTC dive from $7,935 to $5,142.

Using NUPL as our guide, we can see that buying Bitcoin today at $16k is comparable to buying Bitcoin in the low single digits from March 2020 and in the $3.4k region from November to December 2018. The NUPL in the minus 30% region is of the same order.

If we use history as a guide to our future, and it's probably the best guide that we have, you will see that most new technologies have these big blooms and busts. The dotcom crash in the early 2000s looked to some people like the failure of this weird new thing called the internet. Spoiler alert: it wasn't. So we'd probably be wise to take a longer view of crypto and the underlying blockchain technology.

Stronger crypto business models will prevail in 2023. And Bitcoin will recover. To quote Italian essayist George Santayana from 1905's The Life of Reason: The Phases of Human Progress with: “Those who cannot remember the past are condemned to repeat it.”

Markets

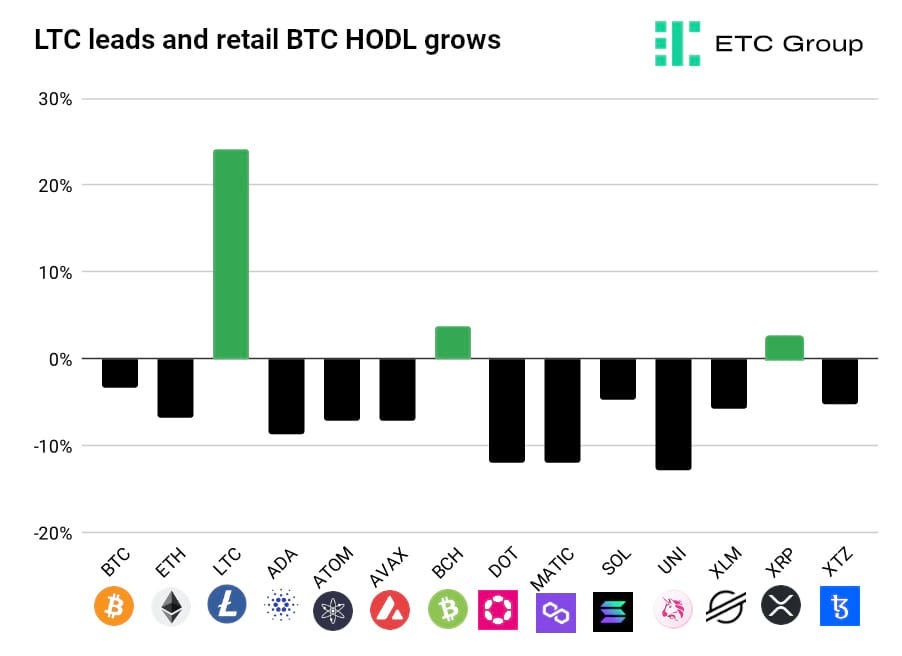

With less than 250 days until its next block reward halving, Litecoin led markets this month with a gain of 26.1%. LTC, like its progenitor BTC, was designed as a deflationary currency whose supply schedule is sliced in half once a set number of blocks have been processed.

This provides an intriguing foreshadowing for Bitcoin, whose halving is scheduled for mid-2024. Crypto markets in general have stabilised after the wider confidence losses from the collapse of FTX, with Bitcoin and Ethereum both posting slips of less than 5% across the fortnight.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.