ETC Group Crypto Minutes Week #46

Hubris and greed at bankrupt FTX does massive damage; Bitcoin, regulated companies and custodians are biggest winners; bank run on Crypto.com, offshore cryptocurrency exchanges.

Hubris and greed at bankrupt FTX does massive damage; Bitcoin, regulated companies and custodians are biggest winners; bank run on Crypto.com, offshore cryptocurrency exchanges.

Writing a biweekly newsletter like Crypto Minutes in the midst of a huge breaking story is like trying to empty a lake with a teacup in the middle of a thunderstorm: there's no possible way to keep up.

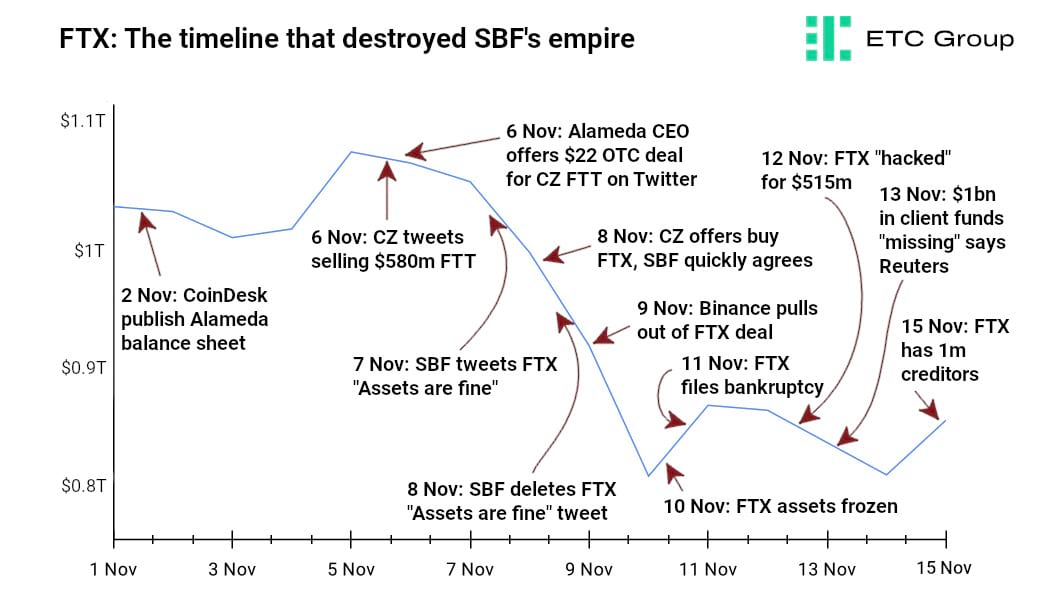

We can likely all agree on one thing, though. The FTX/Alameda collapse began the worst week in crypto market history. If not, it was pretty damn close. The head of the world's second-largest crypto derivatives exchange, a man whose face had been on the front of Time magazine, put his $32bn company into bankruptcy. How did the house of cards collapse so quickly?

The exchange's founder Sam Bankman-Fried secretly transferred $10bn of customer funds from FTZ into market-maker/hedge fund Alameda Research, sources told Reuters. It's hard to find the words. Just, wow. So illegal.

Incompetence, hubris, greed, no risk management, 100x leverage and a casino mentality, no safeguards, rehypothecated loans, where do we even begin with the rest of it? In short, a pale-faced crook and his house of goons in the Bahamas embody all the worst excesses of finance, packed together in a big bundle.

The bankrupt exchange now faces criminal investigation in the country where its headquarters are located.

Asset managers CoinShares, 21Shares and Van Eck have of course been forced to suspend their FTX ETPs, just as they were forced to suspend their Terra Luna ETPs just months after launch and report substantial losses when the algo stablecoin collapsed in May.

It started with a news story, as these things usually do. After seeing the $14.6bn Alameda balance sheet, Binance CEO Changpeng ‘CZ' Zhao, an early investor in SBF's risky altcoin casino, said he would liquidate Binance's entire $580m holdings in FTT, the native token of the FTX exchange. Buying FTT tokens is like buying a seat at the New York Stock Exchange: giving users a discount on trading fees. But Bankman-Fried had been using FTT as collateral in loans. Lots and lots of very big and very risky loans.

Until the start of November 2022, Sam Bankman-Fried (SBF) was worth around $17bn. VCs, politicians and SEC chair Gary Gensler all fawned over him. In a matter of days, he lost most of his fortune. The one-time face of the industry was retitled in popular culture as ‘Scam Bankman-Fraud'.

And the news keeps getting worse. Every day another shocking story comes out about FTX and the biggest crypto-native market maker Alameda Research. Hacks, insider trading, the fact that the Alameda CEO had just 19 months trading experience before managing a $1bn fund? SBF reportedly had a secret ‘backdoor' that allowed him to move funds around without his auditors noticing.

FTX could have up to one million creditors, new bankruptcy filings show: it will take some time just to unpack who owes what.

Some of the most sophisticated traders and investors in the business did not see this coming. Larry Cermak, the head of research at The Block, was one of many industry insiders who held all of his funds on FTX. Kevin Zhu of Galois Capital, an early critic of failed stablecoin TerraUSD who made millions shorting LUNA months before it collapsed in May. He held half his $80m hedge fund's AUM on FTX.

Both will join a long line of creditors who may have to wait years to get a scrap of what is left over. Bitcoin exchange Mt Gox, which collapsed after a hack in 2014, is still going through the arbitration process.

In traditional finance, exchanges cannot be custodian funds.

Exchanges should not be banks that hold customer funds.

It's worth repeating, only louder. EXCHANGES SHOULD NOT BE BANKS.

Especially if they are not regulated like banks, and provide no recourse to customers when money is lost.

It should be obvious, but it is worth stating: ETC Group has never had any business relations with FTX or Alameda Research.

When designing our ETPs, it was essential to the team that investors' assets are strictly separated from any interests of companies and market participants. Details and mechanics were built into the product structure of our ETPs that now suddenly turn out to be very crucial: Regulated custodians, independent administrators, no trading in the ETP itself, and of course, 100% physical backing at all times, with no lending of the underlying assets. All information can be found in the base prospectus of our ETPs launched in Germany.

In truth, Alameda Research likely collapsed back in May along with the implosion of Terra Luna, the massive losses racked up at Three Arrows Capital, bankrupt Voyager Digital and lender Celsius.

Lukas Nuzzi, head of R&D at Coin Metrics, showed a chain of transfers of FTT between FTX and Alameda suggesting Bankman-Fried provided an $8.6bn bailout for Alameda in Q2 2022 using FTT tokens.

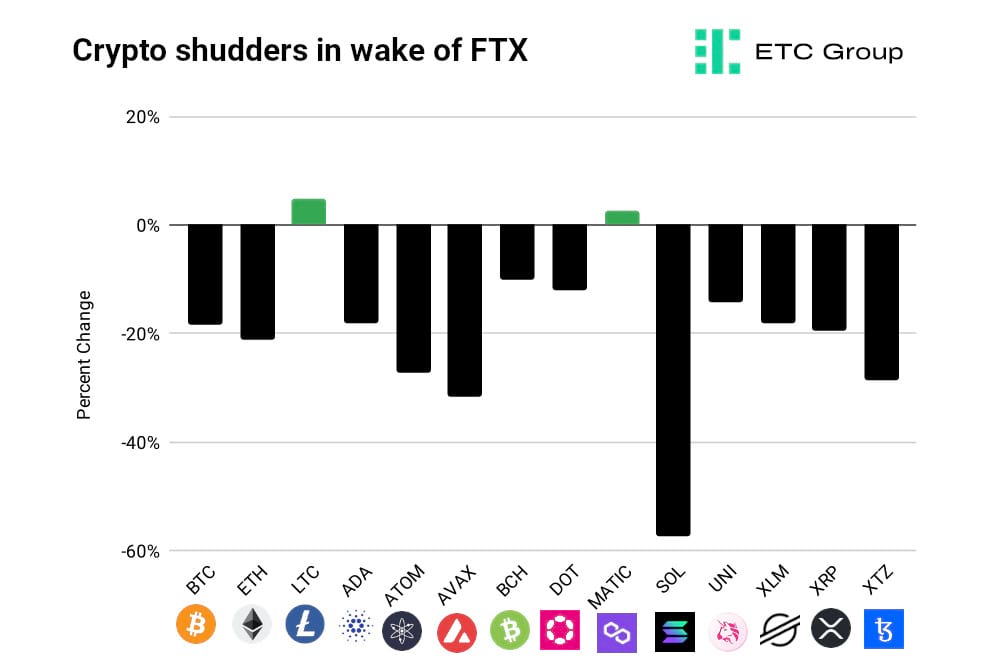

Alameda Research grew to become one of the largest market makers in the crypto industry, providing billions of dollars-worth of liquidity across illiquid tokens. We would expect illiquid altcoins outside the top 10 most-traded to take the biggest hit from this. Expect wide spreads and few buyers.

The entire Alameda desk seems to have been propped up by FTX and co-mingling (stealing) client funds. We said at the time that mishandling client funds is not a mistake, it is flat out fraud. And that is the charge that Alameda will have to face.

Alameda Research was frontrunning token listings, according to data provider Argus.

It begs the question: how did FTX and Alameda lose so much when they clearly had the whole system tied up? They had illicit advance knowledge of which tokens would list, and ran the casino, trading against their customers, but still managed to lose $10bn? That's some pretty special level of incompetence.

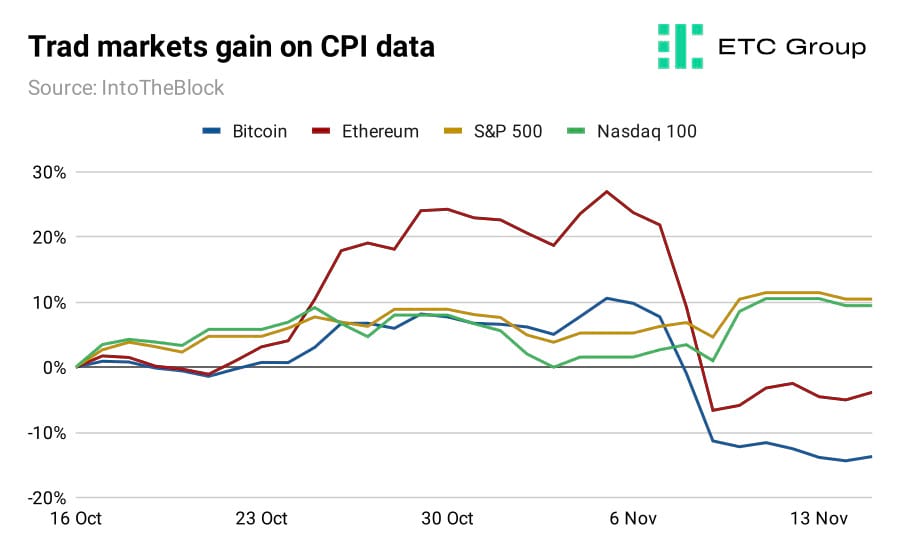

The FTX collapse could not really have come at a worse time. Sentiment in crypto, it seemed, was starting to turn back for the better.

And we had a clear vision of what might have happened next: equities went on the biggest two-day rally since 2008 after US CPI print of 7.7% showed disinflationary consumer pricing, setting up what could be the end of the Fed's rate hike cycle. The S&P 500 gained 9.4% in two days. That should have meant even greater upside in crypto markets.

Industry participants like ETC Group have been pleading for better and more comprehensive regulation across the industry, and the EU has MiCA legislation now expected to come into force in 2024. But that is Europe. FTX is very much an offshore US story.

The death of FTX and Alameda have prompted much soul searching in the industry, and this can only be a good thing.

It should come as no surprise that there will be two big winners from FTX, once the dust settles.

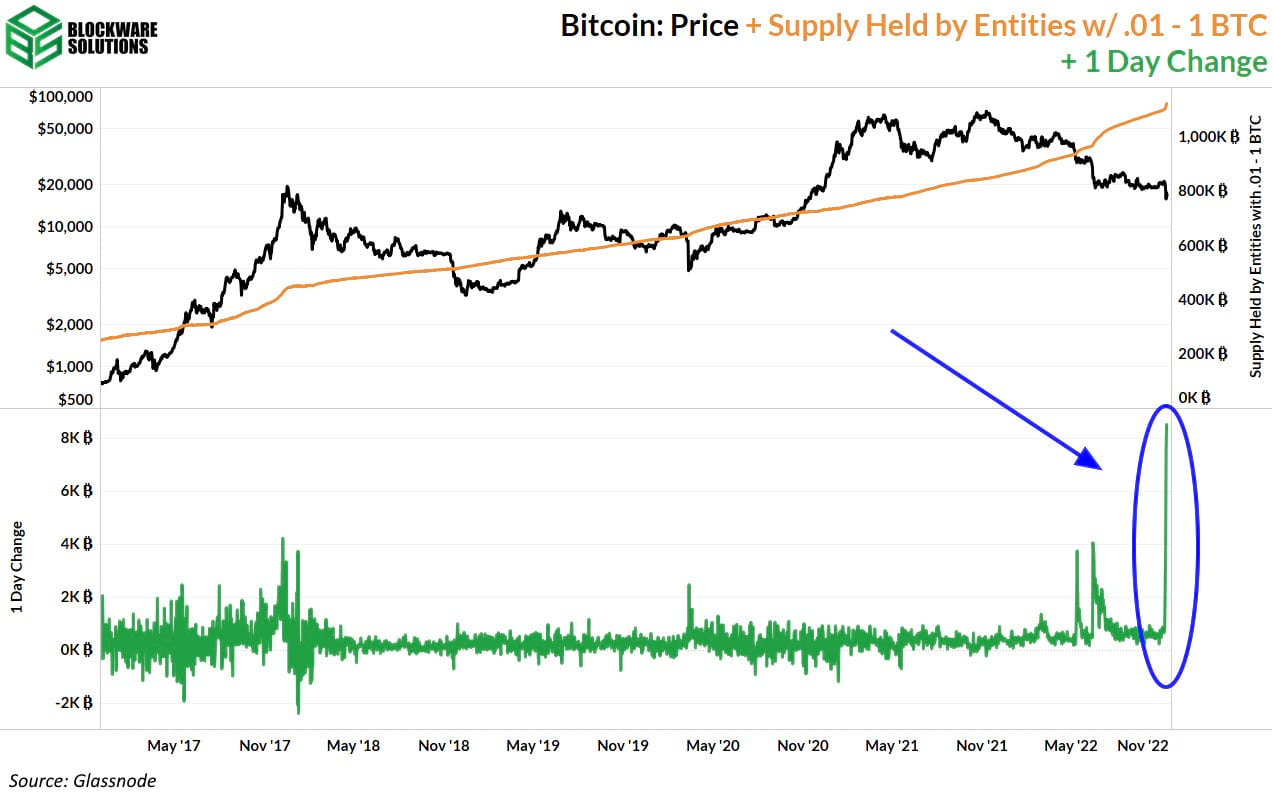

Bitcoin was hardly affected by the FTX scandal. It has little use in DeFi. And smaller investors have been scooping up Bitcoin in their droves. Those who have wallets holding up to 0.1 BTC ($1,681), have climbed substantially since the start of the year, despite the price of Bitcoin falling by 62%.

Those holding up to 1 BTC (worth around $16,000) have jumped by 40% since the turn of 2022. In the last two weeks, amid the FTX drama, small holders have improved their holdings by more than 5%.

And Bitcoin saw the largest one-day change in holdings for those investors with 1 BTC or less in their wallets

Will Clemente at Blockware Solutions has a chart for this.

Looking at the wallets that hold between 0.01 and 1 BTC ($169 to $16,900), we can see that these investors have bought more BTC this week than at any other point in Bitcoin's history. BTC being reallocated from over-leveraged traders to value-seeking retail is very bullish for the ecosystem.

The utility of Bitcoin and other blockchains grows with their wider adoption. As a technology akin to a social network - but for exchanging value instead of data - the more users and holders the Bitcoin network has, the more useful it becomes.

Bitcoin will survive FTX. To be protected, however, investors must move away from unregulated platforms and start looking at regulated, reliable products.

If anyone sees a ETC Group Bitcoin product trading on regulated stock exchanges in Europe, they know without question it is 100% physically backed by BTC held in cold storage with the regulated custodian BitGo.

Exchange Traded Products like BTCE rely on a foundation of regulated companies. They cannot just go bankrupt and leave a trail of destruction in their wake. And those investors who still want exposure to Bitcoin, Ethereum and other blockchains, without having to custody their own funds or worry about trading on unregulated exchanges, will turn to companies like ETC Group, which is overseen by the German market regulator BaFin.

If there is an audit coming, and companies are having to move money around just before or just after, that is not a good sign that they are acting within the law.

Deribit, Huobi and a swathe of custodial exchanges have been scrambling to post proof that they hold their customer's funds in the wake of the FTX scandal.

But the absolute clown show going on behind the scenes at offshore exchanges like Crypto.com is being exposed, and with good reason. The CEO of Crypto.com admitted that his company accidentally sent $400m in ETH to rival exchange Gate.io “in error”, before asking for it back.

A preliminary audit found that 20% of Crypto.com's assets were in the Shiba Inu memecoin.

Last week was one of the most volatile in crypto history, with both BTC and ETH registering double-digit losses before stabilising.

Solana, a token heavily supported by FTX and SBF, racked up huge losses in the region of minus 57% and was the worst-hit by the crisis. ETH scalability token Polygon (MATIC), which inked NFT deals with social media giants Instagram and Reddit, and was used in JP Morgan's first live DeFi trade on 9 November, was one of only two tokens that ended up in the green across the fortnight.

Contagion is a strange thing: once it spreads it is difficult to contain. The evident silver lining is that a massive amount of leverage had exited the industry in May and June, so the fallout from FTX may not be as bad as has been suggested elsewhere.

They may be far behind where they should be. But Bitcoin and Ethereum will survive this.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.

L'ETC Group è nata da una chiara missione: fornire agli investitori l'accesso al vasto potenziale di crescita nell'ambito delle criptovalute e degli asset digitali. Il nostro track record comprovato ci rende un partner affidabile: in oltre tre anni di successi, abbiamo consolidato la nostra posizione come emittenti di cripto-titoli con sede in Germania e siamo diventati un punto di riferimento europeo per soluzioni d'investimento in questo dinamico settore.

Con un solido track record di oltre tre anni, crediamo che sfruttando l'esperienza e le conoscenze del settore finanziario tradizionale e applicandole a questa nuova ed entusiasmante classe di asset, possiamo portare sul mercato prodotti d'investimento di prim'ordine.

Nel giugno del 2020, ETC Group ha lanciato il primo ETP su Bitcoin con compensazione centralizzata al mondo, quotato su Deutsche Börse XETRA, la più grande borsa di ETF in Europa. Da allora, la società è stata un pioniere dei prodotti negoziati in borsa basati sulle valute digitali con numerose idee di prodotto innovative. ETC Group è costantemente impegnata ad ampliare la propria gamma di ETP di qualità istituzionale sulle criptovalute, offrendo agli investitori la possibilità di investire in Bitcoin, Ethereum, Cardano, Solana e altri asset digitali popolari sulle principali borse europee.