Why Paypal just launched a US dollar stablecoin on Ethereum

$70bn market cap PayPal dropped a positive bombshell on crypto markets this week by announcing it will become the first major retail-focused financial institution to launch a stablecoin to allow users to access cryptoassets on its platform.

PayPal USD (PYUSD) will be a dollar-backed stablecoin and its 1:1 peg with the US dollar will be backed by US dollar deposits, short-term Treasuries and other cash equivalents, the company said.

PYUSD can be exchanged for any of the cryptocurrencies on PayPal’s network, which are Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH) and Litecoin (LTC).

After BlackRock’s announcement of its planned entry into Bitcoin by applying to list a spot Bitcoin ETF in June, this represents another signal of growing maturity in crypto markets.

PayPal is not the first financial institution to make this move. In April 2023, the digital asset arm of French bank Société Générale launched a Euro-backed stablecoin on Ethereum called Coinvertible (readers can see the contract address here.)

However PayPal is the first retail-focused institution bringing an Ethereum-based stablecoin to the mass market.

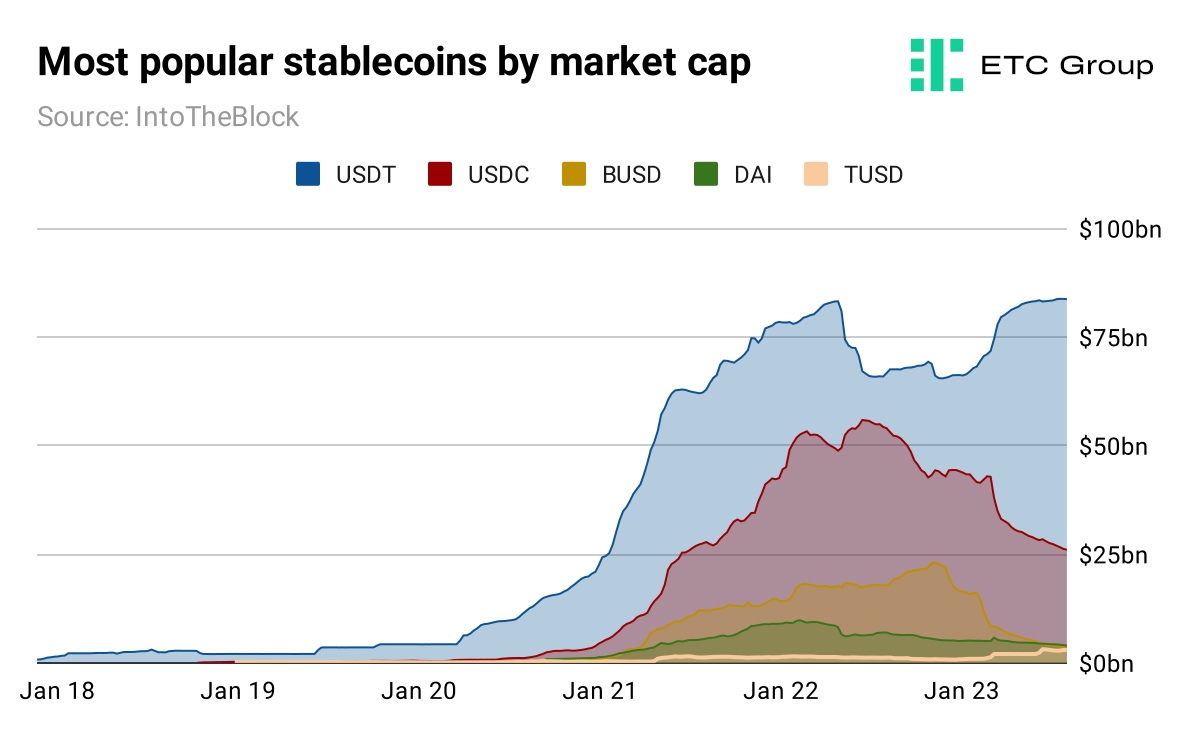

According to Clara Medalie of Paris-based data provider Kaiko, 74% of all trades on centralised exchanges use stablecoins, an increase of 10% since the start of 2020.

Tether’s USDT remains by far the largest at more than $83bn, and has been growing its market cap at the expense of its nearest rival USDC since the middle of last year.

USDC is issued by the (at one time) more regulatorily-friendly US based entity Centre, which is a partnership between Circle and Coinbase.

With the SEC’s recent action against Coinbase, this has complicated the situation for USDC, which was once the US stablecoin that crypto-friendly lawmakers and policy chiefs could default to when defending the nature of the market.

There may be surprisingly little competition ahead for PayPal if it decides to corner the US dollar stablecoin market, especially since potential challengers are falling to the wayside: British fintech Revolut shut down its US crypto arm this week in the wake of regulatory uncertainty, but is expanding its crypto team headcount by 20% as it explores growth in other regions.

London-based Revolut is set to hire more than 1,000 people this year across the UK, Europe and India, according to one insider speaking to fnLondon, and has expanded its services to include staking for UK and European customers.

The regulatory angle

The European Banking Authority has already told stablecoin issuers they must make immediate efforts

The provisions include a permanent right to redeem a stablecoin for the underlying asset (be that gold, US dollars or euros) and new regulations on complaint handling. That phrase above is bolded for a reason: we’ll come back to that later.

Stablecoin laws are also working their way through the US Congress as we write: for example, Republican Congressman Patrick McHenry has been working on the Clarity for Payment Stablecoins Act for almost two years.

McHenry is the Chairman of the US House Financial Services Committee.

Yet there still remains much uncertainty as to how stablecoins will be treated under various jurisdictions, especially when it comes to the transparency of the assets backing these stablecoins.

PayPal's crypto deep dive

The crypto market has become exponentially more mature over the last two years. And yet, crypto-native stablecoins with uncertain regulatory status and sometimes obscure ownership still account for the vast majority of retail cryptoexchange trading.

It was telling to see the first line of PayPal's 7 August 2023 press release say that “fully-backed, regulated stablecoins have the potential to transform payments in Web3 and digitally-native environments”.

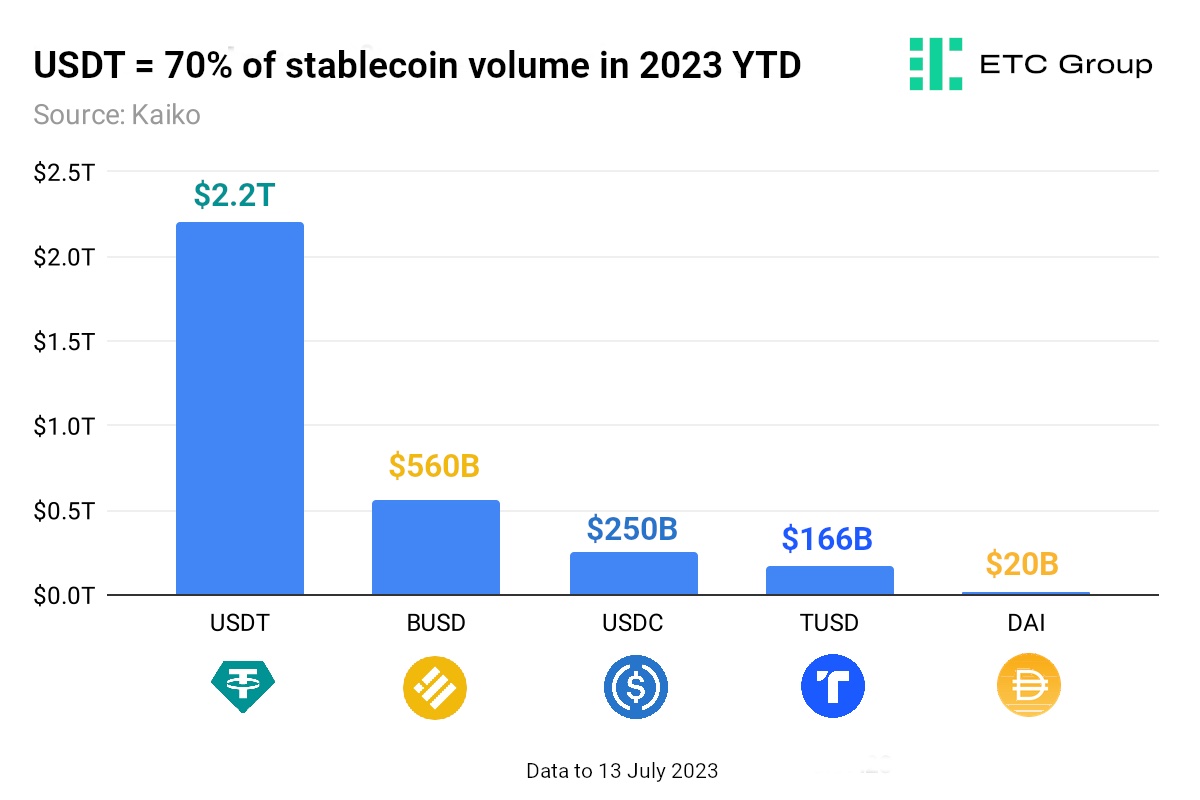

In terms of market structure, there is a clear winner in stablecoins today.

Tether’s USDT currently accounts for 70% of the stabl coin market volume across all exchanges, Kaiko data shows.

As of the first week of August 2023, the average balance of USDT across all its users is more than $8,600, IntoTheBlock data shows.

But ongoing concerns over the quality of Tether’s reserves (and indeed its levels of compliance with financial regulations, and transparency), have cast a pall over crypto markets for some years.

The reserves backing Tether’s USDT have in the past included Chinese commercial paper, according to Coindesk Freedom of Information reporting released this year.

When New York Attorney General Letitia James announced her office was settling its case against Tether in February 2021 — including an $18.5m fine for the defendant — she noted that there were times in 2017 and 2018 that USDT was not fully backed.

So, that “permanent right to redeem” under the EBA rules noted above may not be as simple for Tether as it could be for a known and regulated entity like PayPal.

As Liam Wright, senior editor at CoinSlate, noted last year “to redeem Tether for fiat currency…users have to pay $150 for ‘verification’, and the minimum transaction amount is $100,000.”

Little public information is available about the operator of TUSD, another dollar-pegged stablecoin. As Bloomberg reported in mid-July, its IP was taken over by offshore operator Techteryx.

With this in mind there appears ample room for a large financial incumbent, especially one with the bona fides of PayPal, to disrupt this scenario and start to take market share.

PayPal first opened up cryptocurrency trading in November 2020, later adding native crypto transfers between PayPal wallets in June 2022.

Stablecoins are a vital on-ramp to get users into the crypto ecosystem: before investors can buy Bitcoin or Ethereum on an exchange, many have to convert the US dollars or British pounds in their account to a stablecoin like USDC or USDT. This is because so few exchanges have links to banks that allow investors to easily buy cryptocurrencies with their national currency.

Stablecoins may well become much more popular in the future. The UK arm of HSBC, along with building society Nationwide, recently put strict limits on how much crypto its users could buy using their bank accounts. UK high street bank Natwest made the same move in March this year. Until banks come in line with existing and upcoming legislation as regards allowing users access to those markets they want to trade in, we will likely see more stablecoin usage across the board.

Why PayPal chose Ethereum

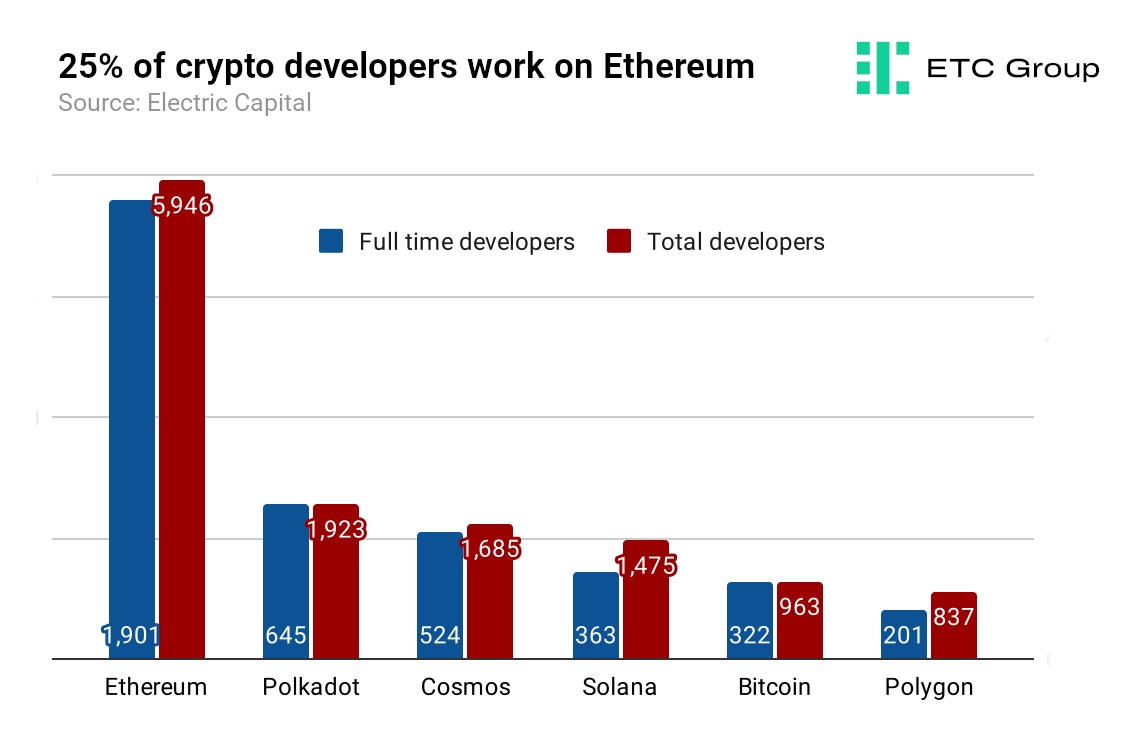

We already know that at least 25% of the 20,000+ current public blockchain developers work on Ethereum, and that Ethereum has created and set the standards that will form the structure of crypto markets for decades to come.

PayPal USD is set up as an ERC-20 token. As soon as a token is an ERC-20 (and therefore conforms to the standards of the Ethereum blockchain), it can be sent to any Ethereum wallet and can be used across the crypto ecosystem, on any chain that is also compatible with Ethereum.

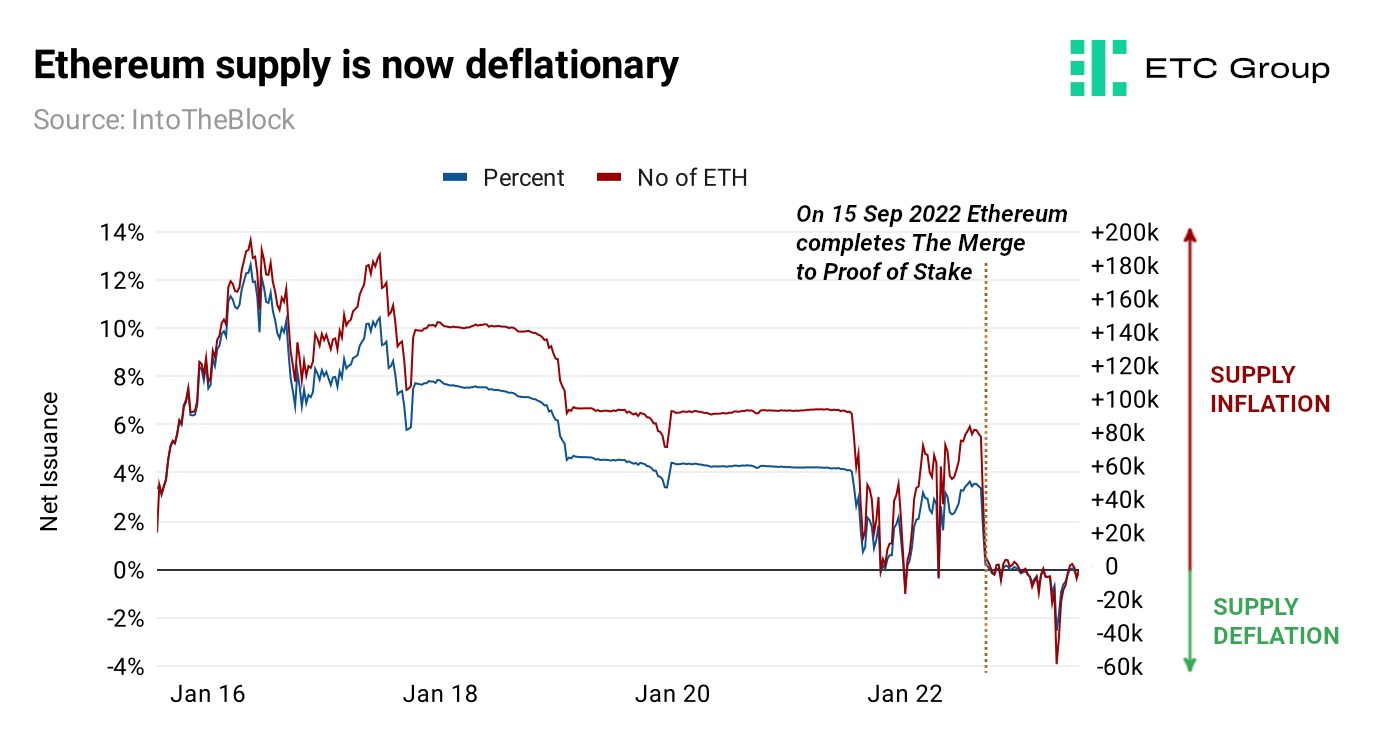

This is another bullish signal for Ethereum in the long term. All ERC-20 transactions require ETH to pay for transactions: so the rapid growth of a new stablecoin player would increase demand for the deflationary ETH currency.

The more the Ethereum network is used, the more ETH is removed from supply, in a function not too dissimilar from a share buyback mechanism.

This is yet another institutional vote of confidence for the second-largest cryptoasset by market cap.

And finally, with regulators now cracking down on the more uncertain elements of the market — for example forcing New York issuer Paxos to stop minting Binance’s BUSD stablecoin — it is highly likely that existing fintech players will be investing more time, capital and energy in scooping up market share over the coming months and years.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.