US sleepwalking into European and Asian crypto supremacy

There's a famous quote from the Chinese premier Zhou Enlai, who served the country from 1956 until 1974. When asked about the impact of the French Revolution 200 years earlier, Enlai paused for a moment before declaring it was “too soon to tell.”

While politicians may wring their hands over the impact of Bitcoin, crypto and blockchain on their domestic economies, the fact is that it is not “too soon to tell”.

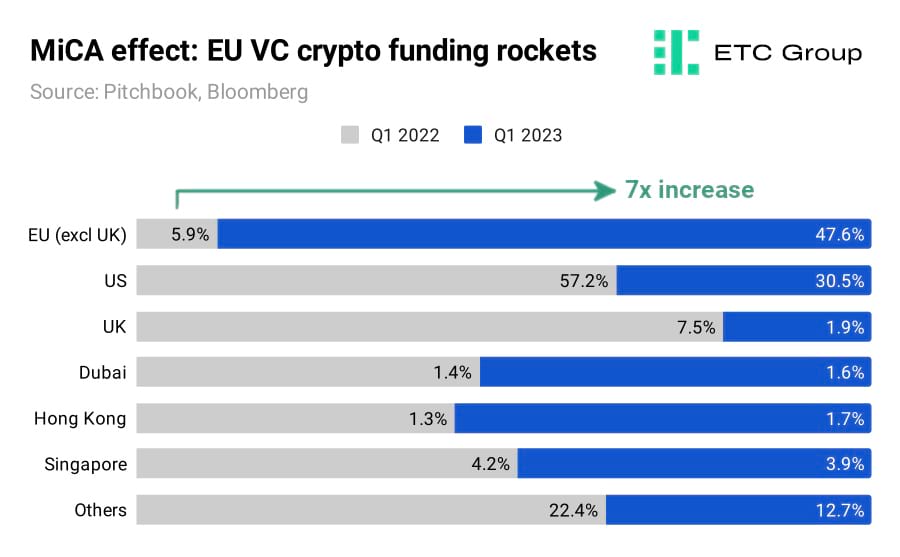

By offering crypto companies standardised rules of the road with April's MiCA (Markets in Crypto Assets) - the first continent-wide crypto regulations - Europe has opened up a large lead over the United States.

Testament to this fact is the searing growth of European VC crypto startup funding and the rapid decline of the same in the US. While the EU's share of funding for new and early stage crypto businesses jumped by 700% between Q1 2022 and Q1 2023, the US share dropped by 46%.

Business in any industry will always go where they are supported, and not demonised and penalised.

The language and political stance of the US has turned increasingly hostile in recent years, beginning with regulators like the SEC and continuing on through President Biden's White House.

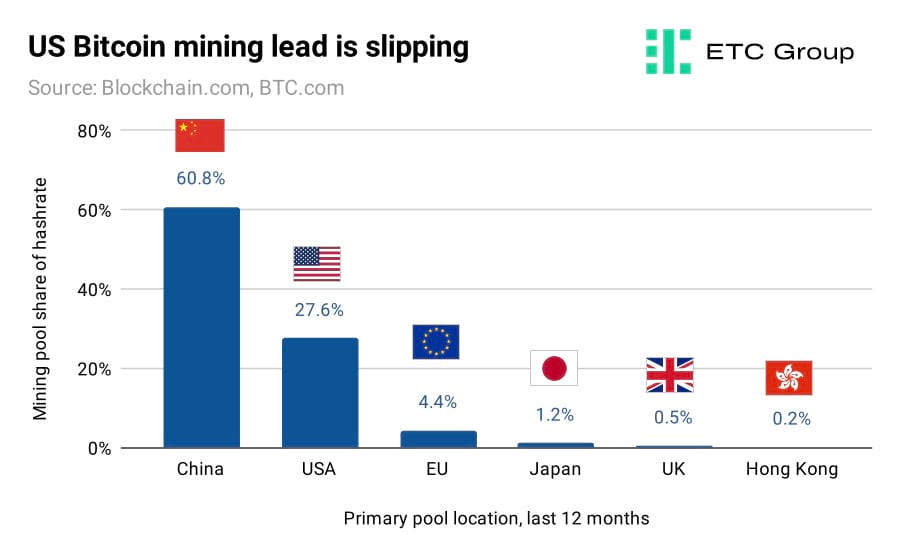

But the current political party particularly bellicose attempts to diminish US Bitcoin mining is highly counterproductive, for three key reasons.

- The amount of Bitcoin mined every day (~900BTC) remains the same, no matter who mines it. Attempts to curtail mining in one jurisdiction simply hands profits and economic power to other regions - most notably, Europe and Asia.

- The proposed 30% tax on US Bitcoin mining operations through DAME will push miners offshore to locations where less renewable power is used: the exact opposite intended consequence of such a levy. The Bitcoin mining industry is one of the cleanest in the world in terms of its renewable power mix. By demonising miners and imposing outsize taxes on operations, the net result will be to upend the renewable mix used in Bitcoin mining, from hydropower in Canada and Alaska to coal in Kazakhstan and China. It is relatively simple for miners to pick up their operations wholesale and move them to more favourable locations - as happened with three tonnes of mining machines airlifted from Guangzhou to the US midwest in the wake of China's 2021 crackdown.

- States with the largest Bitcoin mining industries - such as Texas - are still circumventing the stance from the White House by introducing more favourable carbon emission reduction and pro-mining legislation. For example, the recently-passed House Bill 591 provides clarity to oil and gas operators who want to use Bitcoin miners to reduce their flared (waste) gas burning.

So while FoundryUSA is the world's largest single mining pool with 27% of hashrate, other jurisdictions are climbing the ranks, and quickly.

Despite China's official protestations to the contrary, the fact is that Chinese mining pools such as ViaBTC and Poolin lead the globe in total hashrate, and rake in hundreds of millions of dollars a year from mining Bitcoin.

As a reminder, a Bitcoin mining pool is a group of miners who share computing power and are rewarded on a pro-rata basis, depending on how much power each contributes. This setup helps to make revenue generation more predictable.

Further to this point, on 9 May Marathon Digital (NASDAQ:MARA), the largest US Bitcoin miner by market cap, announced it was partnering with Abu Dhabi-based Zero Two for the first industrial-scale Bitcoin mining operation in the Middle East.

So while political careers wax and wane, and some fret that it is “too early to tell” of the impact of Bitcoin, crypto and blockchain, it is clear that the technology has no borders, and will outlast them all.

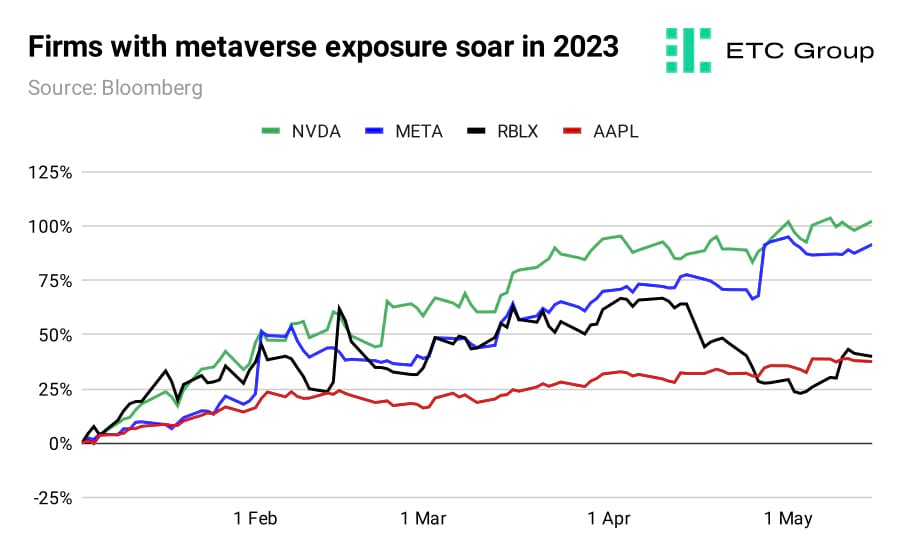

Investors hunt Metaverse gains with Apple VR launch incoming

The world's most valuable company is just weeks away from launching its first entry into VR. Rumours have been swirling for months that the $2.7T behemoth Apple (NASDAQ:AAPL) will debut the Reality Pro headset at this June's Worldwide Developers Conference.

The Reality Pro is pitched as a direct competitor to Meta (NASDAQ:META), whose Quest headset has dominated retail VR markets since the IP was owned by startup tech firm Oculus, a company since subsumed into Mark Zuckerberg's empire.

Ming-Chi Kuo, an analyst covering Apple for TF International Securities, suggests there will be two versions of the Reality Pro: a cheaper mass-market version and a higher-grade headset for richer customers. A second-generation Reality Pro will go into production in 2025, with shipments expected to be 10 times larger than those of the 2023 version, Kuo wrote.

The performance of metaverse-related stocks has surprised mainstream analysts this year, and defied projections of a collapsing tech sector in the wake of macro uncertainty.

With Q1 2023 earnings now largely complete, standout performers include Roblox (NYSE:RBLX) which has seen its shares surge 40% in the year to date.

Despite a downdraft from its pandemic-era upswing, Roblox showed 22% user growth to reach more than 66 million daily active users. Results also showed an average compound annual growth rate of more than 60%.

Some regard Roblox as a preliminary metaverse - an online user-generated game creation platform filled with livestreamed concerts and fan-led interactive experiences.

Their recent integration of generative AI scripting has also been a boon for automating the most technically-challenging elements of game creation. Users are now testing how ChatGPT can be used to create more immersive and reactive non-player characters, alongside the kinds of awe-inspiring photorealistic graphics capabilities of Unreal Engine 5.

Despite its much-publicised VR overspend, Meta's own share price has rocketed 91% in the year to date.

A surprisingly impressive Q1 performance saw earnings per share of $2.20, beating analyst expectations of $2.03, while daily active users reached 2.04 billion. Meta leadership has also reassured shareholders that the metaverse remains a long-term priority for growth.

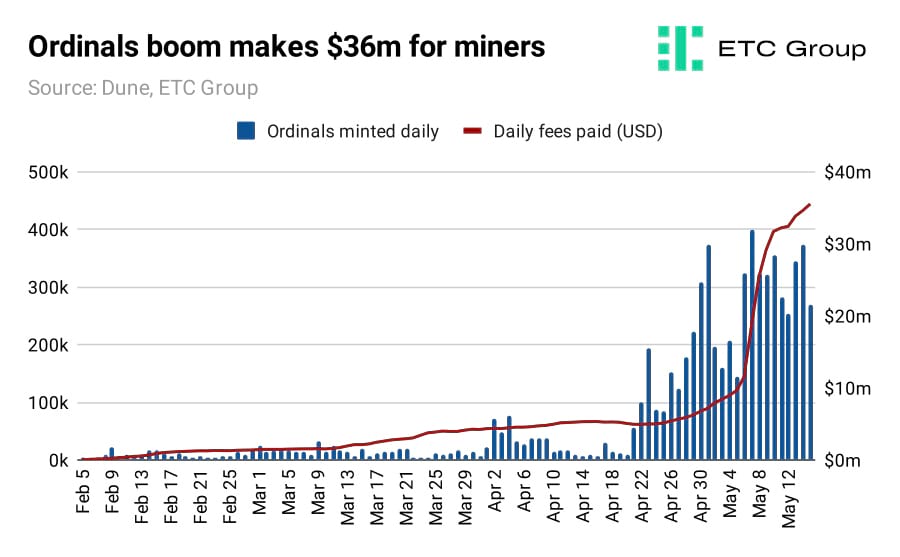

Ordinals boom makes millions for Bitcoin miners

The rapid rise of Bitcoin Ordinals - the original blockchain's version of NFTs - has upended revenue generation for Bitcoin miners for the better.

Companies such as Marathon Digital and Riot (NASDAQ:RIOT) are experiencing unprecedented revenues from transaction fees as the craze around Ordinals continues its parabolic growth.

Ethereum and other smart contract-based platforms once held a total grip on the non-fungible token market, because it was considered impossible to create them on Bitcoin, given coding limitations.

But in late 2022, Bitcoin researcher Casey Rodarmor debuted a new invention to ‘inscribe' the individual satoshis that make up each Bitcoin with text, audio or video content.

As ETC Group noted in comments published in Business Insider, Bitcoin broke its all-time record for daily transactions on 2 May. This was largely down to the searing growth of Ordinals.

And the figures are trending exponentially higher. While it took more than four months for the first million Ordinals to be inscribed, it took just three days to rise from 4 million to 5 million Ordinal creations, between 6 May and 9 May.

Since February, Bitcoin mining companies have been rewarded with transaction fees to the tune of more than $36m.

Markets

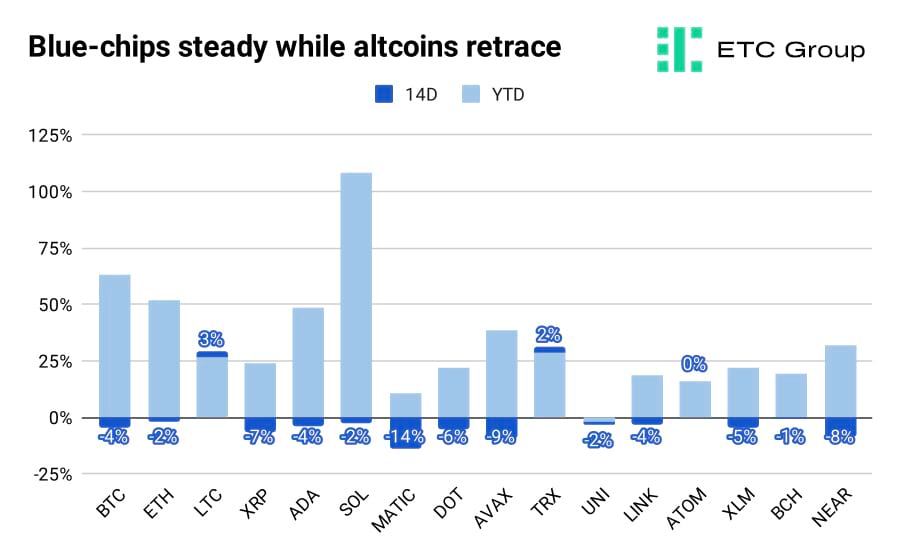

The blue-chip digital assets, Bitcoin and Ethereum, have shown resilience in the face of macro uncertainty with slight falls of 3% and 4% over the last fortnight.

BTC has been in a holding pattern around the $26.5k-$27.5k range while ETH rebounded from a fall below $1.8k to recapture that price point by 14 May.

Among the top 20 altcoins, Solana (SOL) remains the largest growth story of the year, with a 2% fall in the last two weeks not making much of a dent in its 125% year to date gains.

Other Ethereum competitors, such as NEAR (-8%) and AVAX (-14%) have not fared so well.

With the largest smart contract blockchain enabling staking withdrawals last month, Ethereum has managed to gain back much of the market share it had given up while traders anticipated the mass derisking around the Shapella hard fork.

It remains to be seen whether Ethereum's biggest rivals can iterate on their own development just as quickly.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.