Co-CEO of ETC Group

Digital asset and blockchain infrastructure are critical to global markets, and the growth of users, holders and traders of digital assets continues to outpace almost any other sector. If anything, Q1 2022 has demonstrated the depth of affection for digital assets in all their forms, and the rise of exchange-traded products offering wide exposure to the best of the best in these markets is a key insight into how markets could develop going forward.

We are moving past the stage of retail and institutional early adopters and into the early majority in digital assets and blockchain, and we are just at the start of a likely decades-long journey entering the brave new world of the metaverse. While it’s not clear yet who will be the biggest winners from this structural shift, investors still have room for exceptional growth if they maintain focus on the very best revenue-generating blockchain-based and metaverse stocks and shares.

Introduction

Digital assets and blockchain are becoming ever more ingrained in the global financial system.

At the same time, investors are having to grapple with the prospect of ongoing war in Europe and the reality of a world in which inflation is approaching or exceeding 10% in Europe, the US and South America, and may remain elevated for significant periods at 40 or 50-year highs, making asset price volatility the only certainty going forward.

Few have any idea what the world will look like next quarter, let alone next year. The cost of living is rocketing in all major economies. Amid spiralling consumer prices and debased fiat currency whose value is frittered away by central bank QE, Bitcoin offers a release valve of sorts. A programmatically scarce, desirable asset whose utility now extends to pristine collateral and corporate treasury in place of fiat currency.

Fed chair Jay Powell’s assertion that inflation would be “transitory” will likely come back to haunt him. And even central bankers now strongly disagree on whether we face years of persistent inflation akin to the 1970s: Agustín Carstens, head of the “bank of banks”, the Bank for International Settlements, said this week that the world economy may be on the brink of a new inflationary era with stubbornly higher prices across the board, higher borrowing costs for years to come. In February, the UK consumer prices index hit 6.2%, the highest in 19 years. Official figures from Eurostat show Eurozone inflation surged to an all time high of 7.5% in March, up from 5.9% in February and well ahead of expectations around 6.6%.

Over in South America, Brazil’s statistics authority IGBE pegs the powerhouse country’s FY2021 inflation at 10.06%, its highest level in six years. Expectations will have to change. And in an inflationary era, there is Bitcoin. Programmatically reducing its issuance, day after day, month after month.

The conflicts playing out in front of us, now both military and economic, have led the world’s largest economies to seek a pressure release valve, and at last we are starting to see serious crypto regulation from the world’s most prominent economies.

From Ukraine itself to the UK, and the US to the Middle East, governments appear finally willing to legalise cryptoassets and bring them into the fold of their day to day economies. Certainly US President Biden’s call for a cross-departmental effort to explore the “risks and opportunities” of cryptoassets is markedly different language from the previous focus on scams, criminal use of crypto and finger-wagging from past officials.

More regulatory certainty is almost always a net benefit to the crypto industry at large. Blockchain and crypto companies and service providers (wallets, exchanges, cybersecurity companies, for example) can plan better and project their costs further into the future if they know how much they will have to spend on taxation.

Certainly the double-digit jump in crypto-related stocks across the board in reaction to President Biden’s Executive Order is evidence that the industry is desperate for proper legal frameworks. Mining companies like Riot Blockchain and Marathon Digital were among the largest winners, leading analysts to restore their buy rating for the stocks given that the US government has now more formally recognised and appears to be supporting the cryptoasset industry.

Against a wider backdrop of geopolitical and macroeconomic uncertainty, accumulation of the limited Bitcoin supply continues apace from both retail buyers and institutions. Data analysed by ETC Group shows more are buying Bitcoin, and holding it for longer.

Only 21 million coins will ever be mined. 18.9 million already exist. Around 20% of those coins — somewhere between 2.78 and 3.79 million — are lost, locked in wallets with inaccessible private keys, a figure produced by data analytics company Chainalysis in 2021 which is likely higher by now. The pseudonymous Bitcoin creator Satoshi Nakamoto famously said in 2010 that irretrievable coins only make everyone else’s coins worth slightly more and we would tend to agree. These supply constraints play only in Bitcoin’s favour.

And looking wider: in a world where debts are assets, inflation rages, and cash is an increasing liability, Bitcoin thrives.

Mining by the numbers

A key portion of the Bitcoin infrastructure market is those publicly-listed miners, like Marathon Digital (NASDAQ:MARA) and Riot Blockchain (NASDAQ:RIOT) working to mine new coins on a daily basis. Across Q1 2022, we looked at the most important metrics to determine how Bitcoin miners operated.

In Q1 2022, Bitcoin miners produced $3.49bn in total revenue, $3.44bn of that is block rewards, with $42m from transaction fees.

Bitcoin hashrate continued to climb to all time highs, denoting a bullish metric on a wider time scale.

Growing hashrate generally indicates that businesses are willing to invest large amounts of capital to compete for new Bitcoin issuance. Falling hashrate would mean fewer miners are willing to support the network, that the economic incentives for doing so are not bringing new miners online.

The market remains in a secular trend of ever-increasing hashrate. If hashrate rises faster than the price of Bitcoin, then mining-related stocks will likely underperform the asset itself, according to analysis by Dylan LeClair and Sam Rule, who write:

This is due to the inelastic supply issuance of the asset in an increasingly competitive global mining arms race.

Publicly traded Bitcoin mining stocks in general have fallen with the wider market, as the market price of BTC fell away from its euphoric all time high of $69,000 November 2021. But most importantly, Q1 2022 marked the start of a new era: firstly, in terms of US total dominance, and secondly in the growth of environmentally acceptable Bitcoin mining.

ETC Group has covered the Bitcoin mining market in some considerable depth previously, in its report Bitcoin ESG and the Future, which is available on its website.

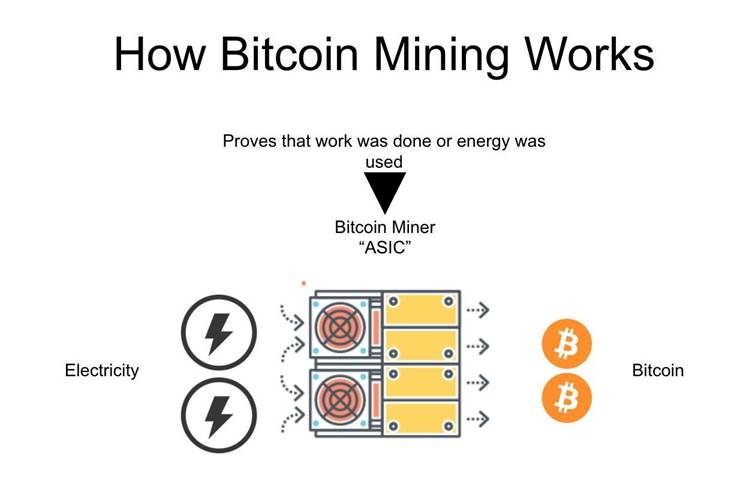

Bitcoin’s network is secured by a type of cryptographic algorithm called SHA-256. Its hashrate is a calculation of the total combined computing power used to mine and process transactions. Effectively, this is the speed at which mining machines run their algorithms to compete for new issuances of bitcoin. The more hashing power in the network, the greater its security and the greater resistance it has to being attacked.

Because Bitcoin is a Proof-of-Work blockchain, the faster a computer can process calculations (the ‘work’), the more likelihood that machine has of being rewarded in bitcoin. In the early days of cryptocurrency, a home computer could run calculations fast enough to be in with a chance of winning block rewards (currently 6.25BTC per block). As competition ramped up, by 2013 specialist Application Specific Integrated Circuit (ASIC) machines were developed for the singular purpose of Bitcoin mining, with Bitmain’s Antminer the industry-standard machine.

One of the unintended consequences of the proliferation and growth of the Bitcoin network — and the bitcoin price — is that intense competition has sprung up between miners in order to compete for the rewards distributed in BTC. Mining pools — vast agglomerations of combined computing power — are the result of this competition.

US now dominates mining landscape

We learned from the Cambridge Centre for Alternative Assets that by August 2021 — the latest data available — the United States had become the largest venue for Bitcoin mining worldwide, with a 35.4% share, nearly double second-placed Kazakhstan and more than three times larger than third-placed Russia.

Figures analysed by ETC Group show that across the quarter the US has become more entrenched as the global mining leader.

In Q1 2022 Foundry USA maintained its position as the largest Bitcoin mining pool in the world. Data via mempool.space also shows that throughout the quarter, the US-based pool actually increased its dominance from 19.02% of Bitcoin hashrate on 1 January to 19.46% by the end of March 2022, continuing a trend that started in spring 2021.

In May 2021, Foundry had only 2.9% of global hashrate, making it the ninth-largest mining pool globally, far adrift of the leaders Antpool and F2Pool. (NB, below charts track a seven-day average of hashrate distribution).

Over the next six months, with China’s deliberate and wholesale destruction of its Bitcoin market, that figure had increased rapidly. Foundry USA had near-tripled its share to 7.7%, moving it into sixth place.

ETC Group analysis shows that as of the end of Q1 2022, Foundry USA is now the world’s largest Bitcoin mining pool by some considerable margin, controlling nearly a fifth of the entire Bitcoin hashrate. It has beaten AntPool into a distant second place, more than 5% ahead. This is the likely largest driver of the ‘opportunities’ side of US President Biden’s multi-agency call for reports on the risks and opportunities of crypto.

Foundry USA, incidentally, is run by the Digital Currency Group, which owns Coindesk, Grayscale Investments, and Genesis. It opened to institutional clients in March 2021 after around six months in private beta.

Coal-dominated China once made for a perfect destination for Bitcoin miners to set up, because of its cheap electricity prices and large areas of unused land. Miners relied on hydropower in the rainy season before coal and natural gas in the dry season. But that era is over.

And it is being replaced by a more environmentally acceptable era of US-dominated Bitcoin mining with a focus on more efficient, less polluting machines, greater use of renewables to power those machines, and cutting waste through the use of stranded flared natural gas.

As Microstrategy CEO Michael Saylor notes:

Bitcoin runs on stranded energy at the edge of the grid and acts as a global battery for otherwise idle generation facilities. It recycles wasted energy [and] provides a mechanism to commercialize clean, renewable energy wherever we may find it.

The new era of environmentally-acceptable Bitcoin mining

The difficulty for fund managers today who are considering ESG in terms of digital assets is the arduous task of separating fact from misconception over Bitcoin’s power usage. We know that Bitcoin’s portion amounts to a rounding error in terms of global CO2-equivalent emissions: less than 0.1% according to the latest research.

And set against the much larger draw from other industries (7-8% of global CO2-equivalent emissions come from the manufacture of cement, for example), the question then becomes: how much energy should Bitcoin mining be allowed to use? More than the total CO2-equivalent emissions from holiday lights in the United States? Powering the Bitcoin network uses 0.31% of the world’s energy, according to the CCAF. Given media headlines, you might expect that to be much larger.

The Bitcoin Mining Council (BMC) represents 46% of the industry, including all of the major US-listed Bitcoin miners from Argo Blockchain (LSE:ARB) to SBI Crypto.

It estimates a 3x improvement in mining efficiency over the next four years.

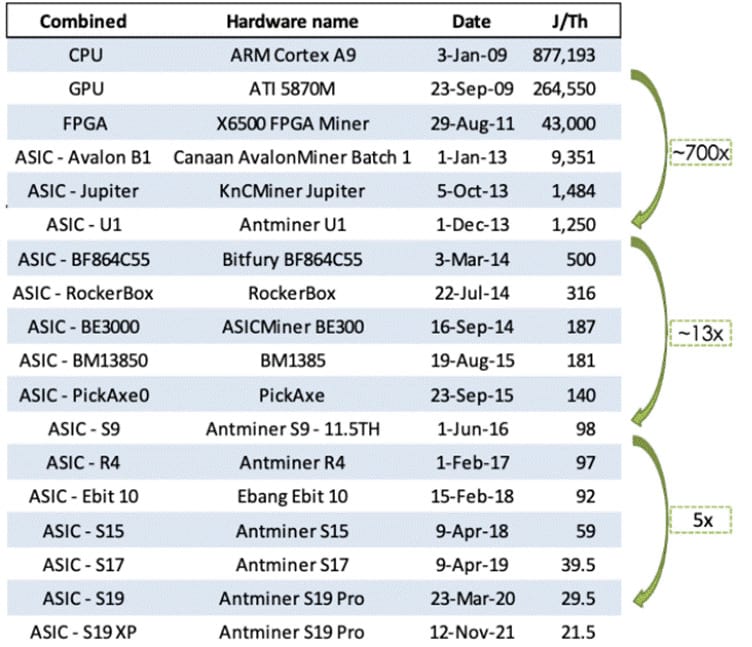

Bitcoin has already increased its efficiency 58x over the last eight years, according to the BMC. Below is a table showing the leading Bitcoin mining machines since the advent of cryptocurrency.

Efficiency is measured in J/TH or Joules per Terahash.

Throughout this quarter we have also witnessed a wide-scale reconfiguration of the argument. Media headlines go for the most impressive comparisons available, noting Bitcoin’s 142TWh yearly energy draw.

Saying that Bitcoin uses more electricity per year than Argentina’, is not as impressive-sounding as powering the global Bitcoin network uses around the same amount of energy as the state of Pennsylvania (144.7TWh) — equivalent to 4% of total US energy consumption as of 2015 — although both statements are valid.

Flared gas: once burned, now Bitcoin

Global gas flaring recovery: or in plain English, actually utilising the natural gas that is currently burned off by oil producers by using it to power Bitcoin mines — could power the entire Bitcoin network 4.9 times over, according to the Cambridge Centre for Alternative Finance, who are the pre-eminent researchers in the space.

In short: the carbon footprint of the United States’ flared natural gas would be more than enough to completely offset all Bitcoin mining emissions. Hence: there are solutions available to regulators in the US to make Bitcoin mining entirely carbon neutral, without even needing to dramatically ramp up renewables energy usage.

Major oil producers started to realise this expansive potential in Q1 2022: with the additional consequence that it creates the foundation for a system of carbon-neutral Bitcoin mining.

Modern oil extraction releases large amounts of ‘flared’ natural gas as an unwanted byproduct. While it might be difficult to visualise, this effectively means that gas released from the earth by the drilling process is set alight and burned on site, because it is not economically viable to use it in any other way.

The World Bank notes that gas flaring has persisted from the beginning of oil production over 160 years ago, remaining an intractable problem. And even as global oil demand dropped by 7% in 2020, flaring only fell by 5%.

The most recent research from the International Energy Agency says that 142 billion cubic metres of natural gas was flared in 2020, equivalent to the entire natural gas demand of Central and South America combined.

This resulted in around 245 [metric tons] of CO2, nearly 8 [metric tons] of methane and black soot and other greenhouse gases being directly emitted into the atmosphere. Five countries: Russia, Iraq, Iran, the United States and Algeria accounted for more than half of all volumes flared globally in 2020.

Small energy companies have been utilising the new business model of converting flared gas for use in Bitcoin mining since early 2021, but in Q1 2022 we started to see major producers getting into the game. The $127bn market cap ConocoPhillips (NYSE:COP), operating in North Dakota, is selling this byproduct natural gas to Bitcoin miners instead of burning it, as per a 15 February CNBC report.

Energy producers have long battled with the issue of what to do with natural gas released by accident when drilling for oil. Piping it offsite requires costly infrastructure that nearly all do not have, and most are unwilling to pay for. Hence the flames rising from oil fields as the gas is burned away, releasing methane and black soot, along with carbon dioxide. Environmental concerns aside, these oil producers are also starting to realise that they are setting fire to a potential revenue stream through Bitcoin.

This is likely just the crest of a wave. By the end of 2022, most major oil and gas producers could be using Bitcoin mines to generate new income and improve their ESG credentials through lower waste. Many oil producers, including ConocoPhillips, have committed to reducing their operational greenhouse gas emissions to net zero by 2050.

Bitcoin mining machines are relatively simple to move and transport and companies often employ

prefabricated mobile datacentres on locations otherwise inaccessible to modern pipelines, making them ideal venues for otherwise burned flared gas.

ExxonMobil Bitcoin move sparks majors

Importantly, we heard in late March 2022 via Bloomberg that the oil giant ExxonMobil (NYSE:XOM), now valued at $350bn, had signed an agreement with Crusoe Energy to power nearby Bitcoin miners using the natural gas from oil wells at Bakken in North Dakota, considered an important new source of oil for the United States. These miners require 18 million cubic feet of natural gas per month, which accounts for just 0.5% of ExxonMobil’s daily production volume in the state.

The pilot project, which has not been publicly announced, started in January 2021. It has been so successful that ExxonMobil executives are reportedly considering expanding the project to four countries: Germany, Guyana, Argentina and Nigeria. That gas would have been burned and released into the atmosphere due to a lack of pipelines to transport it to consumers or otherwise use it efficiently.

So flared gas for Bitcoin mining has proven viable, a low hanging fruit for reducing emissions and waste, and the template, born in the US, is now being exported worldwide.

While some market participants still argue that, if left unchecked, Bitcoin mining could affect energy markets with its growing demand for electricity, the greater oversight from nation-level regulation is finally starting to appear, a mere 13 years after Bitcoin made its whitepaper debut.

Crypto advocates have been shouting themselves hoarse calling for stricter regulation, standards, supervision and disclosure to move them out of grey-area guesses to black-and-white. And as Fitch Ratings notes:

Digital currency markets should become more mainstream and predictable in the long term, with many aspects, including mining methods, coming under regulatory oversight.

In March 2022 the US Securities and Exchange Commission put forward regulations that require public companies to report information on greenhouse gas emissions and climate change risks.

We welcome it,

Marathon Digital (NASDAQ:MARA) CEO Fred Thiel told industry website Coindesk. Marathon Digital said this quarter it expects its Bitcoin mining operations to be 100% carbon neutral by the end of 2022.

We don’t think as a miner, complying with the reporting requirements is going to be necessarily onerous,

Thiel added.

It is highly unlikely that publicly traded crypto mining companies are not aware of the need to follow regulations to the letter, and indeed improve their access to renewable power as and where it is available. There are additionally a slew of ways in which a Bitcoin mining company can achieve carbon neutrality: by only using renewable energy to power their Bitcoin mining machines, that’s wind, solar or hydropower. The other is to invest in carbon offsets, incentives that require a firm to invest in projects that offset the amount of carbon they are producing themselves.

This is becoming markedly more common. Even now, some Bitcoin ETPs are moving entirely carbon neutral, setting aside part of their management fee to offset the cost of mining the Bitcoin that makes up their funds.

Cleanspark (NASDAQ:CLSK) for example, is a Utah-based software company that designs and builds microgrids. Today it claims 95% carbon-free Bitcoin mining. With a $500m market cap it is far from the largest company of its type, but its stated ambition to move to mining Bitcoin with 100% renewable energy sources, this is clearly the way the industry is going.

Indeed, in the post-quarter period Marathon Digital which runs the carbon-neutral focused MARA Pool (the 11th largest mining pool globally) announced it was moving its operations away from a coal-powered site in Montana to seek more renewable energy generation in a bid to become carbon neutral in 2022.

Intel entry to turbocharge US Bitcoin mining supremacy

With the deliberate collapse of China’s mining market in 2021, US-based businesses are now in charge of the majority of Bitcoin mining. And while for the past few years the focus for Bitcoin mining companies has been on upgrading to the latest, most efficient machines like the China-manufactured Antminer L7, we witnessed in Q1 2022 the new entry by a US business to solidify the nation’s increased dominance in the space.

We saw the surprise entry into the Bitcoin mining market by Intel (NASDAQ:INTC) in February 2022, in a bid to oust Chinese manufacturers from the top of the leaderboard. Those leaders include Bitmain and the Shanghai-headquartered Goldshell, which produces mining machines dedicated to smaller Proof of Work cryptoassets including Kadena, Nervos Network, Handshake and Siacoin.

Chinese manufacturers tend to push their long lead times and production delays onto their customers, so Intel’s mass disruption of the Bitcoin mining market makes economic sense, too.

Initiatives by a $200bn dominant tech player entering the Bitcoin field and offering a new solution should not be underplayed. It is at once confirmation of more big players entering crypto and a boon to help more institutional investors who have ESG concerns their top priority to gain exposure to Bitcoin more broadly.

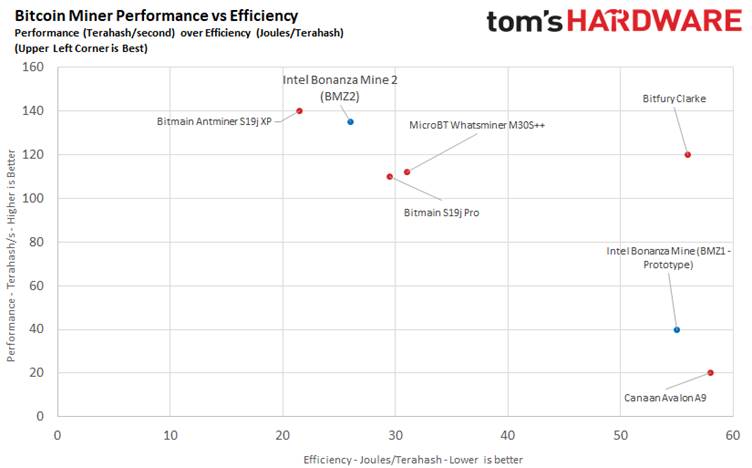

The Intel chip aims to reduce the considerable power consumption of Bitcoin mining machines by around 15%, while attempting to improve processing power to make the technology much more efficient. The first iteration of its tech, dubbed ‘Bonanza Mine’ uses a 7nm process node, and was unveiled at the International Solid-State Circuits Conference in February 2022.

Vancouver-based Hive Blockchain (TSXV:HIVE) said on 7 March, announcing the purchase of Intel’s BMZ2 Bonanza Mine chips, that the tech could improve its aggregate hashrate by 95%.

Additionally, President and COO Aydin Kilic added:

Intel’s energy efficient and high performance blockchain accelerator is expected to reduce our power consumption over current ASIC miners on the market.

At half the price of the Bitmain S19j Pro ($5,625 compared to $10,455) Intel has a clear headstart. And as some commentators have noted, Bitmain often adjusts its pricing based on the market value of Bitcoin on any particular day, exposing industrial-grade miners to Bitcoin’s price volatility.

Data shows that Intel’s Bonanza Mine effort approaches the best of what the Chinese manufacturers can produce in terms of energy efficiency and power output.

Intel has since doubled down and released a second-generation chip in April 2022, dubbed Blockscale. According to official figures, it is capable of up to 26J/TH efficiency with a 580GH/s performance rate.

Announcing the launch, Intel VP and general manager of its blockchain unit Balaji Kanigicherala said:

Intel’s decades of R&D in cryptography, hashing techniques and ultra-low voltage circuits make it possible for blockchain applications to scale their computing power without compromising on sustainability.

The data for Blockscale has not yet been released but it is expected to take account of Intel’s stated intention to allow miners to adjust their power consumption up and down as required, rather than running at full speed constantly. This is a key point. Miners need to be able to adjust their output based on hashrate, and have the ability to power down machines when it is not economically viable to mine. The chips are also designed to be customisable for use with air-cooled and liquid immersion cooling systems, potentially cutting costs with additional hashrate increases.

Intel has another benefit: it is not subject to 25% tariffs unlike those on Chinese products, nor the shipping and logistics costs associated with sending machines halfway across the world.

Proof of Work under regulatory microscope

Bitcoin’s Proof of Work consensus mechanism has come under increasing scrutiny. In March 2022 the Environmental Conservation Committee of the New York State Assembly voted to move forward with a proposed law that could ban PoW mining in the state until 2024. That is one US state, and not yet enshrined in law.

Europe as a whole, by contrast, has implicitly embraced Bitcoin mining.

On 14 March 2022 the ECON, the EU’s Committee on Economic and Monetary Affairs responsible for the regulation of financial services and oversight of the European Central Bank, voted against a proposal that could have seen the end of Bitcoin mining in Europe.

A last minute addition to the bloc’s upcoming Markets in Crypto Assets (MiCA) framework aimed to limit the use of cryptocurrencies powered by Proof of Work.

32 voted against the proposal, with 24 voting for. A majority of MEPs from the EPP, ECR, Renew and ID parties voted against, while a minority of MEP from the Greens, S&D and GUE mainly voted in favour.

As hoped for by Bitcoin proponents, politicians voted against the ban, favouring instead new draft rules to protect consumers and make Proof of Work mining more sustainable.

This was a source of huge relief in the crypto community and a significant political success for Bitcoin in Europe.

Instead of the ban, an alternative amendment from Dr Stefan Berger was supported. It reads: By January 2025, the Commission shall present to the European Parliament and to the Council, as appropriate, a legislative proposal to amend Regulation (EU) 2020/852, in accordance with Article 10 of that legislation, with a view to including in the EU sustainable finance taxonomy any crypto-asset mining activities that contribute to climate change migration and adaptation.

Conclusion

The change we are witnessing is really five-fold: firstly we are seeing the Bitcoin mining industry becoming more transparent with the shift in powerbase to the US and their publicly-traded miners, secondly, the introduction of better regulation offering more oversight of the climate change impacts of Bitcoin mining, thirdly the expansion of more efficient and less wasteful technology through the likes of Intel, fourrthly, a wider reconfiguration of the argument that Bitcoin mining is wasteful in general, and fifthly, a new ESG-friendly economy emerging from the use of otherwise burned flared gas by the world’s multinational oil producers in Bitcoin mining.

Climate change regulations are critical for the future of the planet and must be followed. US Bitcoin miners, who now control the largest proportion of the industry, are using more renewable energy than ever, and getting out ahead of regulations much faster than any other industry, certainly more so than oil and gas. Net zero by 2050? Not fast enough. Marathon Digital’s pledge to become carbon neutral by 2022 is more likely to become the standard.

Increasingly, ESG-focused miners are gaining market share, further greening Bitcoin’s mining landscape, and commercial priorities are clearly shifting in that direction.

Bitcoin mining has moved beyond the early adopter and institutional adopter phase. What is more likely to happen now is the formalisation of governments vying for mining supremacy.

Crypto M&A, funds explode with Metaverse/Web3

New data from PwC shows the total value of crypto fundraising deals increased by 645% in the last 12 months, with crypto M&A jumping 50x from 2020 to 2021, from $1.1bn to $55.9bn.

Among the figures released by the Big Four accounting company show that traditional VCs and investment funds, and not just crypto-specific entities, are entering the space with buckets of cash in a bid to find the next Metaverse and Web3 winners.

Ethereum is still the backbone for ~70% of DeFi and NFT markets, and 90% of the crypto-focused Metaverse, as the host blockchain for Decentraland and Sandbox. Ethereum takes a cut whenever any transactions are recorded on these leading Metaverse and financial platforms.

But the Metaverse and Web3 extends far further. It is becoming the bridge between the Nasdaq tech giants of Microsoft and Google, online gaming, the next-generation of digital natives and this new world of crypto-based value.

Among the new set of entrepreneurs heavily focused on finding the next set of winners from Metaverse and Web3 is Katie Haun. After her surprise exit from Silicon Valley VC giants Andreessen Horowitz (a16z) in December last year, Haun initially targeted a $900m fundraise, but made headlines globally in March 2022 by pulling in a $1.5bn haul.

This is the largest debut venture fund ever raised by a solo female founding partner, topping the $1.25bn raised by investment banker Mary Meeker in 2019. Haun’s first investments will come from a $500m fund ringfenced for early-stage NFT and crypto startups, and $1bn aimed at more mature Metaverse/Web3 companies.

Short-term declines in the market price of Bitcoin have not stemmed the flow of capital into crypto VC. In March 2022 Electric Capital raised $400m to invest in Web3 startups and $600m to buy crypto directly. In the same month, the 1994-founded VC firm Bain Capital Ventures raised $560m for its first crypto-dedicated fund. Bain has been pouring money into DeFi since around 2015 and is an early investor in lending platform BlockFi and the Digital Currency Group conglomerate.

Big Tech enters the chat

One of the earliest criticisms that industry insiders faced was that Big Tech appeared to be ignoring blockchains. If this was such a disruptive, world-changing technology, why was Silicon Valley so dismissive? It is true that Big Tech has been remarkably slow to enter the space, but this is changing.

IBM was one of the first to cross the Rubicon as a founding member of the Hyperledger consortium in 2015, developing private and permissioned enterprise-level blockchains and notably working with the Bank of Thailand to issue bonds in two days rather than the 15-day industry standard.

Meta (Facebook) is the obvious comparator, but has struggled to make regulators see the benefits of its Diem (formerly Libra) cryptocurrency. That experiment fell by the wayside in Q1 2022 with the ignominious collapse of the project and the 1 February sale of Diem’s assets to crypto-focused Silvergate Bank.

Both Twitter and Reddit are experimenting with the largely Ethereum-based NFT markets, but the biggest social/gaming news in years is the 18 January announcement that Microsoft was to purchase Call of Duty, World of Warcraft and Overwatch publisher Activision Blizzard in a $68.7bn deal. That makes Microsoft the world’s third-largest gaming studio after Sony and China’s Tencent.

Satya Nadella, CEO and chairman made explicit mention of the metaverse not once but twice in the short release, fuelling speculation that the company would follow the likes of Ubisoft to release primary and secondary markets for in-game unique NFT assets -- with the French gaming studio’s innovation based on Tezos blockchain technology.

So — to Google. Reports via Bloomberg and ArsTechnica now suggest that the web giant has switched focus to run headlong into blockchain, starting up a new division headed by long-time advertising chief Shivakumar Venkataraman.

Little has been revealed publicly about the division, other than it will focus on blockchain and other next-gen distributed computing and data storage technologies.

It will sit as part of newly reopened Google Labs vertical (shuttered in 2011 but reappearing now), which acts as the multinational’s sandbox for beta testing new programs and apps, and which has since been revitalised to incubate high-potential, long-term projects.

Crypto exchanges now generate 60% more revenue than traditional exchanges

Research by capital markets firm Opimas, published on 9 March 2022, shows that 2021 was the first year when the trading revenues generated by crypto exchanges surpassed the trading and clearing revenues of traditional exchanges.

Legacy names such as the venerable 220-year-old New York Stock Exchange, the relative upstart Nasdaq, which launched in 1971, and CME Group, which began trading silver futures in 1933 and gold futures in 1974 were left in the dust by cryptoexchanges Coinbase, Binance and FTX.

Analyst Suzannah Balluffi writes:

In 2021, for the first time, trading revenues generated by crypto exchanges surpassed the trading and clearing revenues generated by all of the traditional exchanges in the world by a staggering 60%.

Coinbase is the only one of these exchanges to be publicly traded.

The report estimates that — based on trading volumes and publicly available information, crypto exchanges earned a combined $24.3bn from trading fee revenues in 2021, up from $3.4bn in 2020, a seven-fold increase.

Only Intercontinental Exchange Inc, which owns the NYSE, and the London Stock Exchange Group had higher revenues than Coinbase, according to the research.

This is quite a shift from only a year earlier, when the traditional exchanges had revenues four times greater than the exchange of the crypto world,

wrote Balluffi.

Ever since Bitwise made its now-famous 2019 presentation to the SEC there has been a generalised flight to quality among investors as to where they exchange their fiat currencies for crypto. Bitwise’s research posited that 95% of trading volume on poor-quality exchanges could be attributed to wash trading, noting that despite the explosion in crypto trading venues there were, at the time, only 10 which demonstrated real spot volumes.

Speaking to TheBlockCrypto at the time of publication, Bitwise global head of research Matt Hougan noted:

A lot of people have a view of the crypto market that is anchored somewhere in the past ... maybe in Silk Road, maybe in the 2018 bear market. The reality is that the market has become truly institutional in nature, with very tight arbitrage between real exchanges, major advances in custody, and the growth of a large, regulated futures market.

That truly institutional nature of crypto market trading has only become more valid over the past two years.

When it comes to compliance, crypto companies face a stark choice, wrote Balluffi. Work with regulators or continue to battle against them. The latter strategy has resulted in large financial penalties and a loss of market share, and we see exchanges moving towards the former.

Working with regulators has become the industry’s clarion call. Coinbase in particular, for example, dropped its Lend programme in September 2021 in response to SEC criticism. While it pushed back on the SEC’s viewpoint, CEO Brian Armstrong ultimately decided to scale back its ambitions in that area, as decentralised lending and borrow (along with stablecoin usage) have become flashpoints for US and EU financial regulators.

Citadel crypto entry marks end of early adopter phase

The entry of Citadel Securities into crypto marks another shift. The Chicago-based market maker has around $35bn AUM, according to the latest available figures and sees almost as much trading volume as the Nasdaq, according to data from qz.com. It announced a $1.15bn investment from two crypto-focused VC funds in early January 2022 — Paradigm and Sequoia Capital.

Notably, this was Citadel’s first outside investment.

Paradigm, you may be aware, launched the world’s largest crypto fund in history in November 2021, worth $2.5bn. Sequoia Capital also led the $450m investment in Ethereum scaling solution Polygon.

Company founder Ken Griffin admitted on 1 March 2022 he was wrong about Bitcoin, and now wants his firm to offer digital assets to its clients this year. Speaking to Bloomberg, Griffin said it was fair to assume that his company would start offering market making services in cryptocurrencies over the months to come.

Crypto has been one of the great stories in finance over the course of the last 15 years,

he said.

And I’ll be clear, I’ve been in the naysayer camp over that period of time. I still have my skepticism, but there are hundreds of millions of people in this world today who disagree with that.

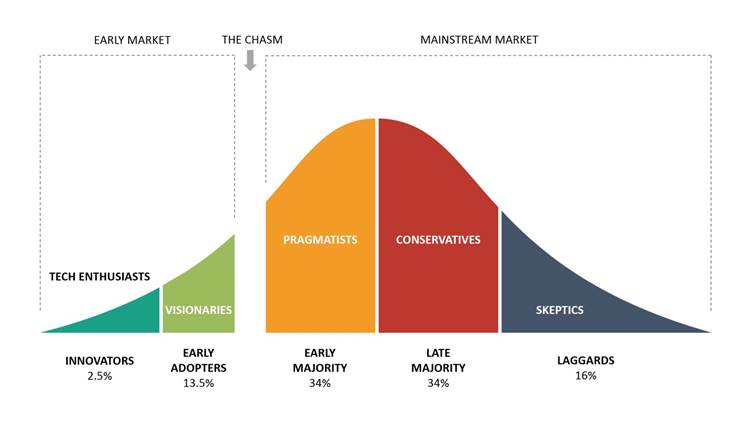

It could easily be argued that the entry of Citadel Securities, when taken with the points noted above, will mark the end of the ‘early adopters’ phase of cryptoassets into the mainstream. The classic bell curve of adoption of any novel technology shows that pragmatists in the ‘early majority’ group tend to enter once it has become clear that any invention is no longer just a passing infatuation, and want to see well-established references from their own peers before offering their services to clients.

The gap between early adopter and early majority represents the ‘credibility gap’ in any novel technology arising from using the group on the left as a reference base for the group on the right. The chasm exists because consumers trust references from people that belong to their own adopter group, as one analyst puts it.

The early majority group is much larger than the tech enthusiasts and the early adopters that came before it, and the signalling we are getting from governments around the world — as we have seen in both the US and the UK, with politicians falling over themselves to put their nation forward as global leaders — suggests that the pragmatists have now accepted the inevitable and arrived in cryptoassets.

Digital Assets and Blockchain Equities

There are certain blockchain and cryptoasset stocks now publicly traded which represent the best of what the industry has to offer, on both the retail and institutional sides of the fence.

Key Company Highlight: Galaxy Digital

Galaxy Digital (TSX:GLXY) shares were up 9.2% in the year to date between 1 January and 31 March 2022.

A general downward drift from early January towards the $15 per share mark reflected more bearish conditions in digital asset markets as a whole, as the total cryptoasset market cap dipped from $2.2 trillion at the turn of 2022, losing $700bn by late January to hit $1.51 trillion. Crypto markets regained some positive momentum towards the end of the quarter, finishing almost exactly where they started at $2.15 trillion, and Galaxy Digital shares moved largely with the wider market until the second week of March when it began to outperform.

As of 28 February 2022 Galaxy Digital had assets under management of $2.4bn, a portfolio of 180 subsidiary companies spanning the digital asset industry, and more than 750 institutional trading counterparties.

The average price target consensus among analysts covering the stock by the end of the quarter was $32.67, or 53.38% above its $21.30 closing price on 31 March.

Among retail stock pickers GLXY started to gain some reasonable traction. It was covered 46 times by the analysts at Motley Fool Canada, the domestic arm of one of the world’s largest consumer-focused investing websites.

The reason for the greater coverage is probably due to CEO Mike Novogratz’s vision of becoming the bridge between traditional financial companies and direct crypto investing. Despite a more permissive atmosphere in the US for digital assets, and an Executive Order from the office of the president on 9 March calling on agencies to investigate the risks and opportunities of the sector more broadly, the highly regulated banking sector still struggles to invest in cryptocurrencies directly.

Galaxy Digital continues to expand through strategic acquisitions, having scooped up digital asset management firms Vision Hill Group and most notably custodian BitGo in the last 12 months. This latter purchase in particular brings Galaxy a swathe of intriguing options.

BitGo gives Galaxy institutional Bitcoin holdings

BitGo is akin to the BNY Mellon Bank in the equities world: the most trusted regulated custodian and the world leader in institutional digital asset custody. It counts among its hundreds of institutional clients the $762.3bn market cap Japanese conglomerate SBI Holdings, prominent VC firms including Pantera and Polymath, crypto exchanges such as Bitstamp, hedge fund managers MetaStable, and a slew of other institutions.

While the purchase of BitGo by Galaxy Digital was announced in May 2021 and was expected by the end of that year, it has not yet been completed. As we barrelled towards the end of the quarter, we heard that there was some tweaking of the purchase agreement going on behind the scenes. GLXY shares slipped on the announcement, made during an earnings call, that Novogratz wanted to renegotiate terms. BitGo shareholders would receive 44.8 million newly-issued Galaxy Digital shares, up from 33.8 million previously, meaning that BitGo shareholders would own 12% of the company compared to 10% agreed in the original deal. The $265m in cash for the deal would remain the same, with the total deal value in the $1.2bn region.

Announcing the deal in an SEC filing, BitGo CEO and founder Mike Belshe said: "Joining Galaxy Digital represents an exciting new chapter for our business, as our current clients gain access to a wide set of financial solutions.We will now be in a position to offer our best-in-class digital asset infrastructure capabilities to significantly more corporate, institutional, and high net worth investor clients."

The news came as Novagratz awaits SEC approval of its plan to reorganise as a Delaware-based company and list its shares on the Nasdaq exchange.

Clearly listing on Nasdaq would be a major coup for the Toronto Stock Exchange-listed Galaxy Digital. The Nasdaq is the second-largest stock exchange in the world by market cap of listed companies: $24.5trn compared to TSX’s $3.2trn.

The BitGo acquisition remains a risk and must be completed to investor satisfaction to merit future investment potential. Failure to correctly integrate BitGo would mean derailing Galaxy’s profile as a cutting edge digital asset investment bank and return it to a run of the mill brokerage.

In FY21 financial results released on 31 March 2022 we got a glimpse into Galaxy’s profitability, and crucially, its crypto holdings.

Net income increased 345% year on year to $1.7bn. Partners’ capital increased 226% to $2.6bn from $798.2m and importantly, we saw the value of the crypto GLXY holds.

Bitcoin holdings were $463.8m compared to $443m in FY20, Ethereum holdings were $391.3m compared to $65.8m in FY20, and Terra (LUNA) holdings were $407.6m compared to no holdings in FY20.

Other key highlights worth mentioning in Q1 2022 were offering Goldman Sachs clients exposure to ETH through a Galaxy Digital fund. The fund had produced sales of $50m to 9 March 2022. Additionally, Galaxy also facilitated the first OTC crypto trade by a major US bank in late March. While a boon for Galaxy and its crypto banking services, this also speaks to a wider point that the crypto-to-tradfi industry bridge is maturing, and quickly.

As CNBC reported:

Goldman is the first major US bank to trade crypto over the counter…The bank traded a bitcoin-linked instrument called a non-deliverable option…the move is seen as a notable step in the development of crypto markets for institutional investors. Compared with the exchange-based CME Group bitcoin products Goldman began trading last year, the bank is [willing to take] on greater risk by acting as a principal in the transactions.

Galaxy Digital co-President Damien Vanderwilt added:

This trade represents the first step that banks have taken to offer direct, customizable exposures to the crypto market on behalf of their clients.

Key company highlight: Coinbase

Coinbase (NASDAQ:COIN) had a tough first quarter of 2022, with its stock price dipping 25.5% from the start of the year, largely in line with the wider digital asset market cap.

COIN hit its lowest point $153.19 on 14 March, before recovering to end Q1 at $189.96. The catalyst for this stock price recovery was largely tied to its expansion into the booming South American market: more on that below.

This downwards drift was perhaps inevitable for one of the most-hyped stock market debuts of any public company in recent memory. Opting for a direct listing instead of a traditional IPO, COIN stock debuted north of $328, lending it the honour of the seventh-largest new US listing of all time. That’s behind tech heavyweights like Airbnb (NASDAQ:ABNB) at $86.5bn, cloud computing giant Snowflake (NYSE:SNOW) with $70.2bn and Uber (NYSE:UBER) at $69.9bn.

In the months since listing, despite price weakness, Coinbase has continued aggressive expansion in the hunt for a greater share of the retail digital asset market.

What investors will want to know first and foremost is the profitability of this flagship digital asset stock. FY21 earnings results released on 24 February 2022 showed Coinbase in rude health. Net income recovered to $840m in Q4 2021 from $406m in Q3 2021, on revenues of $2,490m across Q4 2021 compared to $1,235m the quarter before.

The most important aspect for Coinbase is to bring in rising levels of monthly transacting users. These traders and retail investors are its bread and butter.

Additionally important is to convert the majority of its users from simple buyers and sellers of the handful of the digital assets they know well (Bitcoin, Ethereum etc) into fully-fledged digital asset natives comfortable with holding NFTs and other digital assets beyond currencies in their exchange wallet. One of the ways CEO Brian Armstrong plans to do this is to list an ever-increasing number of cryptocurrencies — 247 at last count — and the other is to launch the Coinbase NFT marketplace. More on that later.

FY21 results show that Coinbase monthly transacting users grew to a record high of 11.4 million people in Q4 2021, while trading volume spiked to $547bn from $327bn the previous quarter.

Coinbase now has wide-scale investment banking coverage, with 22 analysts reporting on the stock, including Compass Point, Goldman Sachs, JP Morgan and Canaccord Genuity. 11 analysts rate the stock a buy, with six setting an outperform rating and five noting a hold. The average price target consensus among analysts covering the stock by the end of the quarter was $291.92, or 53.34% above its 31 March 2022 closing price.

There were some significant purchases for investors to note throughout the quarter. On 12 January Coinbase announced it had acquired FairX, a CFTC-regulated derivatives exchange, to broaden its offerings to include cryptocurrency derivatives in the US.

On 14 February Coinbase also detailed plans to hire 2,000 employees across product, engineering and design in 2022, setting the stage for a massive expansion in its facilities beyond trading, to encompass NFTs and Web3, the next iteration of the internet.

NFTs will likely be a huge money spinner for Coinbase. Its platform is in beta at the moment, with only a waitlist available for those interested. But as a comparison for the potential size of the market we can look at OpenSea. At the start of Q1, the private NFT marketplace raised $300m for a whopping $13.3bn valuation.

As TechCrunch noted, that company takes a 2.5% cut of transactions on its platform, and with a 30-day trailing trading volume nearing $3bn in January 2022, OpenSea would be on track to generate $35bn over 12 months, generating gross revenues of $873m.

The rise of CEX staking

The addition of staking rewards for retail and institutional Cardano (ADA) holders in late March highlighted a key portion of Coinbase’s offering going forward.

When users stake their crypto, they make the underlying blockchain of that asset more secure and efficient, the exchange explained in a blog post. They are rewarded with additional assets from the network, which are paid out in rewards. While it has been possible for individuals to stake Cardano on their own, or via a delegated staking service, the process can be confusing and complicated. With today’s launch, Coinbase is offering an easy, secure way for any retail user to actively participate in the Cardano network and earn rewards.

In its Q4 2021 earnings report, Coinbase CFO Alesia Haas told analysts that Ethereum2 made up the largest portion of its staked assets.

We drove more than $200m of blockchain rewards this year, which is really rooted largely in our staking revenues,

Haas noted.

With the upcoming shift from Proof of Work Ethereum to Proof of Stake, ETH holders have been able to earn yield on their Ethereum holdings by locking it into the ETH2 deposit contract. And while some more tech-savvy investors have chosen the option to become an official Ethereum validator, staking 32ETH, many millions more have picked the easier option of delegating their staked ETH to a larger operation like Coinbase, receiving yield in the form of ETH deposited directly into their exchange accounts. The near $40bn of Ethereum locked in the deposit contract is a massive vote of confidence in the upcoming network upgrade: investors are tying up their stake until Ethereum2 is launched some time in June 2022.

As noted above, crypto exchanges are now generating higher revenues than traditional exchanges.

The ability and the scale to be able to achieve this through new product offerings will likely drive Coinbase to become a Nasdaq stalwart as we head throughout the rest of 2022.

Expansion into South America

The Coinbase share price took a leap to the upside in late March when noises started to appear in local media in Brazil that Coinbase was in talks to buy 2TM, the parent company behind Mercardo Bitcoin, Latin America’s largest digital asset exchange.

2TM had previously raised $200m in a Series B funding round, followed by a further $50m in November 2021, valuing the company at $2.1bn.

Mercado Bitcoin reached 3.2 million customers in 2021, of which 1.1 million were added last year, with trading volume of $7.1 billion across last year.

According to the Brazilian central bank, the total amount of cryptoassets held by Brazilians reached $50bn in 2021, compared to $16bn held in US stocks and shares. So this is clearly a market from which Coinbase can benefit.

And along with all of the standard cryptos like Bitcoin, Ethereum, XRP and Litecoin, it is interesting to note that among the top 10 most traded assets on Mercado Bitcoin is the MOSS Carbon Credit token. Access to carbon credit trades could become a huge bonus for Coinbase. The value of traded carbon credit markets for CO2 permits reached $851bn in 2021, according to Refinitiv data, and while the EU’s Emissions Trading System (ETS) accounts for 90% of trading volume currently, blockchain-based markets are just starting to overhaul the system.

The Wall Street Journal reported during Q1 that 17 million tons of carbon offsets are now tied to digital tokens (or ‘tokenised’, as the parlance goes), bringing a new level of transparency to the largely unregulated voluntary carbon market. As a reminder: blockchains are highly efficient ways to display secure, real-time data and a record of transactions without having to rely on opaque central authority or trusting manual oversight.

South America as a whole is embracing cryptoassets like never before. In the last few months Mexico’s national stock exchange said it was considering listing Bitcoin futures, Paraguay’s Senate approved legislation to take advantage of the country’s energy surplus and to regulate crypto mining and trading, Argentina has said it will levy a 0.6% tax on cryptoexchange operations and Hong Kong’s institutionally-focused exchange OSL announced in October it was expanding into Latin America.

Further to the adoption story in South America, in a 25 March post on the city’s municipal website, Chicão Bulhões, the Secretary of Economic Development, noted that Rio de Janeiro would start to accept Bitcoin for real estate tax payments by 2023.

If Bitcoin, Ethereum and the wider digital asset universe are going to grow in prominence and value in future, then the general store that offers trading in these assets to the widest possible market will benefit.

In that vein, it is worth repeating the old axiom that during a gold rush, the companies that make the real money are the ones selling the picks and shovels.

Outlook

While skepticism has reigned supreme over the last decade, cryptoassets are reaching such a critical mass that it is becoming increasingly impossible to ignore. Everywhere we look there are dominos falling.

Regulated cryptoasset companies will likely continue to be the first interaction that most traditional investors will have with the wider crypto universe.

Coinbase is the anchor tenant for retail, while Galaxy Digital is structurally important for the institutional market, having processed the world’s first OTC crypto trade and provided the backbone for the likes of Goldman Sachs to enter the market in a regulated manner. That company’s impending move from the TSX to Nasdaq should bring it a whole new market of investors and broaden its userbase.

The sense and scale of digital asset regulation remains a key risk factor for both companies outlined here: but the tone of conversations has largely shifted, in the US at least, from cracking down on crypto to supporting what investors actually want to invest in.

Market analysts Crypto.com suggest that there are approximately 300 million crypto users globally as of the end of January 2022. That figure jumped from 221 million in June 2021 and is up from 65 million in 2019. So, with the global crypto population increasing 178% in 2021, and a recent survey from Goldman Sachs showing 60% of their institutional clients plan to increase their crypto holdings between now and 2024, the sensible play would seem to be to gain exposure to the companies that take a cut when times are bullish and when they are bearish; both when markets are fallow and when they are buoyant.

For investors, taking stakes in the companies that provide the picks and shovels for the ever-expanding digital asset trading universe seems to make the most sense.

Into the Metaverse

Introduction

The Metaverse has been hard for investors to avoid in the last 12 months. It has been variously described as everything from the evolution of virtual reality (VR) and augmented reality (AR), to the next logical expansion of the internet.

That is one way to think about it: of a coming technological overhaul which will move users from read-only static webpages (Web1) to interactive read + write and social networks (Web2) to read+write+own (Web3).

The Metaverse is one specific evolution of Web3. When ‘complete’, it will involve a series of decentralised interconnected and increasingly realistic 3D virtual worlds, each with their own functional online economy.

The world’s most recognised investment banks have already scoped out the total addressable market. Morgan Stanley sees Metaverse-related businesses combined creating an $8.3 trillion opportunity in the United States alone. Goldman Sachs sees an ultimate valuation of more than $12 trillion globally.

While the market is still debating how long the metaverse will take to develop and what it will feature, we think the metaverse is most likely going to be a next-generation social media, streaming, gaming and shopping platform. Morgan Stanley

The pace of change may be even more rapid than that. Given that digital asset markets have grown from a $10 billion industry to one worth $2 trillion in less than 6 years, such predictions should not be quickly dismissed.

Investment banks are coming on board at ever greater speed, the latest being Citibank. And while a narrow Metaverse focused only on the estimated 900 million to 1 billion VR headset users by 2030 would yield a total addressable market of up to $2bn, A ‘device-agnostic’ Metaverse that includes smart manufacturing using AR, a vibrant creator economy leveraging VR and non-VR platforms, digital concerts and social gaming could see a total addressable market of between $8 trillion and $13 trillion by 2030, analysts said in a 186-page report released on 31 March called Metaverse and Money: Decrypting the Future.

A January 2022 report by Gartner suggests that by 2026, 25% of people globally will spend at least one hour per day in the Metaverse for work, shopping, education, social media and entertainment.

VR and AR are not new technologies but their usage is growing and their influence is starting to bleed into everyday life. Facebook’s October 2021 name-change to Meta, and its $10bn commitment to developing the Metaverse, was just the crest of a wave. In February 2022 Nigel Bolton, co-head of equities at $10 trillion asset manager Blackrock, predicted “game changer” products including AR glasses and 5G technology would fuel huge Metaverse growth in 2022, not only for tech firms but also consumer, advertising and leisure stocks.

As digital asset exchange Coinbase (NASDAQ:COIN) noted in its own investigation: the hypothetical tech stack of the Metaverse will include persistent, synchronous and mass-scale virtual worlds upon which user will have the ability to socialise, work, transact and create.

Roblox, Snap, Meta to lead

Meta (NYSE:FB), along with Roblox (NYSE:RBLX) and Snap (NYSE:SNAP) will be the early winners of the retail Metaverse economy, according to Goldman Sachs.

Snap is at the forefront (and an emerging industry leader) with respect to the rise of augmented reality, as management has prioritized investments in the development and adoption of AR technologies/use cases, their late-2021 report reads.

Snap has 200,000 Lens creators and developers with use cases spanning taking spatial measurements, new forms of storytelling for entertainment and shopping (for example trying on shoes in AR and purchasing directly).

Epic Games’ Fortnite and Roblox lead social gaming metrics, with users spending on average more than an hour and a half on each multiplayer open-world game in 2020, “signalling the value the younger generation place on social elements and virtual worlds within gaming”.

Key Company Highlight: Roblox Inc

There will be millions of metaverses, just as there are millions of websites, not just a single one controlled by Meta Platforms or Google’s parent company Alphabet.

As ever, the really interesting entry point for investors who want exposure to the megatrend will be to capture the revenue-generating, regulated business that are producing significant cashflows.

18 Wall Street analysts cover the stock, with the mean consensus target price of $70.88, or 53.82% above its $46.24 closing price on 31 March 2022.

Roblox took the same route to market as Coinbase, eschewing a traditional IPO in favour of a May 2021 direct listing.

55% of Roblox players are under the age of 13, according to the company, and 25% are aged nine and under. If ever there was a place where the next generation of digital natives were to build and grow one of the first iterations of the metaverse, it is here.

DAUs rose to 42.1 million in Q1, up 79% from last year.

Users spent 9.7 billion hours on the platform, 2x YOY.

The elements to consider here are significant cash flows, hundreds of millions of customers who login monthly and a low-risk business model.

Covid-19 offered a notable boost for the company, with millions of schoolchildren globally sent home for remote learning and outdoor extracurricular activities cancelled.

As a gaming platform aimed at younger users, Roblox is the standout performer from the current crop of metaverse-related equities for investors to consider. As noted by Goldman Sachs, players spend almost double the amount of time in Roblox as they do in Minecraft, an astonishing figure given the popularity of the now-Microsoft owned gaming sensation.

The games most likely to entice non-gamers to gaming are casual/social in nature, not computationally-rich ones. Few non-gamers will be convinced to start gaming because Call of Duty is bigger, more realistic and easier to access, writes Matthew Ball, a prominent venture capitalist.

As one of the world’s most popular gaming platforms, Roblox also benefits from its large creator economy with over 50 million daily active users and 200 million monthly active users, Goldman notes. Roblox monetises its user base through the sale of its virtual currency, Robux, which can be used to enhance game experiences, customise a players avatar, or acquire development resources. The platform includes content developed by individuals alongside film and TV studios like Warner Bros and Netflix, game studios and external music artists.

One other point to make about Roblox is the success of its livestream concerts. Over 36 million people watched Lil Nas X perform the first ever virtual concert on Roblox in November 2020, which included the exclusive debut of his song Holiday.

11.5 million people watched recording artist 24kGoldn in the most recent Roblox virtual concert on 25 March with viewers earning rare and unique badges to display on their profiles for interacting with the concert in different ways.

There were a number of pre-concert ‘quests’ including challenges related to the artist, redeemable for prizes. Fans who collected all the badges available were able to unlock limited-edition emojis after the premiere launched.

While live concerts have returned to the world post-Covid, livestreamed events like this serve to gamify the experience for millions who are either too young to go out to concerts themselves or otherwise not in the same country or city where artists are performing.

I grew up on Roblox and have been a big fan my whole life,

said 24kGoldn, in a press statement.

It’s been amazing to be a part of the full experience to make this virtual concert come to life. From coming up with the storyline and transforming my hometown to designing verch (virtual merchandise), I wanted to give my fans a one-of-a-kind experience.

Those one-of-a-kind experiences have a dollar value attached, and it appears clear that Roblox will be one of the standout stocks of the first iteration of the metaverse.

Key Company Highlight: PTC Inc

From an industrial perspective, the opportunities in AR are just as evident. While this may never bleed down to the retail version of the Metaverse, the revenue potential from factory and industrial-focused augmented technologies is vast.

PTC Inc (NASDAQ:PTC) was incorporated in Boston, Massachusetts in 1983 as Parametric Technology Corporation. PTC is a software-as-a-service company without much of a retail-focus and is likely not one the average investor has heard of, despite a $11.8bn market cap. FY21 results showed that over the last 10 years it has beaten the S&P 500 total return by 100%, however.

PTC is also accelerating its annual revenue increases: from 2018 to 2019 revenue was up 1.1% to $1.256bn, while revenue for 2020 saw a 16.91% jump to $1.458bn. Annual revenue for 2021 leapt by 23.91% to $1.807bn, according to macrotrends.net.

15 Wall Street analysts cover the stock, and the mean consensus target is $145.57, 35.1% above its closing price as of 31 March 2022.

PTC’s key piece of tech is Vuforia Studio, which allows companies to port across their existing computer assisted design (CAD) into an AR setting in 3D.

Multiple acquisitions support Vuforia

PTC acquiredVuforia Studio from Qualcomm in 2015 for $65m, and has bought multiple AR development companies over the last seven years to expand the brand and its operations.

In December 2015 it added Kepware Technologies to its stable for $100m, followed by Waypoint Labsin 2018 for an undisclosed amount, then bought artificial intelligence and generative design lab Frustrum for a reported $70mthe same year. Rotterdam-based persistent AR software house TWNKLS was acquiredin 2019, and in PTC's second-largesttotal acquisition to date, added the 5,000-customer SaaS platform Onshape for $470m.

Finally, in February 2022 PTC acquiredRE'FLEKT, an AR software and remote maintenance solution provider for an undisclosed amount. The Munich-based startup was founded in 2012 and as of the end of 2020 was returning revenues of around 12m EUR. It targets the enterprise and industrial AR markets with a focus on installation and maintenance of technology.

Vuforia means that PTC leads the industrial AR market, helping to increase worker productivity, reduce the cost of errors, waste and accidents, and aiding competitive advantage. Its industrial software offering is enhanced by sensor-based IoT data from its in-house ThingWorx platform, which allows Vuforia users to take AR experiences and turn them into actionable insights.

And it is not just available through a VR headset — much as the VR industry would like it to be the case, the technology is not at the stage where workers can wear the headgear comfortably for several hours at a time.

Instead PTC Inc have pioneered the use of digital overlays on mechanical objects, such as car parts and oil rigs, that can be viewed through tablets and Bring Your Own Device mobile phones.

In this way the PTC business model references the AR design applied by Nintendo to its Pokemon Go game in 2016, (one which still has hundreds of millions of players more than five years after launch) allowing a low barrier to entry for new customers.

PTC’s customers for Vuforia include Hitachi Energy, Cupra and General Electric (NYSE:GE).

Cupra is the high-performance arm of Spanish car giant SEAT. It manufactures a number of electric and hybrid car models including the Cupra BORN, the Formentor VZ2 e-hybrid, and the Leon VZ2 e-hybrid.

Assembly lines for electric cars are known to be more difficult than for traditional petrol-powered vehicles. Preparing existing factories for their manufacture can require “comprehensive upgrading” of production operations, according to industry sites.

Companies can repurpose their existing 3D CAD data and animated sequences to build more institutive assembly, inspection, service and operating instructions.

With Vuforia Studio, organisations create AR experiences for their products, eliminating the need to transport equipment and instead allowing potential customers to encounter virtual versions of their products. Sales teams can also remotely assess job sites, overlaying machinery using AR to ensure it will fit in a planned location. Evidently with the wide-scale lockdowns associated with Covid-19 this element of the business has come into sharper focus.

In a recent summaryof business streamlining PTC noted that Vuforia improved field service quality and productivity with a 10%-12% reduction in overtime spend; a 5%-10% reduction in spoilage and waste; and a 60% improvement in the time taken to create technical documentation. Most notably, Vuforia aided training times for organisations with businesses noting a 50% reduction in the time required to train employees in complex industrial tasks, transforming classroom and paper-based instructional courses into interactive AR experiences.

Involved in the survey were four existing companies including a medical devices manufacturer with revenues of $10bn, a semiconductor manufacturer with $5.5bn of revenue annually and an industrial machinery company with revenues of $3.5bn. The interviews found that the organisations experienced benefits of $12.5m over three years, versus costs of $4.6m, adding up to an NPV for $7.9m and an ROI of 172%.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.

Informazioni su ETC Group

L'ETC Group è nata da una chiara missione: fornire agli investitori l'accesso al vasto potenziale di crescita nell'ambito delle criptovalute e degli asset digitali. Il nostro track record comprovato ci rende un partner affidabile: in oltre tre anni di successi, abbiamo consolidato la nostra posizione come emittenti di cripto-titoli con sede in Germania e siamo diventati un punto di riferimento europeo per soluzioni d'investimento in questo dinamico settore.

Con un solido track record di oltre tre anni, crediamo che sfruttando l'esperienza e le conoscenze del settore finanziario tradizionale e applicandole a questa nuova ed entusiasmante classe di asset, possiamo portare sul mercato prodotti d'investimento di prim'ordine.

Nel giugno del 2020, ETC Group ha lanciato il primo ETP su Bitcoin con compensazione centralizzata al mondo, quotato su Deutsche Börse XETRA, la più grande borsa di ETF in Europa. Da allora, la società è stata un pioniere dei prodotti negoziati in borsa basati sulle valute digitali con numerose idee di prodotto innovative. ETC Group è costantemente impegnata ad ampliare la propria gamma di ETP di qualità istituzionale sulle criptovalute, offrendo agli investitori la possibilità di investire in Bitcoin, Ethereum, Cardano, Solana e altri asset digitali popolari sulle principali borse europee.