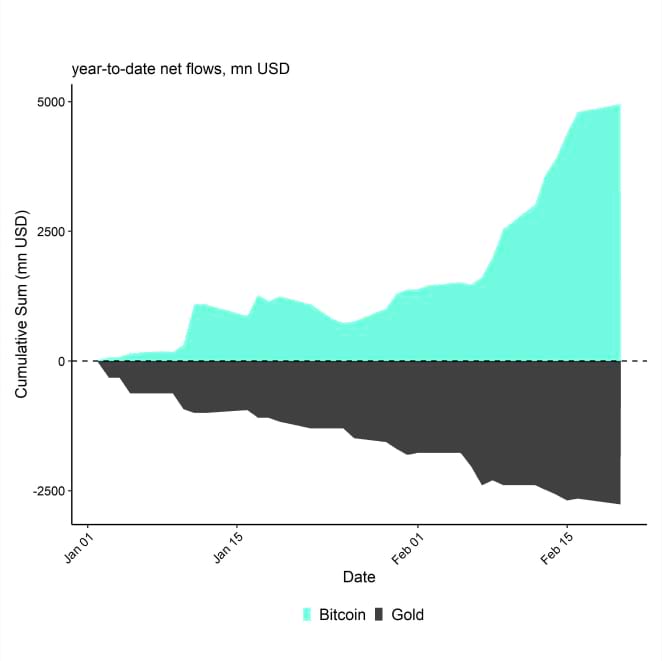

- Gold ETPs have seen significant net outflows while global Bitcoin ETPs have seen significant net inflows in 2024

- We expect this trend to continue in the medium- to long term as Bitcoin will likely disrupt gold as the prime store-of-value

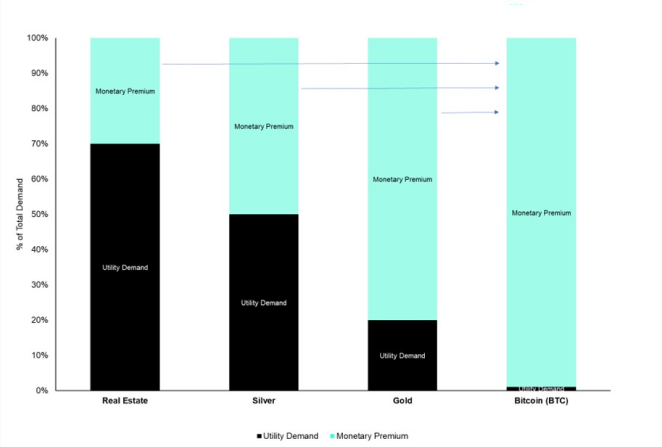

- Other hard assets are also at risk of losing their monetary premium in the long term in favour of Bitcoin

“Software is eating the world”

The internet of information had a profound impact on our everyday lives. One of the biggest impacts came with the dematerialization of physical objects into software and essentially into our smart phone. Think about physical music records, newspapers, photo albums, letters, cameras, maps – all these previously physical items have been replaced by intangible software.

“De-stuffing” as some experts like to call it – we get rid of our old music records and subscribe to a music streaming service over the internet instead.

In fact, the internet has dematerialized information carriers and transformed them into software.

Cryptoassets and in particular Bitcoin are likely going to have a similarly profound impact on our lives.

In this context, Bitcoin dematerializes value carriers like gold and converts them into Bitcoin.

Gold will continue to be as used, but Bitcoin is likely going to disrupt gold as the prime store-of-value and eventually command most of the “monetary premium” inherent in the current gold price.

Gold's contenders think this is an unlikely scenario. The main argument relies upon the observation that gold has been used for thousands of years as the prime store-of-value so it is likely going to be used for another thousand years.

However, gold advocates fail to realize that there are many historical instances were previous technologies have been disrupted despite a very long history of usage.

History provides ample evidence for this:

- Mankind used candles for thousands of years to create light à now we are using electricity and light bulbs

- Mankind used horses for thousands of years for transportation à now we are using automobiles and trucks

- Mankind used to build ships from wood for thousands of years à now we are using other materials like steel and plastic

- Mankind used hand-written letters for thousands of years to communicate à now we are using Emails and messaging services

The key takeaway is that:

A long history of usage is no guarantor that any asset or technology cannot be disrupted at some point in the future.

Gold's monetary premium

Gold contenders used to highlight the risk of continued loose monetary policy on inflation. Especially the increased use of unconventional monetary policies like Quantitative Easing (“QE”) since the Subprime Crisis were feared to set off a lasting high inflation regime for which gold was designed to be a perfect hedge as a scarce commodity.

Despite many rounds of QE, Gold has failed to sustainably reach new all-time highs. Despite high expectations as an inflation hedge, it has also failed to outperform inflation by a wide margin. In fact, Gold has outperformed US CPI inflation only by a meagre 9% over the past 12 years but has underperformed the expansion of the Fed's balance sheet by a staggering -54%.

In contrast, Bitcoin was one of the few assets to keep up with the expansion of the Fed's balance sheet and even outperform it by a very wide margin.

One of the reasons is that Bitcoin is already cannibalizing on gold's so-called “monetary premium”. The monetary premium mainly occurs on account of investment demand to utilize gold as a store-of-value. This demand mainly comes from central banks and investors allocating to gold.

In contrast, there is also “utility demand”. In the case of gold, this would be demand related to jewlery or other industrial purposes. In the case of real estate, this would be natural demand for shelter. The monetary premium in hard assets like gold or real estate has increased significantly since the US went off the gold standard in 1971 which led to an increase in investment demand for scarce hard assets.

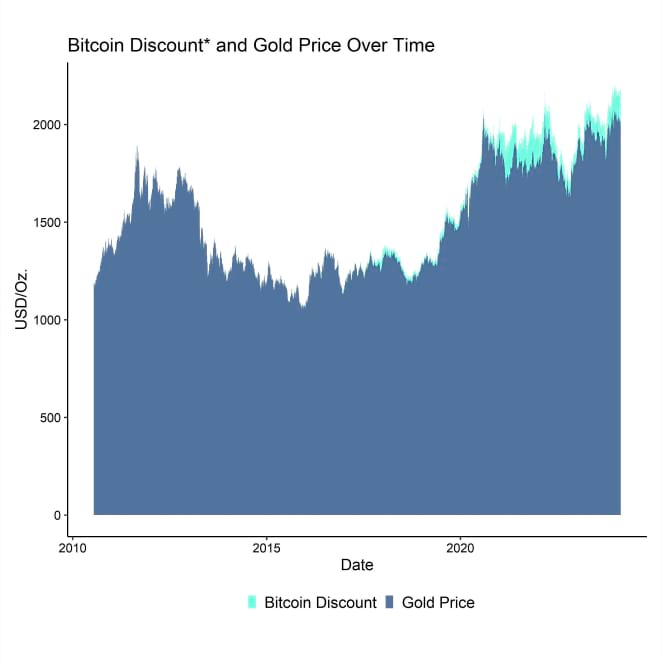

We estimate that if Bitcoin's current market cap would have been invested into gold instead of Bitcoin, gold's price would be around 150 USD higher (“Bitcoin Discount”).

*Bitcoin Discount is the hypothetical price BTCs market cap had been invested into gold instead of Bitcoin

This process is likely going to continue over the coming years as Bitcoin's scarcity relative to gold is going to widen substantially.

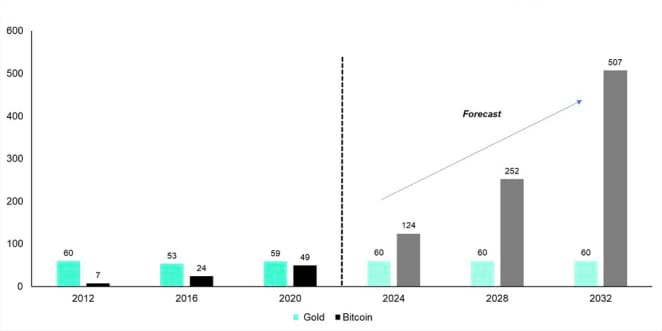

One of the concepts to measure scarcity in the commodity space is the stock-to-flow ratio which divides the current supply of a commodity by its annual production.

While Bitcoin's and gold's stock-to-flow ratio are currently almost identical, Bitcoin's stock-to-flow ratio is going to increase to around 124 with the upcoming Halving anticipated in April this year. The reason behind this is a -50% reduction in the production rate of bitcoins dictated by the algorithm which happens every ~4 years. The result is a doubling of the stock-to-flow ratio.

In other words, it will take 124 years of current production to replicate the current supply of bitcoins in circulation. Gold will likely remain at 60 years.

In April 2024, Bitcoin will become double as scarce as gold based on the stock-to-flow ratio.

However, the important takeaway is that Bitcoin's stock-to-flow ratio will continue to increase beyond this year and will likely be almost 10 times higher than gold's by the year 2032.

In fact, Bitcoin has many similarities to gold due to its proof-of-work mining algorithm that transfers physical electrical energy into the digital realm.

The absolute scarcity of Bitcoin (max 21 million coins supply) render Bitcoin even more scarce than gold. Moreover, the so-called “difficulty adjustment” render the supply growth of Bitcoin completely price inelastic unlike gold's supply growth.

As a result of this increasing scarcity, we also expect Bitcoin's character to change over time:

Bitcoin will likely become more like a safe-haven asset over the coming years and we expect the structural decline in volatility to continue as well.

Some investors may have already realized this and gold ETPs have already recorded -2.8 bn USD in net fund outflows year-to-date despite an anticipated Fed interest rate cutting cycle in 2024 while global Bitcoin ETPs have recorded around +4.8 bn USD in net fund inflows.

In theory, there is significant upside potential for Bitcoin to catch up to gold. Hypothetically speaking, if Bitcoin would reach gold's current market capitalization (~13 trn USD), this would imply a hypothetical price of around ~600k USD per 1 single Bitcoin.

But gold is likely not the only hard asset at risk of losing its monetary premium over time. Hard assets that usually serve another main purpose but have been used as investment substitute like real estate could also lose their monetary premium over time in favour of Bitcoin as a superior store-of-value.

This is even more likely considering the fact that hard assets like gold and (US) real estate are expected to deliver subpar long-term expected returns due to their high valuations. Many assets like gold are still suffering from the higher interest rate environment which increases downside risks for these interest-rate-sensitive assets even further.

More specifically, we expect both gold and US real estate to deliver negative returns on average over the coming 10 years while digital assets like Bitcoin or Ethereum are bound to deliver double-digit returns over the same time period (quantitative forecasts can be provided upon request).

The investment implication is that diversifying away from traditional hard assets like gold and real estate into Bitcoin could go a long way in mitigating the risk of technological disruption.

Bottom Line

- Gold ETPs have seen significant net outflows while global Bitcoin ETPs have seen significant net inflows in 2024

- We expect this trend to continue in the medium- to long term as Bitcoin will likely disrupt gold as the prime store-of-value

- Other hard assets are also at risk of losing their monetary premium in the long term in favour of Bitcoin

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.