- Cryptoassets are volatile but have also shown very high returns comparable to high-growth tech equities.

- The average volatility of Bitcoin has structurally declined with increasing scarcity and adoption and will most likely continue to do so.

- There is a strong case to be made that Bitcoin's exchange rate volatility is induced by wild fluctuations in fiat money supply growth rather than changes in Bitcoin's deterministic supply growth itself.

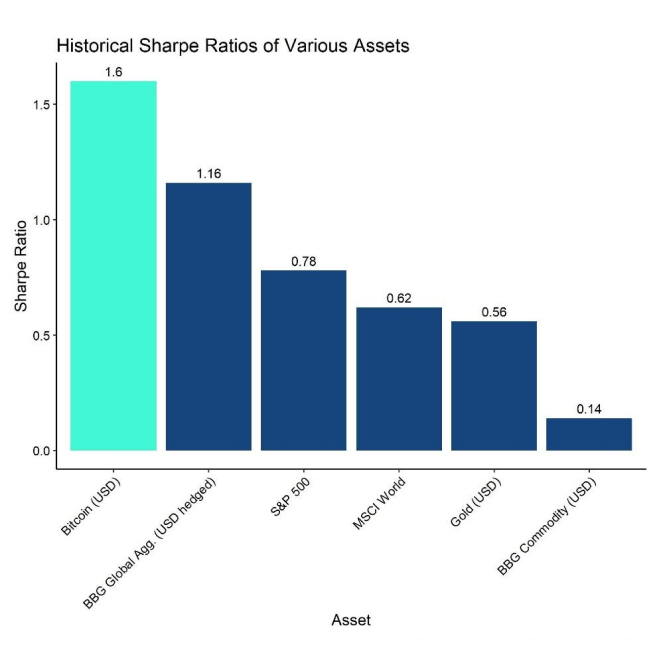

- Cryptoasset investors were more than compensated with higher returns for the additional volatility - Sharpe Ratios of major cryptoassets like Bitcoin are among the highest of any asset class.

Many traditional financial investors tend to shun cryptoassets because of the high volatility.

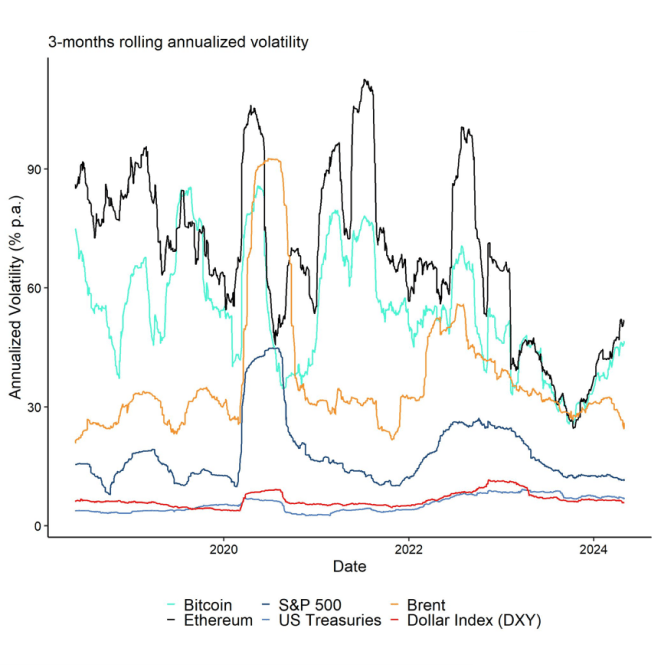

To be fair, the volatility of cryptoassets is relatively high compared to traditional asset classes such as equities, bonds, and most commodities.

Over the past 3 months, the annualised volatility of Bitcoin and Ethereum has been around 45% to 50%, respectively, while volatility of the S&P 500 was around 15%.

A recent global survey by Fidelity among institutional investors has also identified that high volatility is the number one most cited barrier that is keeping investors from allocating to cryptoassets.

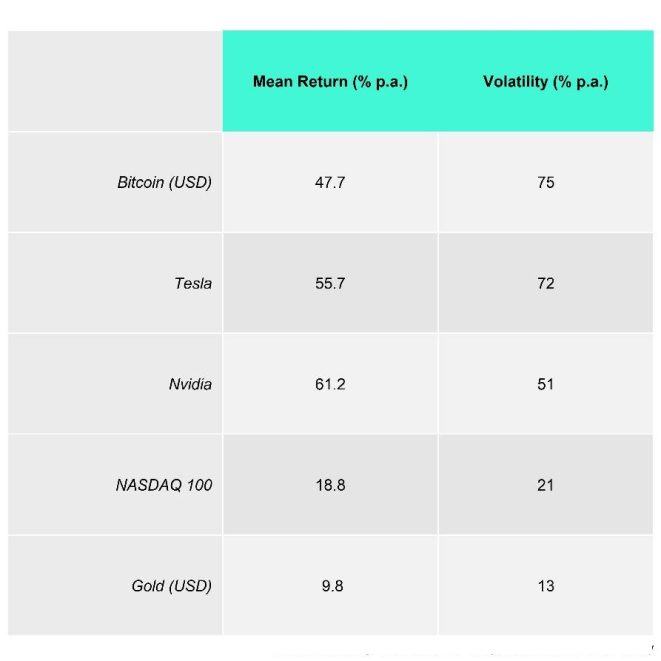

However, a general truth in finance is that high returns come with high risks, ie volatility.

Put differently,

Where there is growth, there is volatility.

In fact, most equity investors tend to know this as most of the high-growth mega cap stocks like Tesla still tend to have high double-digit volatility as there is still plenty of uncertainty surrounding the adoption of EVs as the dominant technology for vehicles but also high growth potential.

was around 15%.

Cryptoassets are still a young asset class. Bitcoin has just turned 15 years old and Ethereum has only been around since 2015.

Will tokenization of real-world assets (RWAs) take off and will Ethereum be the go-to platform?

Will Bitcoin replace the US Dollar as global reserve currency?

Although these types of scenarios have become increasingly likely over the past few years, there still remains uncertainty around these questions.

And uncertainty tends to create volatility.

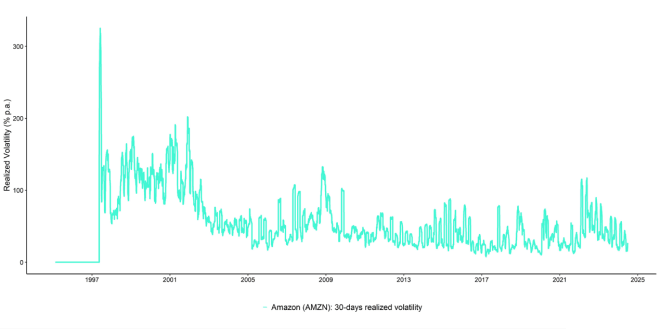

That being said, the history of Amazon holds important lessons in this regard.

In the late 1990s, the majority of Wall Street analysts thought that “selling books online” was a silly idea. There was lots of uncertainty about whether online retailing and the internet in general would eventually become mainstream.

Today, we know that online retailing has become the dominant type of retail business in the US and Amazon has become the dominant platform for this.

In the same way, the uncertainty around the technology has declined and also the volatility in Amazon’s stock price has declined over time.

Few investors seem to remember that Amazon’s stock used to record above 300% in annualized volatility in the late 1990s whereas today, the volatility is well below 50%.

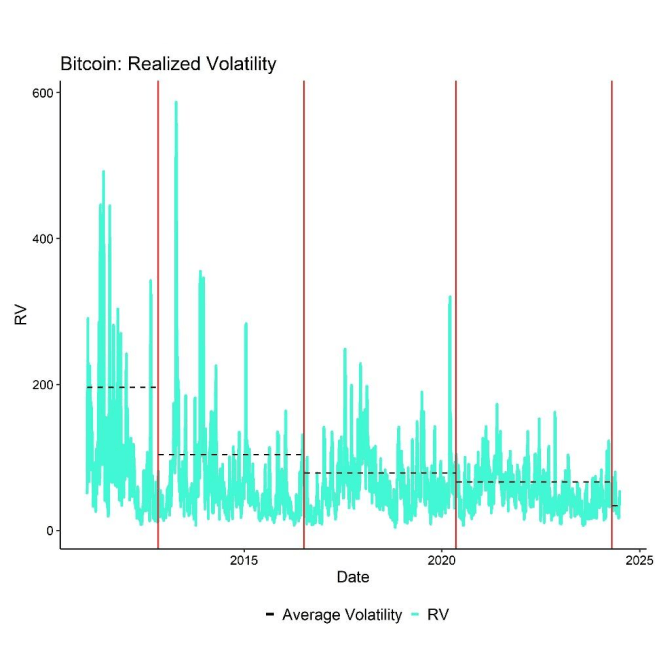

In fact, we have already observed a similar structural decline in volatility in the case of cryptoassets.

For instance, while Bitcoin’s volatility was around 200% annualized during the 1st epoch until 2012, it has decreased to only 45% p.a. more recently. Similar observations can be made regarding Ethereum.

One of the reasons is that Bitcoin’s scarcity has increased with every Halving that has made Bitcoin more “gold-like”. Halvings are best understood as a supply shock that reduce the supply growth of bitcoins by half (-50%). Hence, the character of Bitcoin as an asset class has changed over time.

The latest Halving led to a reduction in Bitcoin’s supply growth to ~0.8% p.a. - double as low as gold’s supply growth of roughly ~1.5% p.a.

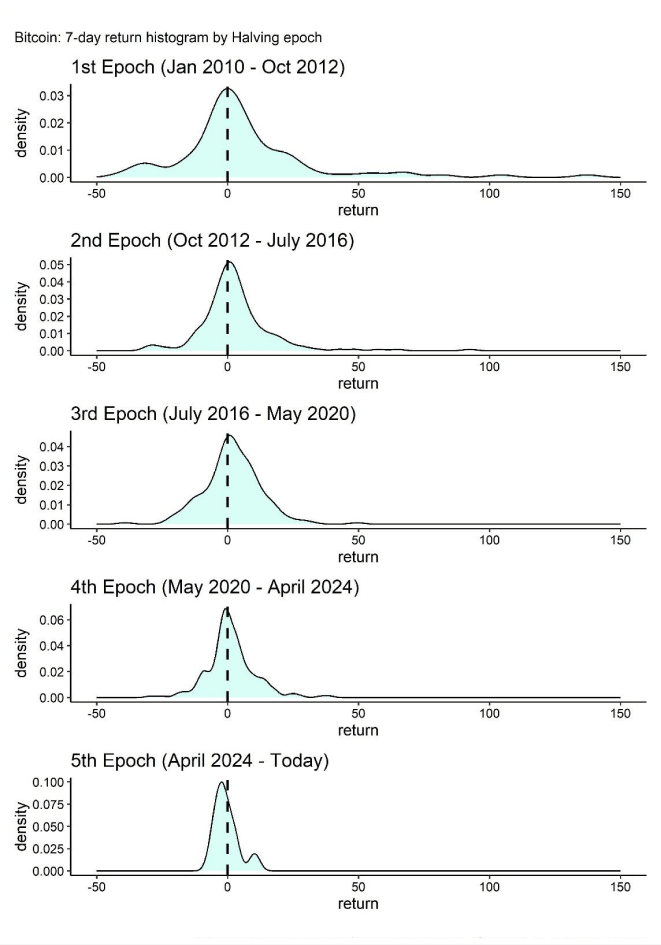

In fact, the average volatility of Bitcoin has structurally declined in each new Halving epoch.

What is more is that the long tails of the return distribution, i.e. the extreme performances to the up- and downside, have also occurred less frequently with every Halving. This can also be seen in the following chart:

Nonetheless, Bitcoin’s return distribution remains highly skewed to the upside which is why a recent scientific paper authored by BlackRock employees has concluded that an almost 85% allocation to Bitcoin could be optimal under certain assumptions.

High return skewness essentially means that positive returns are more likely than negative ones.

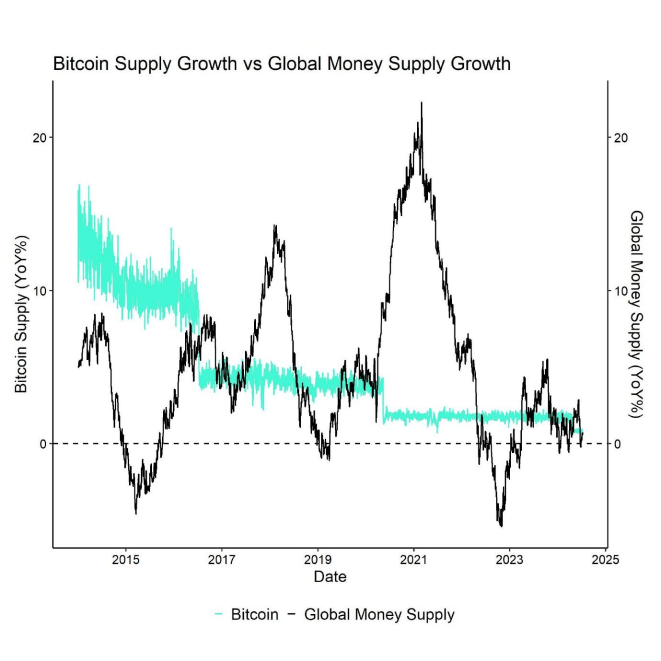

What is often overlooked with respect to Bitcoin is that its own supply has grown very predictably in the past in contrast to global fiat money supply growth. In fact, Bitcoin’s supply growth volatility has essentially been close to 0% with only occasional jumps at every halving.

By contrast, global money growth has been rather wildly fluctuating with the vagaries of central bank monetary policy and the global business cycle.

So, there is a strong case to be made that Bitcoin’s exchange rate volatility is induced by wild fluctuations in fiat money supply growth rather than changes in Bitcoin’s supply growth itself.

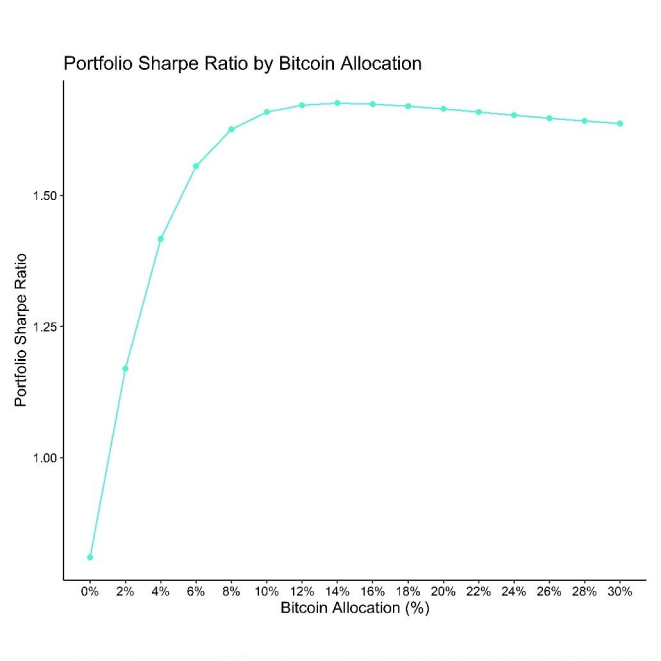

Moreover, there are plenty of studies including by us for instance here, here, and here that demonstrate how only a marginal increase in portfolio allocation to cryptoassets can significantly enhance absolute and risk-adjusted portfolio returns with only a minor increase in portfolio volatility and max drawdowns.

More specifically, in a global 60/40 stock-bond portfolio, the maximum Sharpe Ratio is achieved by increasing the Bitcoin allocation to around 14% at the expense of the global equity weighting.

So, again here, multi-asset portfolio investors are more than compensated for the higher volatility.

One of the reasons is that the Sharpe Ratio of major cryptoassets like Bitcoin itself is significantly above 1 which means that investors get more than compensated for exposing themselves to higher volatility. They get a higher return per unit of risk.

Investors tend to focus on the denominator of this ratio (volatility) while the numerator (returns) is often overlooked.

Looking ahead, the decline in volatility is bound to continue with every new Halving. The next one is scheduled to happen in 2028 which will render Bitcoin 4 times as scarce as gold from a supply growth perspective.

Moreover, increasing retail and institutional adoption of this technology is also bound to decrease volatility structurally over time.

The reason is that increasing heterogeneity among investors will lead to more dissent between buyers and sellers which dampens volatility - the essence of the Fractal Market Hypothesis (FMH) put forth by Edgar Peters.

Investors essentially pay a price for waiting for lower volatility which is foregone returns in the future.

Just remember: Where there is growth, there is volatility.

Note: A similar article was originally published in Coindesk’s “Crypto for Advisors” edition.

Bottom Line

- Cryptoassets are volatile but have also shown very high returns comparable to high-growth tech equities.

- The average volatility of Bitcoin has structurally declined with increasing scarcity and adoption and will most likely continue to do so.

- There is a strong case to be made that Bitcoin's exchange rate volatility is induced by wild fluctuations in fiat money supply growth rather than changes in Bitcoin's deterministic supply growth itself.

- Cryptoasset investors were more than compensated with higher returns for the additional volatility - Sharpe Ratios of major cryptoassets like Bitcoin are among the highest of any asset class.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.