Jack Dorsey drops Twitter for Square and Bitcoin

Twitter co-founder Jack Dorsey has officially stepped down as the social media giant’s CEO.

Not earth-shattering news, you might think. But the implication is that Dorsey is dropping out to focus on Bitcoin.

The self-taught programmer turned billionaire influencer had to face an acrimonious grilling from the US Senate Judiciary Committee last November to counter accusations of anti-conservative bias and censorship around the 2020 US General Election. It might all have become too much for the man who appeared via video link for a Congressional hearing sporting a hermit-like beard with a blockclock displaying Bitcoin prices over his right shoulder.

Dorsey is famously a cryptocurrency evangelist. His payments company Square invested $50m in bitcoin in October 2020 and followed up with a further $170m in February 2021. The company now holds 5% of its cash reverses in the cryptocurrency. In recent months Dorsey has put forward proposals for Square to run both a bitcoin mining system and a decentralised exchange. The company launched a Bitcoin Clean Energy Investment initiative in April this year, committing $10m to fund companies that drive higher use of renewable energy in the Bitcoin system.

The list goes on. In February this year, he set up a bitcoin node, which means that he personally helps to verify transactions on the Bitcoin blockchain. His Twitter profile reads simply “‘#bitcoin”. And as part of the development of Square, Dorsey set up an independent research team to improve Bitcoin’s open source software. Square Crypto supports and funds independent Bitcoin developers including Gloria Zhao, Vasil Dimo and John Atack, while Matt Carlo is a permanent member of Square Crypto.

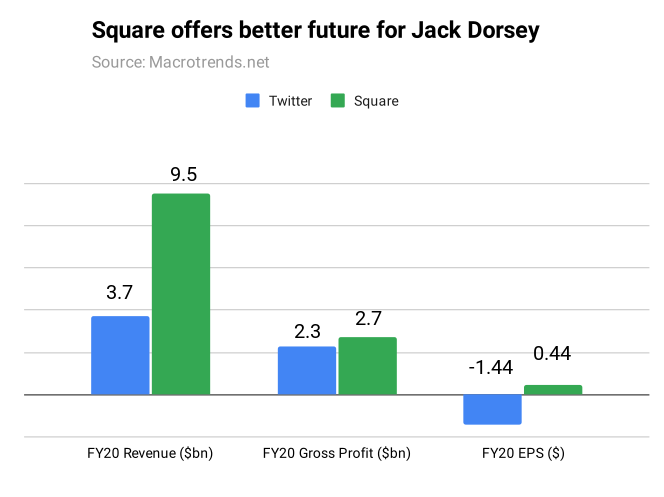

The other point to weigh is that Square is simply more profitable and is growing faster than Twitter. It may just offer Dorsey the chance to work on projects he personally finds more interesting for the next couple of decades.

As one Quartz reporter suggested in a recent reaction piece:

While Twitter’s financial success is mostly limited to its ability to sell digital advertising, a market dominated by Google and Facebook, Square has a grip on the entire consumer payment system. Square is enmeshed with brick-and-mortar sales, e-commerce, peer-to-peer, and increasingly the crypto market. While Twitter is building new revenue streams, particularly through its subscription offering, Square simply has more chips on a table with generally lower risk and better returns. Scott Nover, ‘Why Jack Dorsey chose Square over Twitter’, 29 November 2021

According to the two companies’ financial results (available here and here), between Q4 2020 and Q3 2021, Square pulled in $16.4bn in revenue, compared to Twitter’s $4.8bn over the same period. Net income reported over the four quarters stands at minus $217m for Twitter, but $537m for Square.

Additionally, we heard this week that long-time bitcoin investor and its largest publicly-listed corporate owner Microstrategy, bought another $414m of the cryptocurrency in the recent price dip.

MicroStrategy has purchased an additional 7,002 bitcoins for ~$414.4 million in cash at an average price of ~$59,187 per #bitcoin. As of 11/29/21 we #hodl ~121,044 bitcoins acquired for ~$3.57 billion at an average price of ~$29,534 per bitcoin. $MSTRhttps://t.co/OA8VWG1bZX

— Michael Saylor⚡️ (@saylor) November 29, 2021

Bloomberg reports that the business intelligence software firm’s 121,044 BTC stake has doubled in value to $7bn since the company started buying in August 2020. In that time, Microstrategy’s share price has jumped from $144 to $693, while the price of bitcoin has increased from around $9,000 to $58,000.

European crypto regulation steps ahead of US with PISA, MiCA and DORA

The European Council has officially decided to move forward with two landmark pieces of crypoasset regulation, it said in a 24 November press release.

Between the MiCA and the DORA, the EU is hoping to establish a definitive and clear regulatory framework for businesses operating in the bloc’s burgeoning cryptoasset sector.

DORA, or the Digital Operational Resilience Act, focuses on making sure businesses can withstand cybersecurity threats, while MiCA (Regulation in Markets on Crypto Assets) is a package of cross-border regulations which offers 28 definitions for key terms, including “cryptoassets”, “distributed ledger technology” “utility tokens” and “crypto-asset service providers” (CASPs). As EU regulation, MiCA will supersede any rules imposed by the EU’s 27 member states, in favour of one set of shared regulatory boundaries.

The draft text for MiCA was released in September 2020 with the intention of closing regulatory gaps and bringing all cryptoassets inside a single framework. Many cryptoassets fall outside the scope of existing financial regulations, including MiFID II and the EMD2.

Digital finance is an increasingly important part of Europe’s economic landscape. It is essential to create a stimulating environment for innovative businesses while mitigating the risks for investors and consumers...Both files are a priority for the Presidency and we now hope for a quick agreement with the European Parliament on these proposals. Andrej Šircelj, Minister of Finance for Slovenia

In related news, on 22 November the European Central Bank approved a new oversight framework for electronic payments (PISA), which includes merchant acceptance of stablecoins and other cryptoassets within card payment schemes, and the option to send, receive or pay with cryptoassets through digital wallets.

The central bank proposed the PISA framework back in October 2020 and plans to use it to oversee companies in the digital wallet space, focusing on market verticals including e-money transfers and digital payment tokens.

The announcement could not have come soon enough. Traditional payments giants including Mastercard is ramping up its development and release of stablecoin-linked debit and credit cards, while Visa debit cards added the ability to accept payments directly in the USDC stablecoin in March this year.

Companies that already fall under the Euro-area regulations will have to comply with the new rules by 15 November 2022, the ECB said.

We are starting to see some impressively joined-up thinking from the Europeans on crypto policy. As part of the ECB release, the bank said the policy was released with new EU regulations on stablecoins and cryptoassets in mind.

US falling behind?

Over in the US, the results of a six-month-long joint crypto policy ‘sprint’ between three regulators: the Federal Reserve; the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC), failed to impress to the same degree.

It was announced back in May that staffers at the organisations were investigating the legality of banks engaging in:

- Crypto safekeeping and custody

- Loans collateralised by cryptoassets

- Holding crypto on their balance sheets

- Allowing customers to buy and sell crypto

- Issuing/distribution of stablecoins

Cynics might allege that this ‘sprint’ was more akin to a slow walk, as a 23 November statement yielded little concrete detail apart from saying that the three teams had assembled a crypto asset roadmap to provide greater clarity to banks in 2022 on how permissible certain activities are.

US retail banks are designing and building products around cryptoassets to grab a slice of the market, but from a risk-management perspective feel they must wait for clarity from regulators like the OCC before they are capable of launching such products.

And according to some prominent venture capitalists, while retail banks constantly monitor asset transfers compared to their competitors, they are failing to consider crypto companies as serious rivals. Matt Walsh, founder of Castle Island Ventures and a former VP at Fidelity Investments, spoke to this point in a recent episode of the ‘On the Brink’ podcast.

If you’re Bank of America right now, your competition is actually Coinbase and BlockFi and MetaMask, and all these things that are actually capturing people’s wallet share. It’s not necessarily [JP Morgan] Chase. Matt Walsh, On The Brink, 26 November 2021

Markets

BTC/USD

Across the two-week trading period much was made of bitcoin losing support above $60,000, and indeed the 25 November crater from around $59,000 to $53,800 represented a low not seen since 7 October. However, despite spending a 48-hour period in the doldrums, this offered a buying opportunity for those left out of the cryptocurrency’s recent meteoric rise. BTC climbed a total of 7.3% from this point to close out at $57,202.50.

ETH/USD

Ether fared a lot better than bitcoin across the fortnight, as capital flowed down the list of cryptoassets by market cap, and the continued rise of DeFi and NFTs helped enforce ETH as an increasingly dominant player in the market. The smart contract blockchain shrugged off the same 25 November slip that hit its peers, and despite a stumble down to an intraday low of $3,914.79, managed to repair those gains with a 21.5% rise, climbing as high as $4,756.98. When all was said and done, ETH added a minor 1.6% across the two weeks, but at these levels, remains in striking distance of the ~$4,900 all-time high it achieved on 10 November.

LTC/USD

Litecoin has had a tumultuous couple of weeks, largely aping the price of bitcoin as it tumbled a total of 28.2% from $253.28 to a 28 November low point at $181.97. Recapturing the $200 mark as the fortnight came to a close was one of the only positives for bulls to cling to, as adoption news has fallen a little quiet since the euphoria of July’s Newegg e-commerce announcement.

BCH/USD

Bitcoin Cash is trading at around 65% off its year-to-date highs of $1642 reached in May, and the past two weeks have been slow grind for bullish buyers. However, overall sentiment appears positive, with BCH regaining much of its losses against the dollar in line with the wider market. A 25 November rally up to $641 failed to translate into continued gains, and BCH lost a total of 18% across the fortnight.

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.