The situation in Kazakhstan is terrible for its people and we hope everyone there is staying safe.

On a financial level we think what we saw with the Bitcoin price dipping ~7% overnight is a simple supply and demand story. It’s likely we saw Kazakhstani cryptocurrency miners looking to flee the country and liquidating Bitcoin they had already mined, in order to finance that move. With a greater supply of Bitcoin hitting the market, the price fell.

Kassym-Jomart Tokayev, the president of Kazakhstan, upended Bitcoin miners’ businesses on Wednesday 5 January when he ordered the country’s largest telecom provider Kazakhtelecom to pull the plug on the nation’s internet.

The largest global Bitcoin mining pools such as AntPool and F2Pool showed an almost immediate dip.

Normally we know that quite a lot of Bitcoin supply is stored up in HODLers’ wallets and in very popular exchange traded products like our Bitcoin ETP (BTCE), and therefore isn’t available to the general market. As Brian Brooks, former acting head of the US federal banking regulator, told the House Financial Services Committee last month, something like 80% of Bitcoin holders have never sold any at all. So when there’s a sudden increase in supply it naturally depresses the price.

There is also a lot of speculative leverage in the riskier portions of the crypto daytrading market.

With supply hitting the market and the price falling suddenly, we saw a cascade of highly leveraged long positions being liquidated — and the subsequent margin calls — and more liquidations. ETPs like ours aren’t leveraged to the hilt, or leveraged at all, they are physically-backed 1:1 and so just track the price of Bitcoin and other cryptoassets very accurately, so they aren’t subject to these same kinds of risks.

More than 225,000 traders had nearly $1bn of leveraged long positions liquidated in the following 24 hours, according to Coinglass.

How do we know Kazakhstani miners dumped BTC supply onto the market? Well, it happened before, in China.

With the Kazakhstan government turning off the internet, it was widely reported that cryptominers along with everyone else were unable to get online.

As of last week, Kazakhstan accounted for around a fifth (18.1%) of the Bitcoin hashrate, that’s the amount of computing power globally that is dedicated to mining Bitcoin, verifying transactions and creating new bitcoins. These are figures from the pre-eminent researchers in the space, the Cambridge Centre for Alternative Finance.

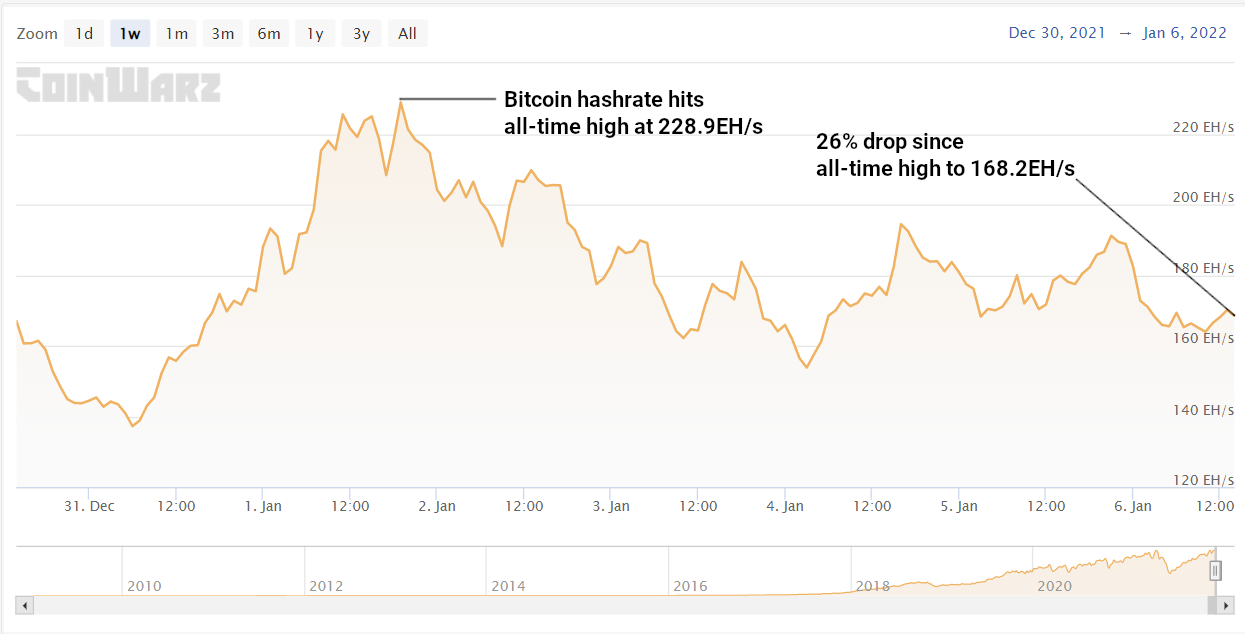

We’re starting to see this situation represented in the Bitcoin hashrate, which has fallen 26% from its all time high of 228 EH/s to 168 EH/s in the last few days.

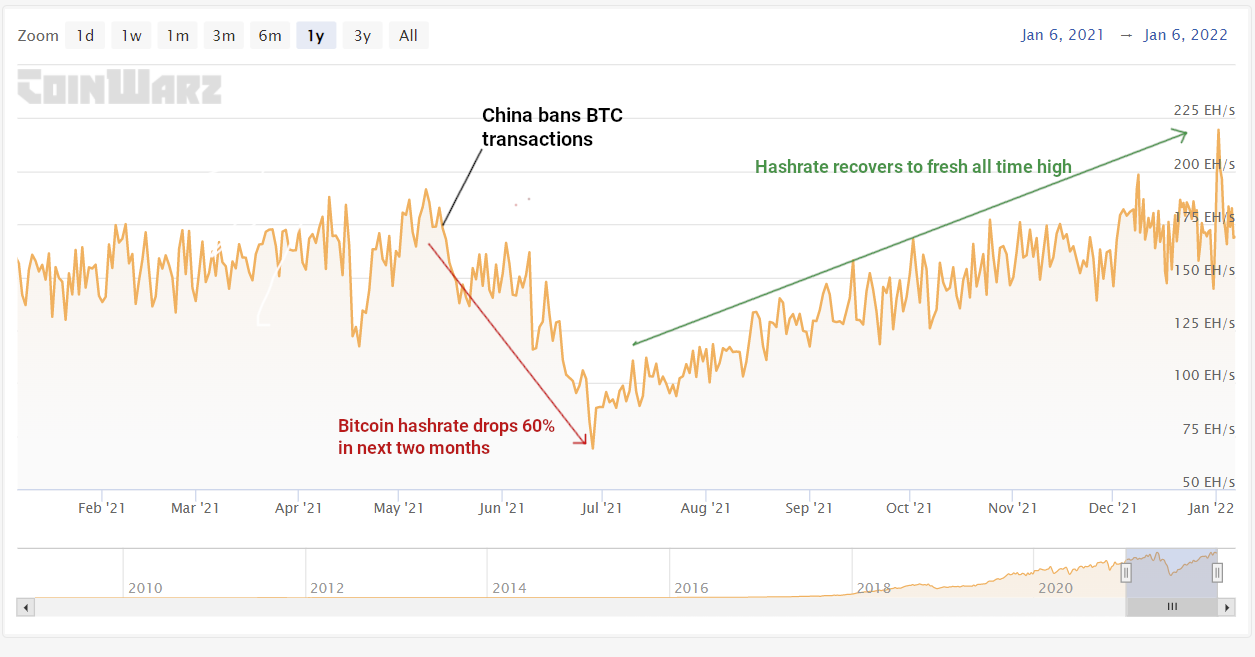

The same thing happened in China in May 2021, when the government started to turn off the power to crypto miners in large centres like Inner Mongolia.

At the time, the region, known for its cheap power, accounted for around 8% of global hashrate. In March 2021 the region’s provincial government cracked down on Bitcoin mining, giving businesses a two-month window to get out. The Chinese government then banned Bitcoin transactions altogether, and by July the Bitcoin hashrate had dropped 60%.

A glut of Bitcoin hit the market, a lot of it likely coming from Chinese miners looking to liquidate their holdings, and the price of 1 BTC cratered from $58,800 on 8 May to $29,700 by mid-July.

Hashrate had recovered to fresh all time highs as recently as 1 January 2022.

Bitcoin miners forced out of China had originally chosen Kazakhstan for its cheap energy prices: around $0.05Kw/h compared to jurisdictions like the US which charge in the region of $0.12Kw/h. Hong Kong-based BIT Mining sent thousands of ASIC mining machines to the state in June last year, alongside Beijing’s Canaan.

With miners operating in Kazakhstan controlling such a large proportion of the Bitcoin hashrate they now face the same kinds of decisions as those businesses in Inner Mongolia, although circumstances demand a less orderly exit and much accelerated time-frame.

Again, this story is one of simple supply and demand.

The price action this time round may be much different: yes, there is a glut of bitcoin on the market but we are seeing some seller exhaustion in the $42k region and there is likely to be a relief rally that we are watching out for. If I’m an institutional investor, I’m finding it hard to see a 2x or 3x from Bitcoin from $69k when it’s already up 5x from January to November 2021. That calculation is a lot easier now at $42k.

We’re looking to US crypto miners like Riot Blockchain to win in the short term from picking up the slack in Bitcoin hashrate from Kazakhstan-based mining operators (like Canaan) going offline, and the time necessary in moving their operations overseas. And easy-access ETFs, like our Digital Assets and Blockchain Equity ETF (KOIN) that hold a good cross section of US crypto miners will likely be the immediate beneficiaries.

Copyright © 2024 ETC Group. All rights reserved

AVVISO IMPORTANTE:

Questo articolo non costituisce consulenza finanziaria, né rappresenta un'offerta o un invito all'acquisto di prodotti finanziari. Questo articolo è solo a scopo informativo generale, e non vi è alcuna assicurazione o garanzia esplicita o implicita sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si consiglia di non fare affidamento sulla correttezza, accuratezza, completezza o correttezza di questo articolo o delle opinioni in esso contenute. Si prega di notare che questo articolo non costituisce né consulenza finanziaria né un'offerta o un invito all'acquisizione di prodotti finanziari o criptovalute.

PRIMA DI INVESTIRE IN CRYPTO ETP, GLI INVESTITORI POTENZIALI DOVREBBERO CONSIDERARE QUANTO SEGUE:

Gli investitori potenziali dovrebbero cercare consulenza indipendente e prendere in considerazione le informazioni rilevanti contenute nel prospetto base e nelle condizioni finali degli ETP, in particolare i fattori di rischio menzionati in essi. Il capitale investito è a rischio, e le perdite fino all'importo investito sono possibili. Il prodotto è soggetto a un rischio controparte intrinseco nei confronti dell'emittente degli ETP e può subire perdite fino a una perdita totale se l'emittente non adempie ai suoi obblighi contrattuali. La struttura legale degli ETP è equivalente a quella di un titolo di debito. Gli ETP sono trattati come altri strumenti finanziari.

Informazioni su ETC Group

L'ETC Group è nata da una chiara missione: fornire agli investitori l'accesso al vasto potenziale di crescita nell'ambito delle criptovalute e degli asset digitali. Il nostro track record comprovato ci rende un partner affidabile: in oltre tre anni di successi, abbiamo consolidato la nostra posizione come emittenti di cripto-titoli con sede in Germania e siamo diventati un punto di riferimento europeo per soluzioni d'investimento in questo dinamico settore.

Con un solido track record di oltre tre anni, crediamo che sfruttando l'esperienza e le conoscenze del settore finanziario tradizionale e applicandole a questa nuova ed entusiasmante classe di asset, possiamo portare sul mercato prodotti d'investimento di prim'ordine.

Nel giugno del 2020, ETC Group ha lanciato il primo ETP su Bitcoin con compensazione centralizzata al mondo, quotato su Deutsche Börse XETRA, la più grande borsa di ETF in Europa. Da allora, la società è stata un pioniere dei prodotti negoziati in borsa basati sulle valute digitali con numerose idee di prodotto innovative. ETC Group è costantemente impegnata ad ampliare la propria gamma di ETP di qualità istituzionale sulle criptovalute, offrendo agli investitori la possibilità di investire in Bitcoin, Ethereum, Cardano, Solana e altri asset digitali popolari sulle principali borse europee.