ETC Group Crypto Minutes Week #15

BTC, ETH post new All Time Highs, Litecoin Q1 metrics demonstrate rapid underlying growth

BTC, ETH post new All Time Highs, Litecoin Q1 metrics demonstrate rapid underlying growth

It has been a little while coming, but the world’s largest cryptoasset, Bitcoin, has breached its all-time high this week, touching $63,285 in mid-morning trading on Tuesday 13 April. Record prices in cryptocurrency markets show no sign of slowing down, even as more retail and institutional investors make aggressive moves to expand their exposure. The wider markets are holding steady and now boast a total market cap of more than $2.1 trillion. That historic measurement now appears to be the floor for the cryptoasset market and not the ceiling.

All the excitement around BTC has seemed to divert attention away from ETH, which also breached its all time high on several occasions throughout the week. Ethereum set a new record price of $2,234 on Tuesday 13 April. This has happened just weeks after the Deutsche Börse XETRA announced the debut of its first 100 % physically-backed and central counterparty-cleared Ethereum ETP, ZETH.

On the fundamental side, the Ethereum network’s latest upgrade, dubbed ‘Berlin’, is due to come into force at block 12,244,000. The current block, at time of writing, is 12,239,760 and according to this Etherscan countdown timer, the update is scheduled for around 10am (UTC+1) on Thursday 15 April. This is the latest step on the road to ETH 2.0, which will eventually switch Ethereum away from a Proof of Work consensus model to Proof of Stake.t was founded in 1970.

Included in the ‘Berlin’ upgrade are four Ethereum improvements, including enabling easier support for multiple transaction types and moves to reduce transaction costs. Ethereum holders, or those invested in tracking the price through a cryptocurrency ETP, do not need to do anything as the upgrade will automatically deploy across the network at the scheduled point.

Markets have been boosted by excitement around the direct listing on NASDAQ of Coinbase, which itself posted a set of monster Q1 results on Tuesday 6 April. The stock market debut of the San Francisco cryptoexchange would have been impossible to foresee just a couple of years ago, but now is just another historic point on the timeline of the intersection between crypto finance and traditional finance.

Q1 2021 results posted on Tuesday 6 April delineated the rate of Coinbase’s stunning growth in this bullish market, as it announced 56 million verified users, a total trading volume of $335bn, revenue up nine-fold from the previous quarter at $1.8bn, with estimated net income of between $730m and $800m for the three months ending 31 March 2021. Results from the single quarter represent double what it earned across the whole of 2020.

We expect meaningful growth in 2021 driven by transaction and custody revenue given the increased institutional interest in the crypto asset class. Brian Armstrong, Coinbase CEO

Early price predictions by analysts suggest Coinbase could arrive with a 12-figure dollar valuation. Bloomberg reported that in a 9 March private auction on the NASDAQ Private Market, COIN traded at $350 per share, lending the company a $90bn valuation, while Gil Luria for investment bank DA Davidson this week raised his price target by 125% from $195 to $440, with the adjustment based on a 20x multiple from this year’s expected revenue. There is no question that Coinbase is “highly correlated” to the price of BTC, Luria wrote in a client note, adding that the platform’s “best in class compliance and regulatory controls should provide a defensible moat,” for investors to cling to.

Fellow Silicon Valley exchange Kraken, too, has said it is investigating a possible public listing. The fourth-largest cryptoexchange by trading volume has around 6 million users and in September 2020 became the first crypto service company to receive a banking license via the State of Wyoming’s Special Purpose Depositary Institution statute.

Kraken could go public sometime in 2022, buoyed by sign-ups four times higher in Q1 2021 than across the second half of 2020, it told CNBC.

The first quarter just completely blew away the entirety of last year. We beat last year’s numbers by the end of February. The whole market has really just exploded. Jesse Powell, Kraken CEO

It is becoming increasingly likely that investors will be asked: ‘Where were you?’ when cryptocurrency vehicles finally broke into mainstream stock markets in the early 2020s.

“2021 will be a crucial time as Litecoin and the community prepare for the most significant update since SegWit,” wrote lead developer Deni Aldo in the Litecoin Foundation’s Q1 report. SegWit, incidentally, increased block size limits by removing signature data from transactions, improving blockchain confirmations.

The latest innovation is the MWEB upgrade, which is now code complete and in developer review. This seeks to aggregate the inputs and outputs of all recorded transactions to further reduce block sizes and speed up the network.

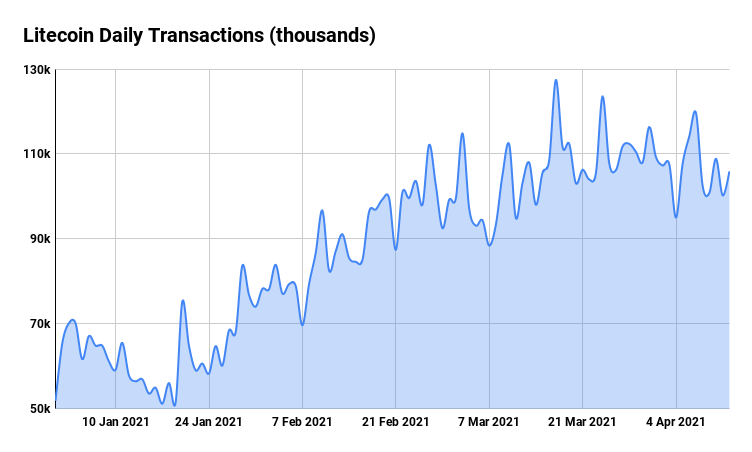

Litecoin’s wider network metrics continue to impress as the blockchain hit a milestone in Q1 2021 of 2 million mined blocks while also supporting a large and growing increase in daily transactions. These have approximately doubled in the last three months. The bombshell addition of Paypal merchant support for LTC has aided this trend.

Litecoin will be heading into its 10th anniversary later this year with fully uninterrupted network service, maintaining 100% uptime since inception. This is an accomplishment that contributes to Litecoin’s reputation as a reliable cryptocurrency with long-term consistency and functionality. Litecoin Foundation, Q1 report

Lobbying in the cryptocurrency industry has long had to lean on blockchain natives and internal advocates for strength. But there are new crypto superpowers growing and it makes sense that the world’s largest asset managers want to protect the vast fortunes they have won to date by influencing governmental and regulatory policy. So it was interesting to see that Fidelity, Coinbase and Square have joined forces to form The Crypto Council for Innovation, to be a more powerful voice to aid regulators worldwide.

Jack Dorsey’s Square added $170m in Bitcoin to its balance sheet in Q1 2021, a more than three-fold rise from the $50m investment it made in Q4 2020, while Fidelity has offered Bitcoin exposure to high net-worth investors through its Wise Origin Bitcoin Index Fund since August 2020.

While Coinbase has been part of a lobbying body before, it is pulling away from its crypto-only rivals with these mainstream industry ties. It was a founder member of the (now mostly-defunct) Crypto Rating Council, which it formed with Gemini, Anchorage and eToro, among others, in order to research and disseminate information to US market regulators with an insight into which cryptoassets could fall under existing US securities laws.

Crypto hedge fund Paradigm, which has $1.1bn AUM, is also a founding member.

First reported in the Wall Street Journal, it appears the outlook of the lobbying group is broadly global, rather than being domestically-focused.

Crypto is at a mainstream inflection point. It is in its very early stages and much like the internet [once was], it’s very fragile at that stage. Fred Erhsam, Paradigm and Coinbase co-founder

This week BTC made a play for its previous $61,291 all time high set in mid-March 2021 and breached that barrier, with the price rallying 13.3% from a low of $55,368 to $63,285. Now all eyes are on the next round-number to fall: $70,000.

ETH has lived in the shadow of BTC ever since its 2015 launch. And while, for now, it remains ‘always the bridesmaid and never the bride’ in terms of market cap, the cryptoasset has seen a strong week. The growth of DeFi markets above $50bn and continued interest in NFTs — both of which are almost entirely built on Ethereum — has encouraged prices higher. Rebounding 15.9% from a weekly intraday low of $1,927.16, Ethereum set a new record price of $2,234.41 on Tuesday 13 April.

Litecoin markets too enjoyed a positive week, with the ninth-largest cryptoasset by market cap seeking an upwards move to match its own all time high of $344.86 set in the midst of the last major crypto bull market in December 2017. From a low of $211.22 the week’s peak price of $269.49 is a three-year high, and falls just 22.62% short of the LTC all time high. It is worth recalling that since LTC was created in 2011 it has never fallen out of the top 10 cryptoassets by market cap, an incredible staying power that remains to this day.

BTC/USD

ETH/USD

LTC/USD

Copyright © 2024 ETC Group. All rights reserved

AVIS IMPORTANT :

Cet article ne constitue ni un conseil en investissement ni une offre ou une sollicitation d'achat de produits financiers. Cet article est uniquement à des fins d'information générale, et il n'y a aucune assurance ou garantie explicite ou implicite quant à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Il est recommandé de ne pas se fier à l'équité, l'exactitude, l'exhaustivité ou la justesse de cet article ou des opinions qui y sont contenues. Veuillez noter que cet article n'est ni un conseil en investissement ni une offre ou une sollicitation d'acquérir des produits financiers ou des cryptomonnaies.

AVANT D'INVESTIR DANS LES CRYPTO ETP, LES INVESTISSEURS POTENTIELS DEVRAIENT PRENDRE EN COMPTE CE QUI SUIT :

Les investisseurs potentiels devraient rechercher des conseils indépendants et prendre en compte les informations pertinentes contenues dans le prospectus de base et les conditions finales des ETP, en particulier les facteurs de risque mentionnés dans ceux-ci. Le capital investi est à risque, et des pertes jusqu'à concurrence du montant investi sont possibles. Le produit est soumis à un risque intrinsèque de contrepartie à l'égard de l'émetteur des ETP et peut subir des pertes jusqu'à une perte totale si l'émetteur ne respecte pas ses obligations contractuelles. La structure juridique des ETP est équivalente à celle d'une dette. Les ETP sont traités comme d'autres instruments financiers.

ETC Group développe des instruments financiers innovants adossés à des actifs numériques, notamment l'ETC Group Physical Bitcoin (BTCE) et l'ETC Group Physical Ethereum (ZETH), qui sont cotés sur des échanges européens, comme le XETRA, Euronext, SIX, AQUIS UK et Wiener Börse.

ETC Group a lancé le premier produit négocié en bourse (exchange traded product- ETP) Bitcoin à compensation centralisée au monde en juin 2020 sur la Deutsche Börse XETRA, la plus grande plateforme de cotation d'ETF d'Europe.

ETC Group travaille en permanence à l'élargissement de sa gamme d'ETPs garantis par des crypto-monnaies, de qualité institutionnelle, offrant aux investisseurs la possibilité de s'exposer au Bitcoin, à l'Ethereum, au Cardano, au Solana et à d'autres actifs numériques populaires sur les principales bourses européennes.