ETC Group Crypto Minutes Week #14

The total cryptocurrency market cap breached $2 trillion on Monday 5 April

The total cryptocurrency market cap breached $2 trillion on Monday 5 April

The total cryptocurrency market cap breached $2 trillion on Monday 5 April as soaring gains across the sector brought fresh waves of investment from both institutional and retail figures. It should come as no surprise, really, given that across Q1 2021 bitcoin (BTC) has returned 103%, ether (ETH) has added 160% while and the S&P 500 (SPX) total return was 6.2%, according to figures provided by Wave Financial.

A 1 April report by JP Morgan, covered by Bloomberg , noted that Bitcoin’s declining volatility is setting the stage for more institutional investors to add the cryptoasset to their portfolios.

Three-month realized volatility...has fallen to 86% after rising above 90% in February [and] as volatility subsides, a greater number of institutions could warm to the crypto space, Report

Volatility is a key consideration for risk management, as the higher this metric reaches, the more risk capital it consumes, JP Morgan’s analysts noted. They conclude:

In our opinion, a potential normalization of Bitcoin volatility from here would likely help to reinvigorate the institutional interest going forward.

A slew of regulatory filings to the SEC over the past week have revealed some very interesting tidbits of information.

Firstly, Morgan Stanley said that a dozen of its institutional funds, including Counterpoint Global, would gain access to bitcoin exposure. The details provided by the investment bank show that up to 25% of the 12 fund’s assets could be placed in bitcoin products.

Secondly, Coinbase and Bakkt were the functionaries for hedge fund magnate Paul Tudor Jones’ bets on Bitcoin last year.

Industry news website Coindesk told how Jones’ $44.5bn Tudor Investment Corporation fund secured custodial ties with the San Francisco cryptoexchange and the Intercontinental Exchange-owned Bakkt when making his approximately $445m long bitcoin bids.

The filings provide a rare glimpse into the hush-hush world of institutional crypto dealmaking, where well-heeled clients pile into an asset class [that] bankers once deemed absurd. Many, like Tudor Jones, see bitcoin as an inflation hedge, and their ranks are swelling, Danny Nelson

Another SEC filing SEC filing from Wednesday 31 March that has wide-reaching implications revealed exactly how that the world’s largest asset manager, BlackRock, had made its pivot into cryptoasset investing.

It was back in February 2021 that Rick Rieder, BlackRock’s chief investment officer for global fixed income, let slip to CNBC back in that the asset management giant had “started to dabble” in bitcoin. But until this set of regulatory filings it was unclear to what extent this “dabbling” was taking place.

BlackRock’s Global Allocation Fund purchased 37 futures contracts at the tail end of January for a reported $6.5m. That’s less than 0.05% of the fund’s total holdings, so the numbers are rather small in the great scheme of things.

However, everything we have learned to date about institutions dipping their toes into crypto waters tells us this: once it is clear that everything works as it should — and everyone from funds to banks and family offices can gain a proportion of a rising market — these UHNW players begin to make a much bigger splash.

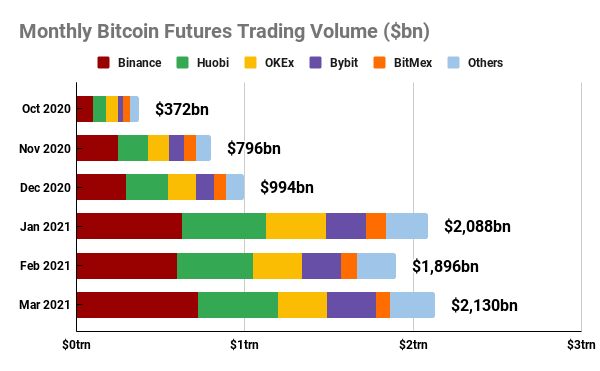

One other useful proxy for institutional interest in cryptocurrency is to look at Bitcoin futures trading volume.

Monthly volume for Bitcoin futures topped $2.13bn in March 2021, according to data from Bybt. That’s another new all time high, after dipping from $2.08bn to $1.89bn from January to February 2021. There’s no question now that institutional investors are making aggressive moves to expand their bitcoin exposure.

As the data shows, Binance remains the premier venue for Bitcoin futures trading, with the China-founded and Hong Kong-operated Huobi Global slotting in as its closest competitor.

The turn of 2021 was the clearest leap forward into record-breaking territory, as Binance improved its monthly futures trading volume from $296.78bn to $627.52bn, while Huobi almost doubled its own figures, jumping from $248.45bn to $498.34bn.

These figures will be of no cheer to the CME Group, the world’s largest financial derivatives exchange. CME launched its own bitcoin futures product as far back as 2017 and yet in the years since, trading volume has failed to live up to even the most conservative estimates.

The decades-old commodities trading venue has perhaps been hamstrung by the size of its bitcoin futures contracts which are set with a lower limit of 5BTC (approximately $294,000). That, in truth, has largely excluded retail investors.

Perhaps in reaction to the explosion of interest in more investor-friendly bitcoin products like ETPs, CME has now announced a plan to claw back some market share. It said on 30 March 2021 that from the first week of May it will offer ‘micro-Bitcoin futures contracts’ worth one-tenth of a bitcoin (~$5,800).

Ether (ETH) had its own record-breaking moment this week, breaking back above $2,000 for the first time since mid-February, and holding that position for now.

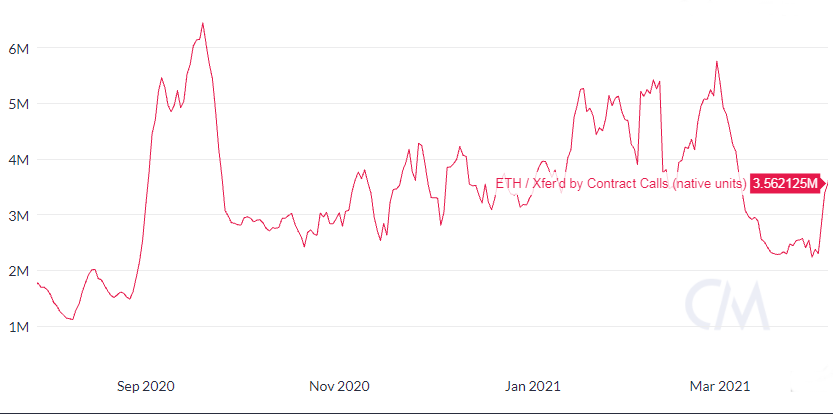

Market analysts are expending more time and energy on Ethereum now than ever before, largely due to its usage as a foundational structure for the DeFi and NFT markets, and an ever greater regulatory focus on Ethereum’s smart contracts.

Certainly the number and value of smart contract transactions are rising. According to Coinmetrics data, it was 16 August 2020 when the amount of ETH transferred daily by smart contracts breached 2 million ETH ($4.2bn) for the first time. As we head towards Q2 the daily average is well above 3 million ETH ($6.3bn).

The way that smart contracts automatically and algorithmically transfer value between parties is revolutionising portions of financial services, law and the arts and avid crypto-watchers are expecting some big pronouncements from governments or regulators as we move into Q2 and beyond.

Everywhere we look, price records are falling all across the map. For example, from a low of $1,771.43, the spot price of ether hit a new all time high of $2,144 over the weekend, dipping slightly before climbing back to reach a new all time record of $2,148 on strong daily volume on Tuesday 6 April. And these gains are rippling outwards as cryptoassets further down the market capitalisation list are starting to see their own momentum grow.

As Week 14 — and indeed Q1 — comes to a close, Bitcoin (BTC) continues to trade in a fairly tight range between $56,435 and $60,003, with a clear rejection at that previous round number barrier. Its market cap is up by around 7% over the course of the week and it is worth noting that the last time BTC dipped under a $1 trillion market cap was Monday 29 March 2021. Lest we forget, it was only on 8 January 2021 that BTC moved above $40,000 for the first time.

Copyright © 2024 ETC Group. Alle Rechte vorbehalten

WICHTIGER HINWEIS:

Dieser Artikel stellt weder eine Anlageberatung dar, noch bildet er ein Angebot oder eine Aufforderung zum Kauf von Finanzprodukten. Dieser Artikel dient ausschließlich zu allgemeinen Informationszwecken, und es erfolgt weder ausdrücklich noch implizit eine Zusicherung oder Garantie bezüglich der Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen. Es wird davon abgeraten, Vertrauen in die Fairness, Genauigkeit, Vollständigkeit oder Richtigkeit dieses Artikels oder der darin enthaltenen Meinungen zu setzen. Beachten Sie bitte, dass es sich bei diesem Artikel weder um eine Anlageberatung handelt noch um ein Angebot oder eine Aufforderung zum Erwerb von Finanzprodukten oder Kryptowerten.

VOR EINER ANLAGE IN KRYPTO ETP SOLLTEN POTENZIELLE ANLEGER FOLGENDES BEACHTEN:

Potenzielle Anleger sollten eine unabhängige Beratung in Anspruch nehmen und die im Basisprospekt und in den endgültigen Bedingungen für die ETPs enthaltenen relevanten Informationen, insbesondere die darin genannten Risikofaktoren, berücksichtigen. Das investierte Kapital ist risikobehaftet und Verluste bis zur Höhe des investierten Betrags sind möglich. Das Produkt unterliegt einem inhärenten Gegenparteirisiko in Bezug auf den Emittenten der ETPs und kann Verluste bis hin zum Totalverlust erleiden, wenn der Emittent seinen vertraglichen Verpflichtungen nicht nachkommt. Die rechtliche Struktur von ETPs entspricht der einer Schuldverschreibung. ETPs werden wie andere Wer

ETC Group bietet erstklassige Produkte für das Investment in digitale Werte wie Kryptowährungen - und das mit Domizil Deutschland. Mit unseren physisch hinterlegten Krypto-ETPs schlagen wir eine Brücke vom klassischen, regulierten Kapitalmarkt in die lebendige Kryptoszene. Unsere ETPs sind der Schlüssel zum Ökosystem der digitalen Vermögenswerte und vereinfachen den Investmentzugang zu Bitcoin, Ethereum und weiteren Kryptowährungen erheblich.

Die ETC Group setzt sich aus einem außergewöhnlichen Team von Finanzdienstleistungsexperten und Unternehmern zusammen, die über Erfahrung mit digitalen Vermögenswerten und regulierten Märkten verfügen. Da Produktqualität und -sicherheit im Mittelpunkt unseres Produktentwicklungsansatzes stehen, ist das Unternehmen bestrebt, kontinuierlich erstklassige börsengehandelte Produkte für institutionelle Kunden auf den Markt zu bringen.

Als Unternehmen hat die ETC Group bereits BTCE auf den Markt gebracht - das weltweit erste börsengehandelte Bitcoin-Produkt mit zentralem Clearing an der Deutschen Börse XETRA, dem größten ETF-Handelsplatz in Europa sowie DA20. Dabei handelt es sich um das weltweit erste Krypto-ETP, das einen MSCI-Index abbildet und einen Schritt in Richtung Investment-Management-Produkte darstellt. DA20 ermöglicht Anlegern ein breites Marktengagement, indem es einen Index von 20 Kryptowährungen abbildet, die etwa 85 % der Kapitalisierung des gesamten Kryptomarktes abdecken.