Bitcoin volatility hits the lowest reading on record; Ethereum staking withdrawal confirmation is bullish for the asset, and the failure of Celsius to properly hold its investor funds throws a spotlight on custody and trust.

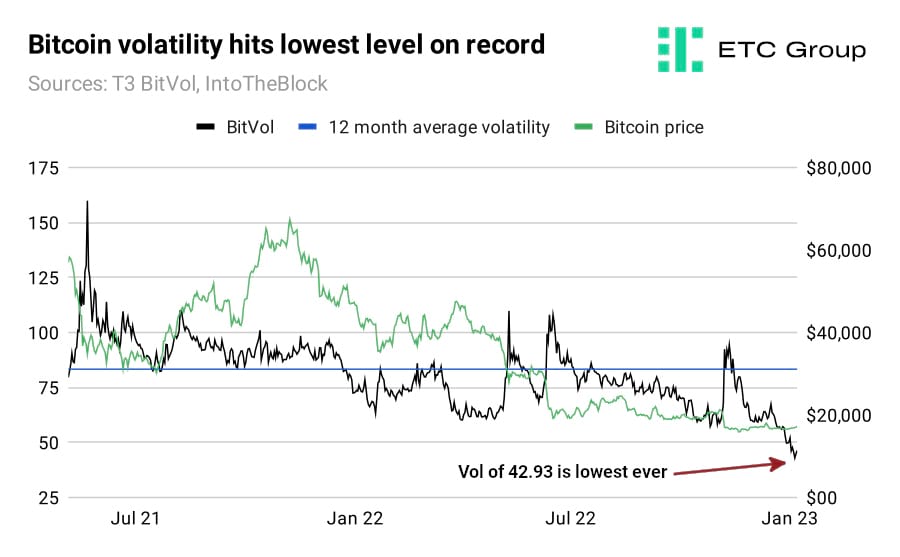

BTC volatility at record low

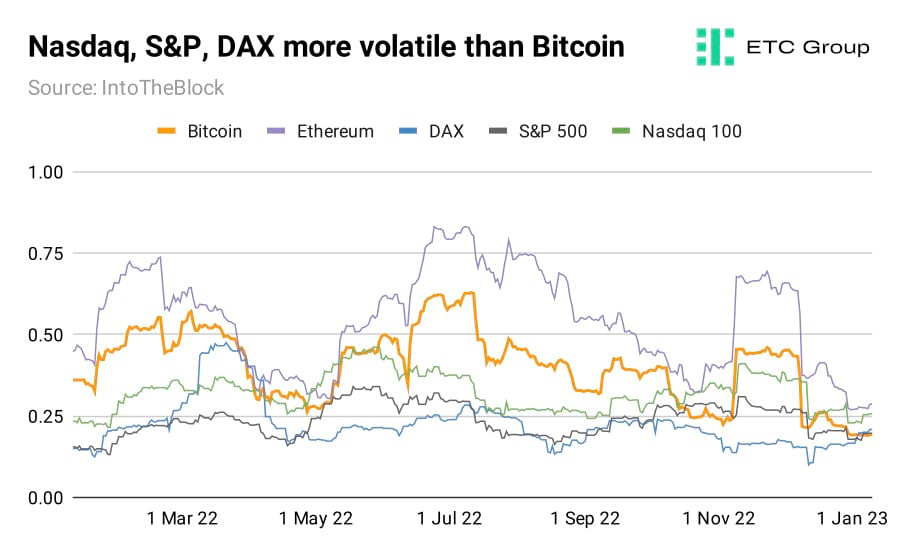

Bitcoin volatility has hit a record low, with stock market indices now widely more volatile than the number one cryptocurrency.

IV, or implied volatility, uses option strike pricing to measure the 30-day expected forward volatility in a particular asset.

The lowest ever T3 BitVol Bitcoin volatility reading came on 7 January 2023 at 42.93. This is more than 50% lower than the 12 month average, around half the volatility levels we saw in November 2022.

From this, we can infer much lower expected daily price movements in either direction than at the tail end of last year.

BitVol is treated much like an action gauge: professional traders will seek out assets with the largest intraday swings either up or down in order to book the highest profits.

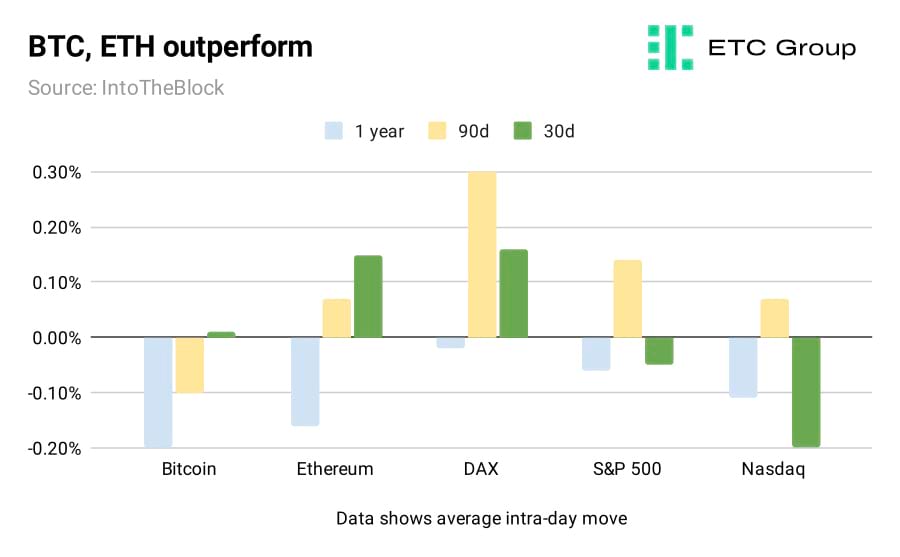

At the same time, stock market investors are dealing with relative whipsaw moves, historically. Currently, Bitcoin has a lower volatility profile than the Nasdaq, DAX40 and S&P 500.

In terms of positive intraday moves, over the last 30 days Bitcoin and Ethereum have turned a corner to outperform the US benchmarks.

Such periods of relative calm and stability in cryptoasset pricing have tended to play out in the form of dips to the downside and riotous upward moves - so which is likely this time?

The answer will rely heavily on three points.

Firstly: where we are in the macro cycle, with interest rates still suggested to rise until H2 2023.

For instance, the yield on 10-year US Treasury bonds plummeted on Friday 6 January as the United States recorded 223,000 new jobs, suggesting economic strength, while the rate of services price increases started to slow. ISM survey readings at a stubbornly elevated rate have been seen as one reason why the de facto US central bank could need to continue raising rates. If US CPI data continues to come in lower, this could give more fuel to the ‘soft landing' theory, where inflation slows without plunging major economies into recession.

Secondly, where we are in the Bitcoin market cycle as regards its upcoming halving.

Previous analysis has shown that Bitcoin prices tend to bottom anywhere from 386 to 517 days before the next halving event. We are now approximately 451 days out from the 2024 Bitcoin halving.

Thirdly, how close any other positive catalysts for crypto markets are, such as regulatory clarity.

A final vote by the European Parliament to ratify the EU's upcoming MiCA (Markets in Crypto Assets) legislation is due in February 2023. Germany has long led the world in terms of clear-eyed legislation to support high-quality cryptoasset companies, and the surety that comes with bloc-wide rules will be no exception.

ETH staking withdrawals confirmed for March 2023

It should come as little surprise that Ethereum developers have come through for their supporters The Merge, after all, was the biggest technical achievement in the history of cryptocurrency. Switching off Proof of Work and switching on Proof of Stake not only improved Ethereum's energy usage by 99%+, it also confirmed that developers were able to marshall hundreds of thousands of individual participants from miners to stakers and validators to unite under one banner.

The most recent development call between Ethereum's top teams scaled back ambitious plans for the Shanghai hard fork in March in favour of prioritising staking withdrawals.

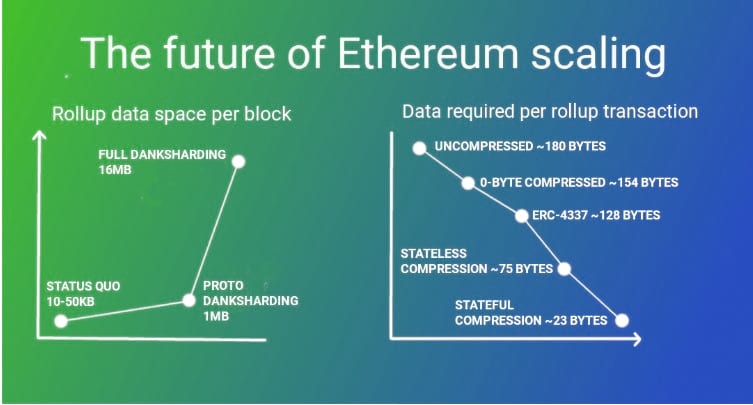

EIP-4844 had been on the table, which would have introduced an upgrade called ‘proto danksharding', to vastly improve the amount of data space available in each Ethereum block for rollups. Currently, scaling solutions like Polygon have to compete with all other Ethereum applications for space, and the amount of rollup data per block is around 50kb.

Proto danksharding, as Ethereum figurehead Vitalik Buterin explained at a recent Ethereum hackathon, would have improved that to around 1Mb per block, a 2,000% increase in data availability.

But developers pushed back EIP-4844 in favour of allowing users to withdraw their staked ETH. Market watchers suggest this is highly bullish for Ethereum going forward. It seems obvious to suggest that there is much capital sitting on the sidelines waiting for certainty on when they will be able to withdraw their gains.

Certainly, the $21.2bn of ETH sitting in the deposit contract to secure Ethereum and earn yield has been placed there by market participants who had little idea when they would be able to withdraw it. That all changes with a firmer date for the Shanghai hard fork.

There remains high demand for liquid staking derivatives, but after the depeg of Lido's stETH Ethereum derivative in June last year, some investors may want to simply deal with the protocol itself and remove unnecessary middlemen.

Celsius investors don't own their crypto

Customers of the bankrupt crypto lender will be last in line to collect their funds, it has emerged. The US bankruptcy judge Martin Glenn, who is presiding over the Celsius Chapter 11 case, ruled this week that Celsius owns most of the crypto that customers deposited.

It means that 600,000 customers with around $4.2bn of deposits will be treated as unsecured creditors, making it unlikely that they will ever recover what they put into the yield-promising Celsius Earn programme.

Celsius rose to prominence offering yields of 20% on crypto deposits that analysis has shown was largely based on the GBTC premium trade that vanished in mid-2021.

Celsius ex-CEO Alex Mashinsky, who stepped down from his role in September 2022, is now being sued by the New York Attorney General Letitia James for allegedly duping investors out of billions of dollars and concealing the financial health of his company.

And what has become painfully obvious to users is that there is not enough consumer protection in large swathes of the crypto investment industry.

Speaking on CNBC this week, ETC Group co-CEO Bradley Duke noted: “It's important when anyone is investing their hard earned savings that they read the small print. What the judge said was unequivocal, that the [Celsius] terms of use were very clear about the fact that as soon as the funds entered the Earn programme that they were now owned by Celsius network and no longer by the users.

“It's always worth imagining the worst-case scenario when investing - how is it set up? Is there a trustee involved in case the company in question goes bankrupt? Where will you stand in terms of other creditors if there are insolvency proceedings?”

There's an obvious contrast here with ETC Group investment products.

By holding 100% physically-backed ETPs like BTCE and ZETH, investors have a legal claim on the underlying Bitcoin and Ethereum. There is also a security pledge on those assets held by the trustee, Apex, in case anything goes wrong with the company itself.

All cryptoassets used to back the ETPs are held securely in segregated cold storage by the third-party custodian BitGo. So investors can feel safe in the knowledge that even if there are problems with the company, they have a legal claim to their Bitcoin and Ethereum.

The weeding out of bad actors, dodgy small print and bad practices - from SBF to overleveraged lenders - is one of the major ways that crypto markets will mature in 2023 and beyond. Learning whom to trust has been a painful lesson, and a mistake many investors will hope not to make again.

Markets

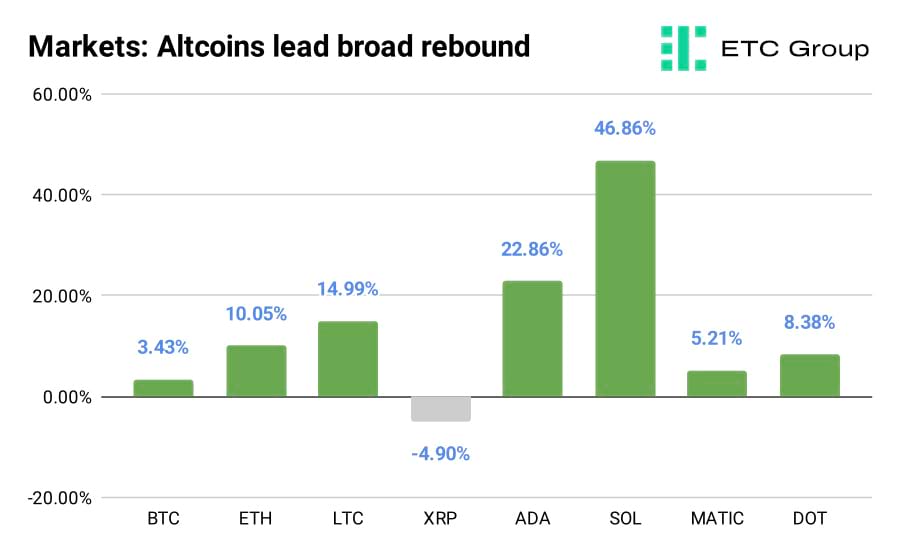

Crypto markets rebounded in the first weeks of the year, adding a total of $54bn to the total market cap and returning valuations back to a two-month high. Ethereum took the highest share of the gains with a 10% rally, with investor enthusiasm largely stemming from protocol development news about staking withdrawals coming in March 2023, adding certainty to its longer term roadmap. Bitcoin added on unexpected macro strength potential from US and EU statistics, gaining 3.43% across the fortnight. This may be a modest reversal, but it is still more than double what the S&P 500 managed in the same period.

Smart contract blockchains were hit hard in the latter half of last year and took the majority of the lead across the fortnight. Solana's 46% gain since 27 December aptly demonstrates the ability for individual cryptoassets to wildly outperform other benchmarks, but it must be cautioned that SOL is rallying from a low ebb. Cardano's ADA token bounced by 22.86% to take second-best performer, ending the session at $0.317. Litecoin continued its impressive rise ahead of the LTC block reward halving - which is just over 200 days out from here - adding an extra 15% and taking it back towards the $90 mark where it sat before the May 2022 crash. LTC was forked from BTC and as such is a deflationary currency whose supply schedule is sliced in half once a set number of blocks have been processed. The Litecoin halving is expected in August 2023, approximately six months before the Bitcoin halving.

Copyright © 2024 ETC Group. All rights reserved