Cosmos is a new type of blockchain architecture which seeks to create interoperability between hundreds or even thousands of parallel, independent blockchains. Each is built using the Cosmos SDK (software development kit) and can be launched in a matter of weeks, instead of the standard 6+ months.

The layer 1, Proof of Stake smart contract blockchain launched its mainnet in September 2020.

This technology also allows for faster and cheaper processes, with everything from NFT marketplaces to decentralised exchanges (DEXes) running on their own dedicated blockchains.

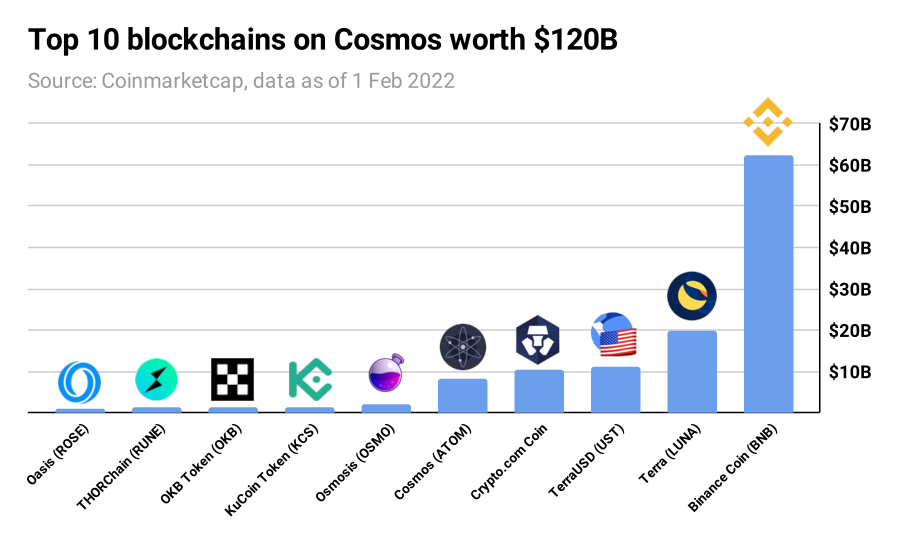

The largest Cosmos adopters are Binance and Terra (LUNA). Binance used the Cosmos SDK to develop both its DEX and the blockchain that hosts its native BNB exchange token: Binance Chain. BNB has a market cap of $60bn+ by itself.

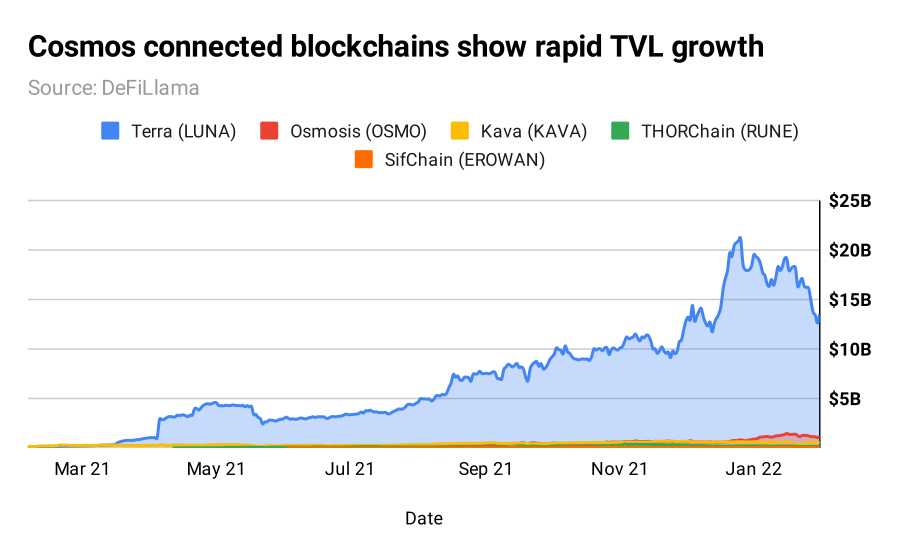

Because popular layer 1 blockchains can be launched quickly and easily, we have a kind of nested, Russian doll-type situation where, for example, Terra runs on top of Cosmos, and Terra has popular DeFi apps like Lido, Anchor and Mirror running on top of it.

This is the vision of an internet of blockchains. In 2014, co-founders Ethan Buchman and Jae Kwon founded this network of blockchain networks, each of which has access to open-source development tools to streamline maintenance of their own architecture.

The creation of modular, application-specific blockchains will be a critical narrative for 2022.

ATOM, staking, airdrops

The Cosmos native token is ATOM, used to pay for transaction fees, execute smart contracts, and in staking to secure the Cosmos Hub. Users can earn up to 13% yield on their ATOM by delegating them to one of 150 validators. And because of the interconnection between Cosmos-based chains, ATOM stakers also receive automatic airdrops (free tokens to incentivise usage) from new chains that launch on Cosmos.

Valuation & DeFi TVL

According to Token Terminal, annualised revenue for Cosmos is only $1.8m, still ahead of Polkadot’s $1.4m but far behind Solana’s $50.6m and orders of magnitude smaller than Ethereum’s $15.6bn.

What this does not take into account, however, is that Cosmos-based DEX Osmosis produces double the revenue of Solana at $104.6m. Again, Cosmos is not a closed ecosystem but a blockchain composed of many other blockchains, each attracting their own liquidity and userbase.

Outlook

Cosmos is a compelling project in the interoperability space, aiming to — and starting to succeed at — creating an ecosystem of interconnected blockchains. It boasts the Cosmos Hub mainnet that has been running smoothly for over a year, and multiple large projects including Terra and BNB that are built using the Cosmos SDK.

Its network effects are amplified by having multiple interconnected blockchains all running on Cosmos technology, able to share and swap data and assets cross-chain, as well as offering new token airdrops to ATOM holders and stakers, and we see this as a specific area of growth for the industry as a whole.

Given the amount of Total Value Locked on Cosmos-based DeFi, and the fact that its market cap lags behind top-10 cryptoasset projects like Solana, we see plenty of room for Cosmos to grow, and hence upside in the market price of ATOM.

Copyright © 2024 ETC Group. All rights reserved

Important information:

This article does not constitute investment advice, nor does it constitute an offer or solicitation to buy financial products. This article is for general informational purposes only, and there is no explicit or implicit assurance or guarantee regarding the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. It is advised not to rely on the fairness, accuracy, completeness, or correctness of this article or the opinions contained therein. Please note that this article is neither investment advice nor an offer or solicitation to acquire financial products or cryptocurrencies.

Before investing in crypto ETPs, potentional investors should consider the following:

Potential investors should seek independent advice and consider relevant information contained in the base prospectus and the final terms for the ETPs, especially the risk factors mentioned therein. The invested capital is at risk, and losses up to the amount invested are possible. The product is subject to inherent counterparty risk with respect to the issuer of the ETPs and may incur losses up to a total loss if the issuer fails to fulfill its contractual obligations. The legal structure of ETPs is equivalent to that of a debt security. ETPs are treated like other securities.

About ETC Group

ETC Group has been created to provide investors with the tools to access the investment opportunities of the digital assets' and blockchain ecosystem. The company develops innovative digital asset-backed securities including ETC Group Physical Bitcoin (BTCE) and ETC Group Physical Ethereum (ZETH) which are listed on European exchanges including XETRA, Euronext, SIX, AQUIS UK and Wiener Börse.

With a track record of over three years, ETC Group is made up of an exceptional team of financial services professionals and entrepreneurs with experience spanning both digital assets and regulated markets. With product quality and safety at the core of our product creation approach, the company aims to continuously launch best-in-class institutional-grade exchange traded products.

As a company, ETC Group has previously launched BTCE - the world’s first centrally cleared Bitcoin exchange traded product on Deutsche Börse XETRA, the largest ETF trading venue in Europe, and also listed DA20, the world’s first crypto ETP tracking an MSCI index signalling a move towards investment management products. DA20 provides broad market exposure to investors by tracking an index of 20 cryptocurrencies which cover 85% of the total crypto market capitalisation.